T4K3.news

Trump allows crypto investments in retirement plans

Trump's new executive order opens 401(k) plans to cryptocurrencies and alternative investments.

Experts warn about high risks tied to including cryptocurrency in 401(k) portfolios.

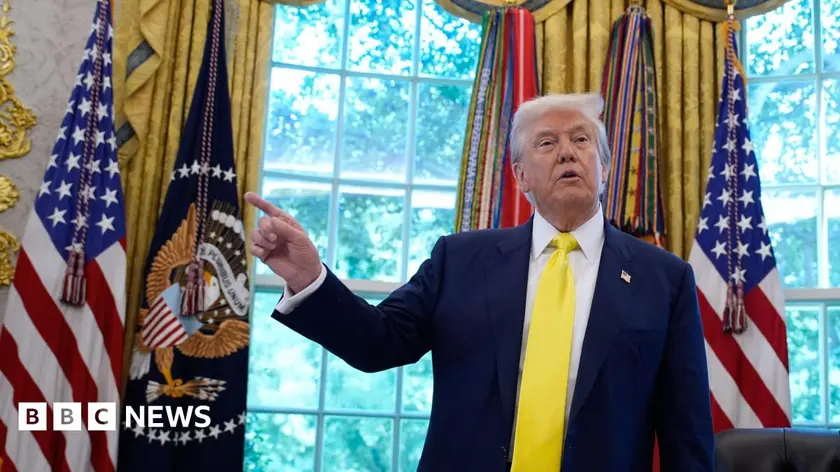

Trump signs order allowing alternative asset investments in retirement plans

Donald Trump signed an executive order to permit cryptocurrency and other alternative investments in 401(k) retirement accounts. This order allows fund managers to access vast amounts of retirement savings, potentially opening a new market worth $12 trillion. Critics express concern about the risks posed to retirement investments, given the speculative nature of assets like cryptocurrency. Trump's position on digital currencies has changed; from skepticism to launching his own cryptocurrency venture, he now aims to position the U.S. as a leader in the crypto space.

Key Takeaways

"A combination of regulatory overreach and encouragement of lawsuits has stifled investment innovation."

Trump highlights his view of the regulatory landscape affecting investment.

"Opening up the 401(k) industry to alternative assets is reasonable, but it could be a big mistake."

Anil Khurana warns about the potential pitfalls of speculative investments.

"The reality is, though, there is a lot of litigation risk in the defined contribution business."

Larry Fink remarks on the challenges facing new investment options under the new order.

"Concerns arise about weak investor protections in private investments and cryptocurrencies."

Elizabeth Warren voices her worries to annuity providers about safeguarding investments.

The decision to include alternative assets in retirement accounts could reshape the investment landscape. Proponents suggest that allowing these investments to younger savers may lead to better returns, especially in a market increasingly tied to innovation in technology. However, significant risks exist, notably in the lack of regulation and transparency currently associated with cryptocurrency. The intersection of political motives and economic implications makes this a critical area to watch, especially as litigation risks loom over the implementation.

Highlights

- Investing in cryptocurrency is rife with risks for retirement savers.

- Alternative assets could open new doors but come with steep challenges.

- Younger investors might chase high returns but at what cost?

- Will the U.S. become the crypto capital or a cautionary tale?

High Risks Associated with New Executive Order on Retirement Investments

The inclusion of alternative assets like cryptocurrencies in retirement plans may introduce significant risks and legal complications for investors, particularly given their speculative nature.

The long-term impact of this executive order remains uncertain as stakeholders evaluate the balance between innovation and risk.

Enjoyed this? Let your friends know!

Related News

Trump expands retirement account options to include cryptocurrency

Trump to sign order permitting cryptocurrency in 401(k) accounts

Trump plans to open retirement funds to crypto investments

Trump opens 401k investment options to private equity and crypto

Trump approves crypto for 401(k) investments

401k changes could broaden investment choices

Private assets move closer to many 401k plans

Trump signs 401k crypto policy expansion