T4K3.news

Trump opens 401k investment options to private equity and crypto

An executive order may allow higher-risk investments in retirement accounts.

A recent executive order may reshape retirement savings by opening 401(k) plans to private equity and crypto.

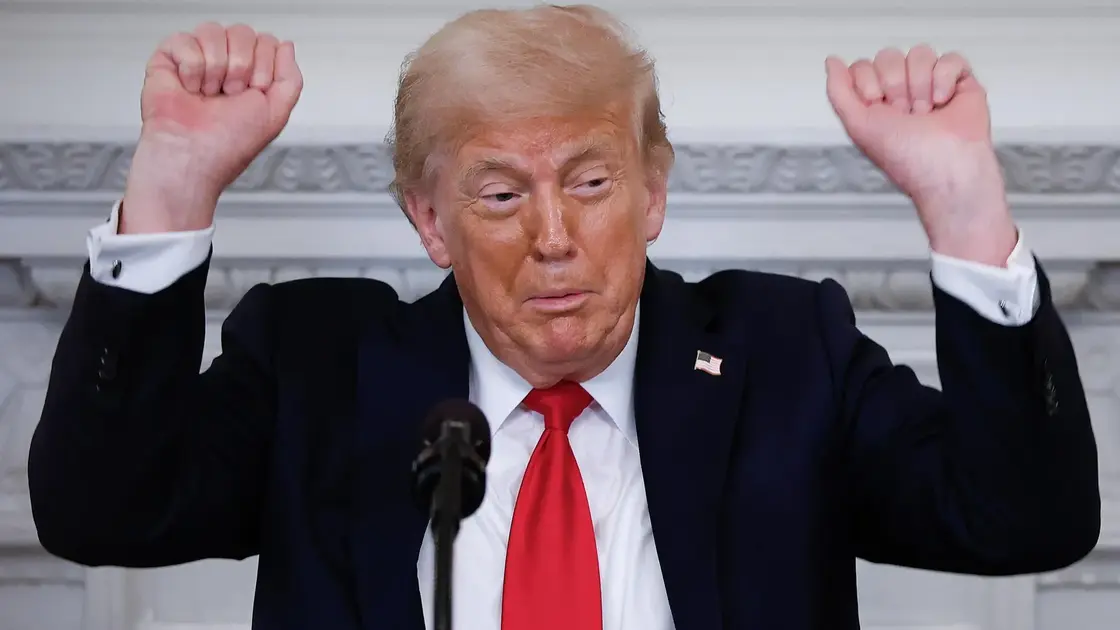

Trump expands 401k investment options to private equity and cryptocurrency

New York (AP) — Millions of Americans with 401(k) retirement accounts could soon invest in private equity and cryptocurrency due to an executive order signed by President Trump. This order aims to redefine what qualifies as a reputable asset under current retirement regulations, potentially allowing employers to offer a wider range of investments. While these changes will not take effect immediately, federal agencies will need to revise rules, which may take months. Trump’s directive benefits both the $5 trillion private equity sector and the cryptocurrency market, a move welcomed by many of their supporters. Currently, 401(k) plans primarily include stocks and bonds, but the inclusion of riskier assets like private equity and cryptocurrencies could change the landscape. This potential change reflects the growing popularity of these investments, particularly among younger savers looking for diverse options.

Key Takeaways

"It was inevitable that bitcoin would make its way into American 401(k)'s."

Cory Klippsten emphasizes the growing acceptance of bitcoin for retirement plans.

"We look forward to working with the Trump Administration on a thoughtful framework."

Bryan Corbett expresses eagerness for collaboration to expand investment options.

"Even after the regulations are written, it will take time for major retirement plan companies."

Insight into the timeline for implementing changes to retirement plans.

"The average historic annual return on private equity assets is roughly 13%."

This fact illustrates the potential gains compared to traditional investments.

The executive order signifies a strategic shift in retirement investment policy, potentially exposing workers to higher-risk assets that have been traditionally excluded from 401(k) plans. As private equity firms seek new capital sources, Trump's move may fuel a competitive market for retirement assets. This pivot could reshape how Americans approach retirement savings, aligning with the interests of those who favor alternative investments. However, the volatility associated with cryptocurrencies raises concerns about long-term implications for retirement security. Balancing the desire for increased investment options with protecting workers' interests will be crucial in the months to come as regulations are crafted.

Highlights

- Investors are welcoming higher-risk options to 401(k) plans.

- Younger savers are looking for diversification in their retirement portfolios.

- The balance between risk and reward is crucial in retirement planning.

- Private equity aims to tap into America's vast retirement assets.

Expansion of 401(k) investment options raises concerns

The inclusion of higher-risk private equity and cryptocurrency in retirement accounts could jeopardize financial security for many workers. While the potential for higher returns exists, the volatility and risks associated with these investments may not align with the best interests of all investors.

As developments unfold, the balance between risk and reward in retirement savings continues to be a vital conversation.

Enjoyed this? Let your friends know!

Related News

Private assets move closer to many 401k plans

401k changes could broaden investment choices

Trump signs 401k crypto policy expansion

Trump allows crypto investments in retirement plans

Trump expands retirement account options to include cryptocurrency

Retirement investors could gain new options

Trump plans to open retirement funds to crypto investments

Bitcoin gets a retirement push