T4K3.news

Private assets move closer to many 401k plans

Executive action could expand options in retirement plans but requires careful safeguards and education first.

Editorial analysis of a move to expand 401(k) investments into private markets and crypto.

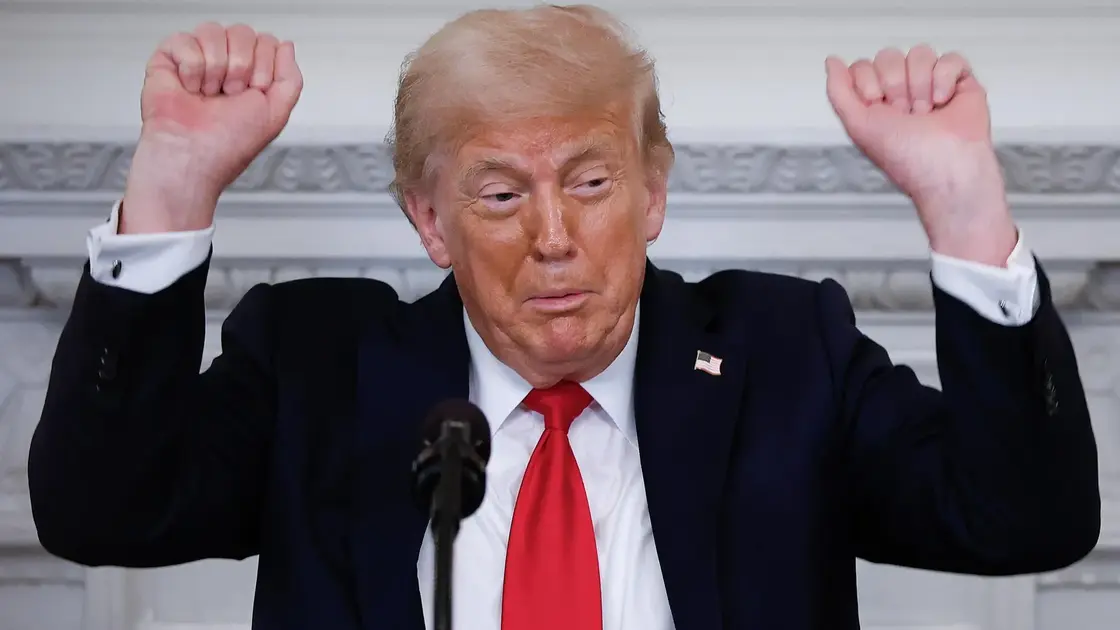

Trump opens 401k plans to private assets

President Trump signed an executive order aimed at allowing retirement savers to access a broader range of assets, including private equity, real estate and digital assets, through 401(k) plans. The change could push a large chunk of the $12.2 trillion held in Americans’ retirement accounts toward private markets where returns can be higher but so can risk and fees. The move is not an immediate switch; it directs the Department of Labor to reexamine guidance within 180 days and asks the Securities and Exchange Commission to explore ways to improve access.

Private assets are already technically possible in some plans but remain rare because many recordkeepers and fiduciaries worry about liquidity, transparency and accountability. If more employers choose to offer these options, they could diversify portfolios but also expose savers to steeper fees and the potential for larger losses during market stress. Crypto adds another layer of complexity, with unclear investor protections and custody risks that are not yet fully mapped in retirement rules.

Key Takeaways

"There is a lot less transparency and liquidity in private markets"

Comment from a financial expert on private market drawbacks

"This could be detrimental to less-informed investors whose only investment account is their 401(k)"

Financial planner Anh Tran on risks to unsophisticated savers

"I think this is going to open the floodgates"

Skeptic on how plan managers may respond

"There’s not as much information about the companies, and it could be hard to sell your investments"

Expert risk note on private assets liquidity

The policy asks regulators to balance risk and reward in a market that rewards ambition but often punishes misjudgment. Expanding access could democratize investment opportunities, but it also shifts fiduciaries toward riskier assets that require stronger guardrails and clearer disclosures. The real test is whether plan sponsors can transparently explain the tradeoffs to ordinary savers and whether regulators can enforce meaningful safeguards without stifling innovation. In practice, the shift may hinge on a steady stream of education, standardized information and practical limits on exposure to private assets.

Public perception matters too. Critics warn this could turn retirement accounts into a lab for high-stakes bets, while supporters argue it reflects a more flexible, modern asset mix. The presence of crypto within retirement plans raises the question of whether protections will keep pace with new technologies and the complexity of private markets. The coming months will reveal if policy makers and industry players can align incentives with savers’ long-term interests.

Highlights

- Private markets in 401(k)s demand real guardrails

- Education and transparency beat flashy returns

- Fiduciaries face a new test with riskier assets

- Crypto in savings plans needs clear protections

Potential risks to savers from new policy

The executive order may widen access to private assets in 401(k) plans but raises concerns about liquidity, transparency, higher fees and investor protection. Some savers, especially younger or less informed, could face larger losses and fiduciaries may bear greater liability.

Safeguards and clear information will determine whether this pivot improves retirement outcomes or simply adds risk.

Enjoyed this? Let your friends know!

Related News

Trump opens 401k investment options to private equity and crypto

Goldman Sachs Offers New Roles to Junior Bankers

Retirement investors could gain new options

401k changes could broaden investment choices

Trump signs 401k crypto policy expansion

Markets rise as Ukraine talks loom

Stratford high street shows vacancy and safety concerns

Manufacturing revival linked to new US tariffs announced