T4K3.news

Trump order introduces private investments in 401(k)s

Trump's executive order allows cryptocurrencies and private equity in retirement plans.

The latest executive order aims to introduce alternative investments in retirement plans.

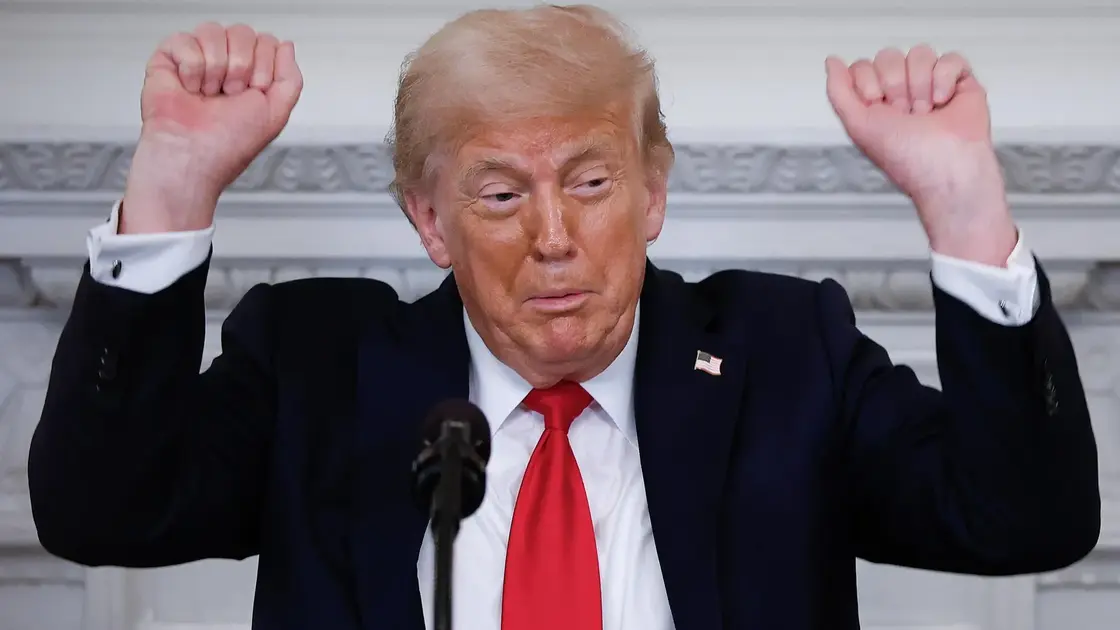

Trump signs executive order to allow private assets in 401(k)s

President Donald Trump is set to sign an executive order allowing alternative assets like cryptocurrencies, private equity, and real estate in 401(k) retirement plans. This directive will task the U.S. Secretary of Labor with examining how private market investments can fit into fiduciary guidelines that govern these plans under the Employee Retirement Income Security Act (ERISA). The move is seen as a significant advancement for the alternative asset industry, which has long sought broader inclusion of private investments in defined contribution plans. In response to the announcement, Bitcoin's value increased, and shares of private equity firms also saw a rise in early trading on Thursday.

Key Takeaways

"This executive order opens up new possibilities for retirement investments."

Highlighting the executive order's potential impact on retirement planning.

"Private market assets have traditionally been excluded from 401(k)s due to their risks."

Addressing the historical context of private assets in retirement plans.

"Trump is responding to investor demand for diversification in retirement savings."

Indicating the motive behind the executive order.

"Concerns remain regarding the transparency of these new investment options."

Mentioning the risks associated with alternative investments.

This executive order underscores the growing trend of integrating alternative assets into retirement accounts. By opening up 401(k) plans to private equity and cryptocurrencies, the administration is responding to investor demand for diversified portfolios that include higher-risk, higher-reward opportunities. However, this shift also invites scrutiny over the transparency and potential risks associated with such investments. As traditional retirement vehicles evolve, the implications for financial stability and investor protections will need careful monitoring.

Highlights

- Alternative assets gain entry into retirement plans under Trump.

- The demand for private investments in 401(k)s is rising rapidly.

- Traditionally excluded, private assets now find a place in retirement.

- Investors are eyeing new opportunities with this executive order.

Concerns over investment risks in retirement plans

The inclusion of private assets in 401(k)s raises transparency issues and potential risks to investors' retirement funds.

The long-term effects of this order on retirement savings will unfold in the coming months.

Enjoyed this? Let your friends know!

Related News

Retirement investors could gain new options

Private assets move closer to many 401k plans

Trump opens 401k investment options to private equity and crypto

Trump allows crypto investments in retirement plans

401k changes could broaden investment choices

Bitcoin gets a retirement push

Trump signs 401k crypto policy expansion

Trump to sign order permitting cryptocurrency in 401(k) accounts