T4K3.news

Bitcoin gets a retirement push

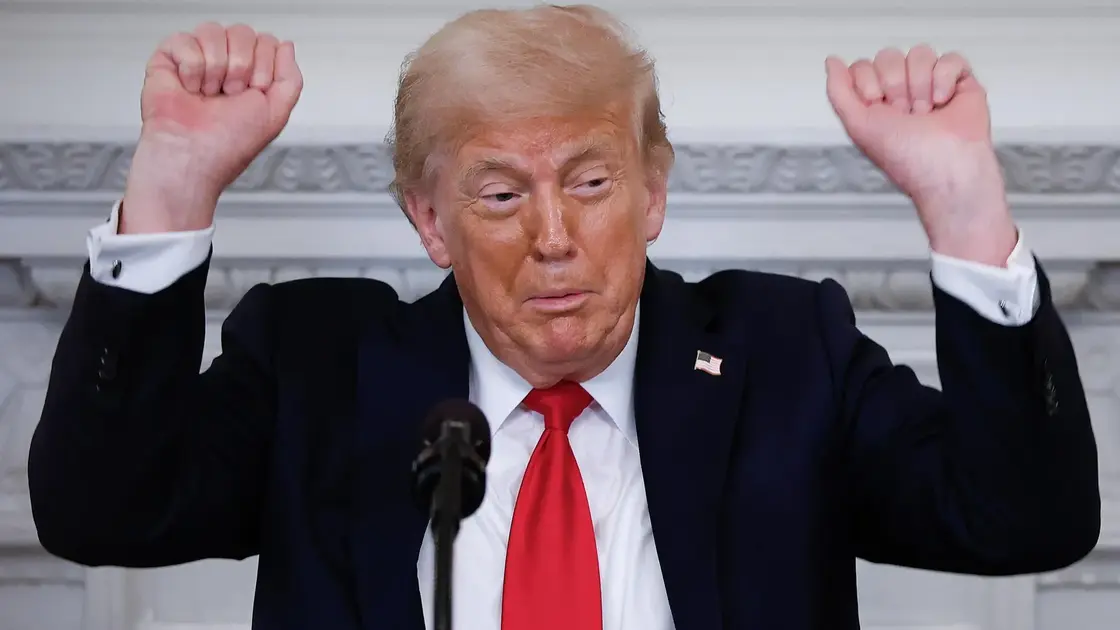

Trump signs an order to let 401(k) plans include Bitcoin, signaling potential billions of inflows amid a shrinking BTC reserve pool.

A new policy opens 401(k) plans to bitcoin investments while corporate buying and a shrinking exchange reserve pool raise questions about market impact.

Trump retirement rule aims to push billions into bitcoin as supply tightens

President Trump signed an executive order directing the Labor Department to allow private equity, real estate and cryptocurrency assets to be included in 401(k) plans through regulated investment products like spot bitcoin ETFs. The policy could unlock a large pool of money in retirement accounts, with estimates of 401(k) assets ranging from trillions to above twelve trillion dollars, depending on who you ask. If sponsors choose to offer crypto linked funds, retirement savers could gain indirect exposure to bitcoin without directly buying it.

At the same time the market faces a liquidity squeeze. CryptoQuant data show bitcoin reserves on centralized exchanges have fallen to about 2.5 million, a seven year low. That means new inflows could meet a tighter supply; issuers would need to secure more coins to back fresh investments. Corporate purchases are rising too, with firms including Strategy and Japan’s Metaplanet among large buyers. Public and private companies now hold close to 1 million bitcoin, approaching five percent of the total max supply.

Key Takeaways

"Bitcoin reserves on centralised exchanges have fallen to about 2.5 million"

Factual data point cited in the article

"A 3 percent allocation could bring hundreds of billions into crypto"

Editorial note on potential inflows

"Corporate treasuries are building a Bitcoin stack at a pace that dwarfs most markets"

Observation on corporate buying

"If retirement plans back Bitcoin, the market will face new test of stability and liquidity"

Editorial outlook

The move tests how far mainstream retirement money can push crypto into the mainstream without triggering volatility or regulatory backlash. It also signals a broader shift in corporate balance sheets toward digital assets, which could intensify market dynamics in ways that are hard to predict for new investors. If inflows materialize, the timing and mechanics of how new bitcoin coins are secured will matter as much as the dollars on the table. The policy could catalyze a new flow channel for crypto, but it also raises questions about risk disclosure, suitability and the potential for sudden price swings during a downturn.

Highlights

- Retirement dollars could ride a Bitcoin tide

- Bitcoin reserves at seven year lows meet new demand

- A tiny slice could move the market more than expected

- These moves test trust in crypto as a long term store

Political and market risks

The policy ties retirement savings to a volatile asset. It could draw regulatory scrutiny, spark public backlash, and shift investor sentiment in uncertain times.

The coming months will reveal whether retirement dollars become a new driver for crypto liquidity or a stress test for market resilience.

Enjoyed this? Let your friends know!

Related News

Trump signs 401k crypto policy expansion

Crypto gains ground in Washington and Wall Street

Idaho Implements New Vaccine Policies Amid Trust Crisis

Trump era crypto boom reshapes wealth map

Bitcoin tops 122K after positive week

Woodford fines issued

Retired banker reaches halfway mark in marathon challenge

Retired wrestler Hulk Hogan dies at 71 from cardiac arrest