T4K3.news

Trump approves crypto for 401(k) investments

President Trump is expected to sign an order allowing cryptocurrencies in retirement accounts.

This decision opens new avenues for retirement savings in cryptocurrencies.

Trump approves crypto investments for retirement accounts

U.S. President Donald Trump is set to sign an executive order allowing 401(k) retirement accounts to invest in cryptocurrencies like Bitcoin, Ethereum, and Dogecoin. This marks a significant shift as crypto was previously considered too risky for traditional retirement plans. Trump's order will eliminate regulatory barriers, and it follows the recent passage of the GENIUS Act, aimed at promoting digital assets. Financial experts suggest this move could broaden investment options and increase the crypto market's legitimacy, as BTC prices have already surged amid the news.

Key Takeaways

"Investing in cryptocurrencies will become a norm in retirement accounts."

This highlights the changing finance landscape, driven by new policies.

"Our goal is to make the U.S. the crypto capital of the planet."

This reflects Trump's vision for the future of digital assets in America.

"Wall Street firms are adapting to a new investment reality."

This suggests a significant shift in financial advisory practices due to crypto inclusion.

The introduction of cryptocurrencies into retirement accounts signals a major shift in both investment strategy and regulatory approach. By endorsing such a bold move, Trump aims to redefine the concept of traditional investing and attract younger investors seeking alternative assets. However, the nature of cryptocurrencies remains volatile, raising concerns about the long-term stability of these assets in retirement portfolios. Investment firms will need to adapt rapidly to this new landscape, which could influence future regulatory frameworks and market behaviors.

Highlights

- Trump's move could reshape retirement investing.

- Welcome to the crypto era of retirement funds.

- Are we witnessing the birth of crypto 401(k)s?

- Investing in crypto is now a retirement plan.

Potential risks with crypto investments in retirement accounts

Allowing cryptocurrencies in retirement accounts could lead to increased volatility for investors, especially those unaccustomed to the crypto market's fluctuations. Policymakers need to ensure investor protection as the market stabilizes.

The future of retirement investing may be changing with this bold decision.

Enjoyed this? Let your friends know!

Related News

Trump plans to open retirement funds to crypto investments

Stellar's Price Set for Rise After Trump's Crypto Bill

Congress approves major crypto legislation in the U.S.

Trump Media applies for Truth Social Crypto Blue Chip ETF

Crypto firms increase focus on tokenization

Trump Media acquires $2 billion in Bitcoin

Trump Media files for Truth Social Bitcoin ETF

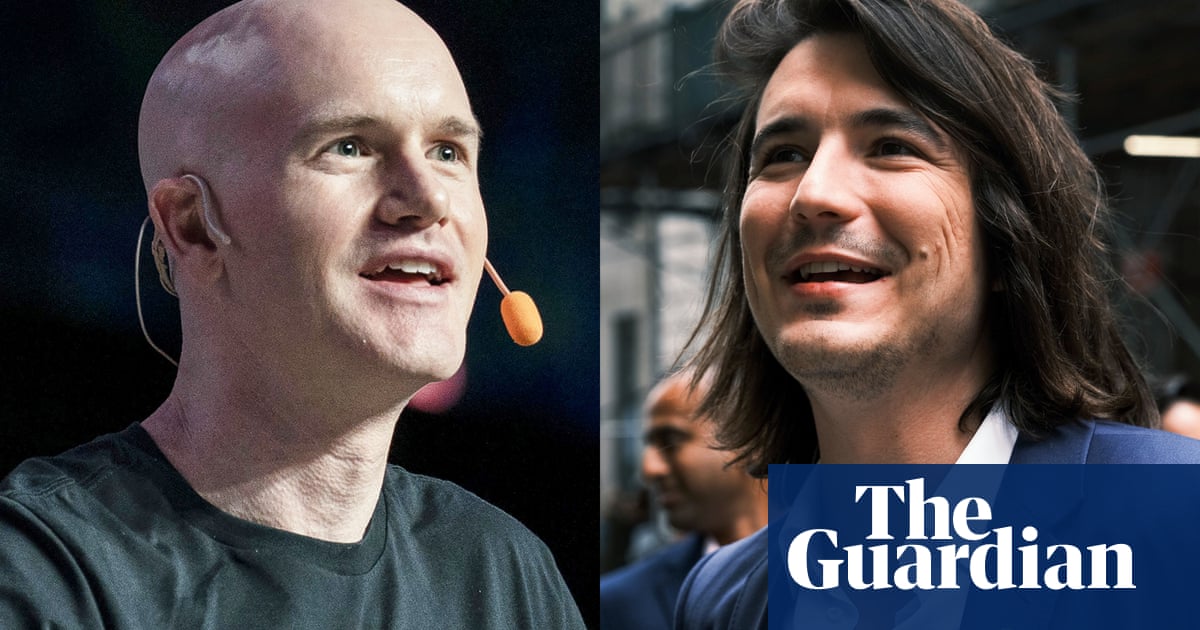

Trump meets with crypto executives to discuss strategy