T4K3.news

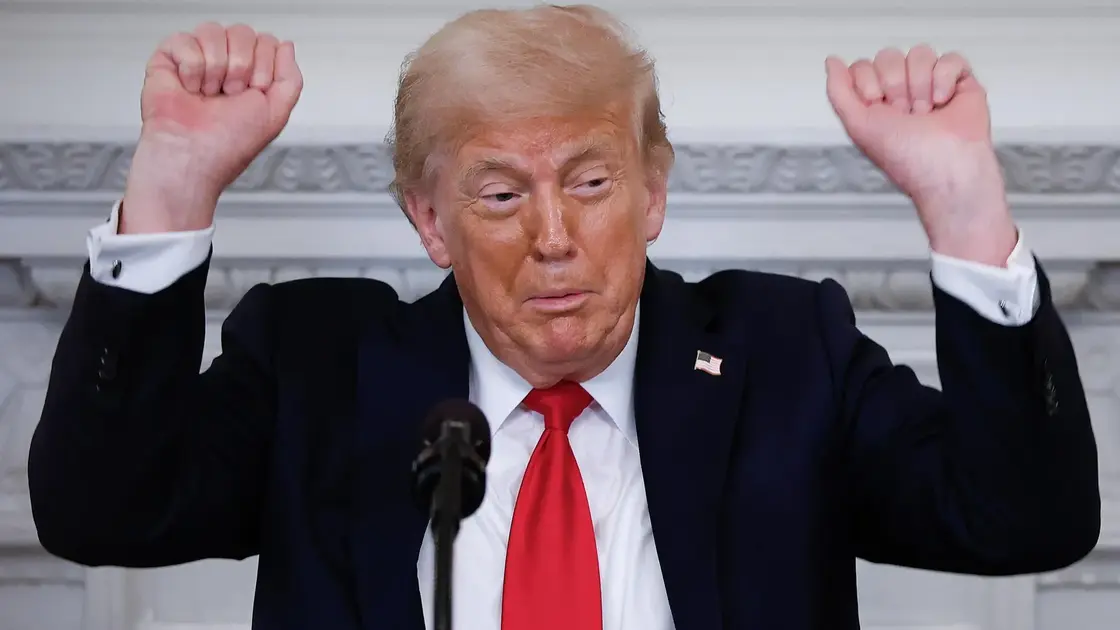

Trump to sign order permitting cryptocurrency in 401(k) accounts

An executive order by Trump could allow investments in cryptocurrencies through retirement plans.

An executive order may soon allow cryptocurrencies in 401(k) plans, boosting the crypto market.

Trump to enable cryptocurrency investments in retirement accounts

Bitcoin’s price rose about 1% on Thursday, reaching the $116,000 mark, its highest since July 31. Ether also saw significant gains, increasing nearly 5%. This surge comes after President Donald Trump is expected to sign an executive order that would permit investment in alternative assets, including cryptocurrencies, through 401(k) retirement plans. The potential for widespread adoption of bitcoin in retirement accounts has been long anticipated by crypto advocates, who believe it could solidify digital assets as a core component of U.S. financial markets. The total size of the retirement market is approximately $43 trillion, presenting vast opportunities for cryptocurrency proliferation. Galaxy CEO Michael Novogratz emphasized this economic potential, noting that making crypto available through familiar brokerage platforms would likely attract a larger audience to the space. Despite Fidelity's early efforts in offering bitcoin options for retirement plans, progress has stalled due to employer hesitancy and regulatory challenges. The anticipated executive order represents Trump’s ongoing attempts to position the U.S. as a leader in the cryptocurrency sector, following earlier legislative moves.

Key Takeaways

"That's a monster pool of capital."

Galaxy CEO Michael Novogratz highlights the substantial financial potential in integrating crypto with retirement plans.

"When you can do it at the place you've already been doing business with... you just pull more people into this ecosystem."

Novogratz emphasizes the importance of accessibility through established financial institutions in attracting new investors.

The prospect of Trump’s executive order appears to be a pivotal moment for crypto. By allowing cryptocurrencies in retirement investments, it opens a significant market door previously seen as elusive. This development could reshape not just individual portfolios but also the landscape of institutional investment. As Novogratz indicated, when crypto becomes an accessible option through established financial institutions, it will likely lead to more robust participation from both novice and seasoned investors. However, lingering concerns around regulatory frameworks and the volatility associated with these digital assets could temper long-term enthusiasm.

Highlights

- A significant shift for cryptocurrency is on the horizon with this executive order.

- This could be the moment bitcoin becomes a staple in retirement planning.

- The crypto market is ready to embrace a $43 trillion opportunity.

- Making crypto commonplace could redefine how Americans invest.

Risks associated with allowing cryptocurrency in retirement funds

The potential integration of cryptocurrencies into retirement accounts poses risks related to market volatility and regulatory scrutiny. There is concern about investor protection and the overall impact on retirement savings.

The implications of this order could extend beyond just investment opportunities.

Enjoyed this? Let your friends know!

Related News

Trump allows crypto investments in retirement plans

Trump approves crypto for 401(k) investments

Trump signs 401k crypto policy expansion

Trump order introduces private investments in 401(k)s

Trump opens 401k investment options to private equity and crypto

Private assets move closer to many 401k plans

Retirement investors could gain new options

Bitcoin gets a retirement push