T4K3.news

Trump signs 401k crypto policy expansion

An executive order broadens retirement plan options to digital assets with a 180-day review period.

An executive order could let 401(k) plans hold digital assets, signaling a shift in retirement policy and market dynamics.

Trump Opens 401k Door to Crypto Assets

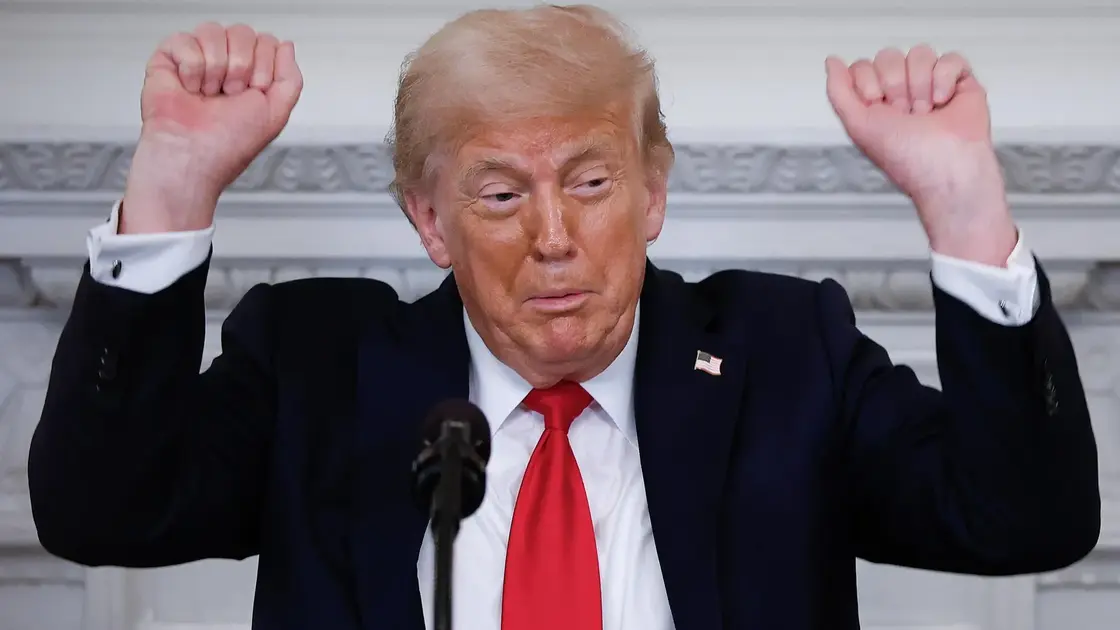

President Donald Trump signed an executive order that could allow 401(k) retirement accounts to include digital assets such as bitcoin and ethereum. The order directs the Labor Department to review current rules within 180 days and to establish guardrails for how these investments would be offered. The White House notes that 401(k) plans total about $12.2 trillion, highlighting the potential market impact while stressing that changes would come through a careful process.

It also contains a separate move aimed at debanking policies tied to political or ideological grounds, and it calls for fair access to banking for all Americans. Market watchers say the move could attract institutional inflows if rules are clear, though actual adoption depends on how quickly regulators act. In the market, participants say moves like this shape sentiment more than immediate prices, making the next steps crucial for the crypto sector.

Key Takeaways

"This order opens the door to greater choice and gives investors more options."

Katalin Tischhauser, head of research at Sygnum Bank, via email.

"It is another bullish driver for the crypto market as the relatively small market capitalisation means fund flows can have a significant impact on price."

Joel Kruger, market strategist at LMAX Group, via email.

"Trump's moves could shift sentiment, but so far the response has been muted."

Markus Thielen, founder of 10x Research, via email.

"This order could mark a milestone in bringing digital assets into the mainstream financial infrastructure."

Antony Agoshkov, cofounder of Marvel Capital, via email.

This policy shift signals ambition more than immediate policy change. It could broaden participation in retirement savings, but it also raises questions about risk, custody and disclosure for millions of savers who may be slow to understand volatile assets. The 180-day review creates a window where market response will help determine how quickly plans offer crypto options.

The political context matters as much as the policy specifics. A push for clearer digital asset rules can calm some investors, but it also invites scrutiny from lawmakers worried about consumer protection and financial stability. The ultimate effect hinges on how the DoL frames guardrails and how quickly plan sponsors implement them.

Highlights

- Crypto enters the retirement playbook at last

- Policy moves push bitcoin toward a new financial stage

- Mainstream finance meets digital assets in a quiet shift

- Markets ride on rules that still need guardrails

Political and financial risk around crypto 401(k) expansion

The move touches retirement policy and market regulation and could provoke investor backlash and political scrutiny as policymakers weigh consumer protection and financial stability.

Policy clarity will determine whether this becomes a real boost for savers or a flashpoint for debate.

Enjoyed this? Let your friends know!

Related News

Trump advocates for cryptocurrency mining amid noise complaints

Private assets move closer to many 401k plans

401k changes could broaden investment choices

President Trump signs GENIUS Act into law

Trump takes action to support crypto industry

Trump signs law regulating stablecoins

Trump opens 401k investment options to private equity and crypto

Trump Media holds $2 billion in bitcoin and plans for future crypto investments