T4K3.news

Retirement investors could gain new options

Labor Department review of guidance may broaden access to private assets in 401(k) plans over the next 180 days.

A federal executive order asks labor officials to review guidance that restricts private assets in retirement plans, signaling a shift in access to private equity.

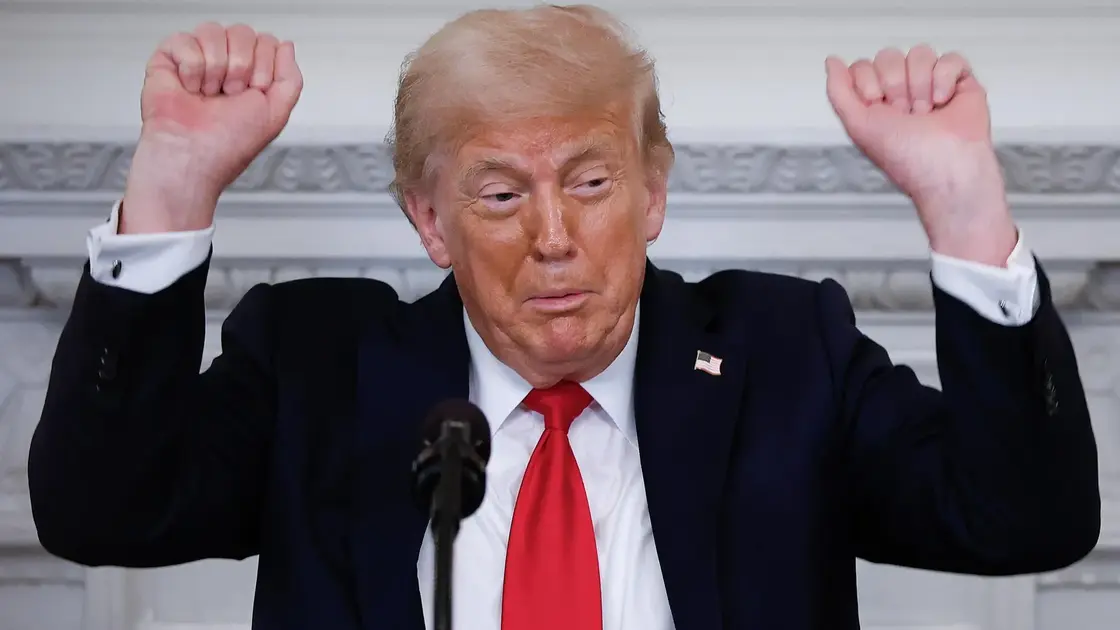

Trump Executive Order Opens Private Equity Access for 401k Plans

President Donald Trump signed an executive order directing the Labor Department to review past guidance on 401(k) investments. This move is framed as a step to open private equity and other alternatives to retirement plans, potentially tapping trillions of dollars from workers’ accounts. The numbers are large: about 12.2 trillion dollars in defined contribution plans and 16.8 trillion in individual retirement accounts could become part of a broader private markets mix.

The order does not change policy right away. It asks Labor Secretary Lori Chavez-DeRemer to clarify existing guidance within 180 days. Industry players have pushed for looser rules for private markets in 401(k)s, while critics warn of higher fees, illiquidity, and fiduciary risks. The action follows private equity firms’ long efforts to broaden access through partnerships with asset managers and fund families that blend public and private markets.

Key Takeaways

"The federal government should not be making retirement investment decisions for hardworking Americans."

Statement by Lori Chavez-DeRemer after the EO was signed

"President Trump's EO is a great step that will help all Americans enjoy the same benefits of stronger returns."

Will Dunham of the American Investment Council

"Target date funds will always be daily liquid but there is a sentiment that everything within the target date fund must also be daily liquid."

Dan Cahill of Partners Group

If implemented well, the policy could broaden access to private assets through professionally managed funds, notably target date funds that already hold trillions in assets. The real test will be governance: plan sponsors must balance potential returns with duties to protect savers. The shift could also reshape fee structures and risk profiles across retirement portfolios. The political conversation around the move will hinge on perceptions of who benefits and who bears the cost.

The 180-day review period will reveal how far the administration is willing to go and how much traction private equity firms gain with plan sponsors, vendors, and retail investors. Public reaction and regulatory scrutiny could shape the pace of change, even as large fund firms push to embed private assets into mainstream retirement products.

Highlights

- Access should be earned not exploited by fees

- Retirement should not become a private equity bet

- Illiquidity must come with safeguards and clear liquidity paths

- Smart managers will know when to act and when to wait

Political and regulatory risk around 401k access to private equity

The move intersects retirement protections with high-stakes finance, creating potential litigation, political backlash, and public scrutiny. Outcomes depend on how the Labor Department implements changes and how sponsors respond, with implications for fees and investor risk.

The road ahead will test whether retirement plans gain flexibility without sacrificing protections.

Enjoyed this? Let your friends know!

Related News

Wash sale risk rises with meme stock comeback

401k changes could broaden investment choices

Trump opens 401k investment options to private equity and crypto

Bitcoin investing strategies attract new U.S. investors

Stellar's Price Set for Rise After Trump's Crypto Bill

Trump order introduces private investments in 401(k)s

YieldMax Announces New Distributions on Major ETFs

Trump signs 401k crypto policy expansion