T4K3.news

Trump expands retirement account options to include cryptocurrency

New order directs the review of investment rules to potentially allow crypto in retirement accounts.

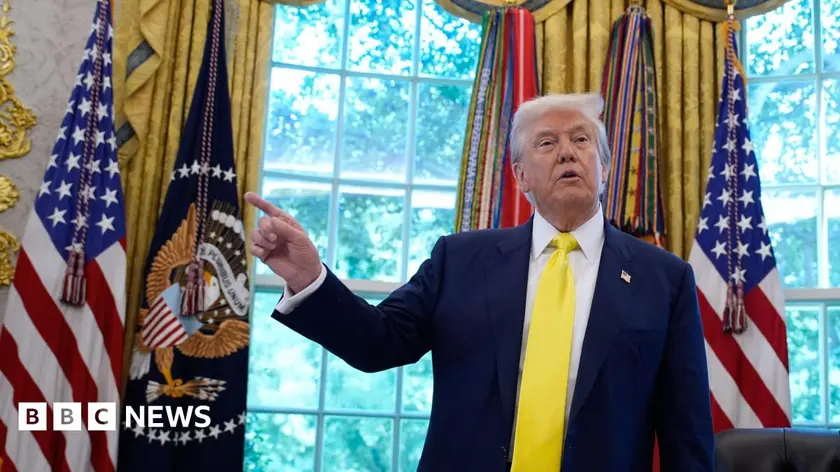

The president signs an order aimed at expanding the kinds of investments allowed in retirement accounts.

Trump takes steps to integrate cryptocurrency into retirement accounts

Most employers in the US no longer provide traditional pensions with guaranteed payouts after retirement. Instead, employees contribute part of their salary to investment accounts, with nominal boosts from employers. Government regulations have typically held these firms responsible for considering risk and costs. Historically, employers were hesitant to include investments such as private equity due to higher fees and less transparency. Now, a new order from Trump directs the Department of Labor to review these rules within 180 days. Although change may take time, leaders in investment management, including State Street and Vanguard, are already forming partnerships to offer private-equity retirement funds. Meanwhile, Trump's personal interests intersect with crypto investments. In a prior move, the Department of Labor cautioned against adding crypto to retirement plans, a stance that shifted under Trump's term.

Key Takeaways

"Employers will now have more options in how they structure retirement accounts."

This reflects the changed regulatory landscape under the new order.

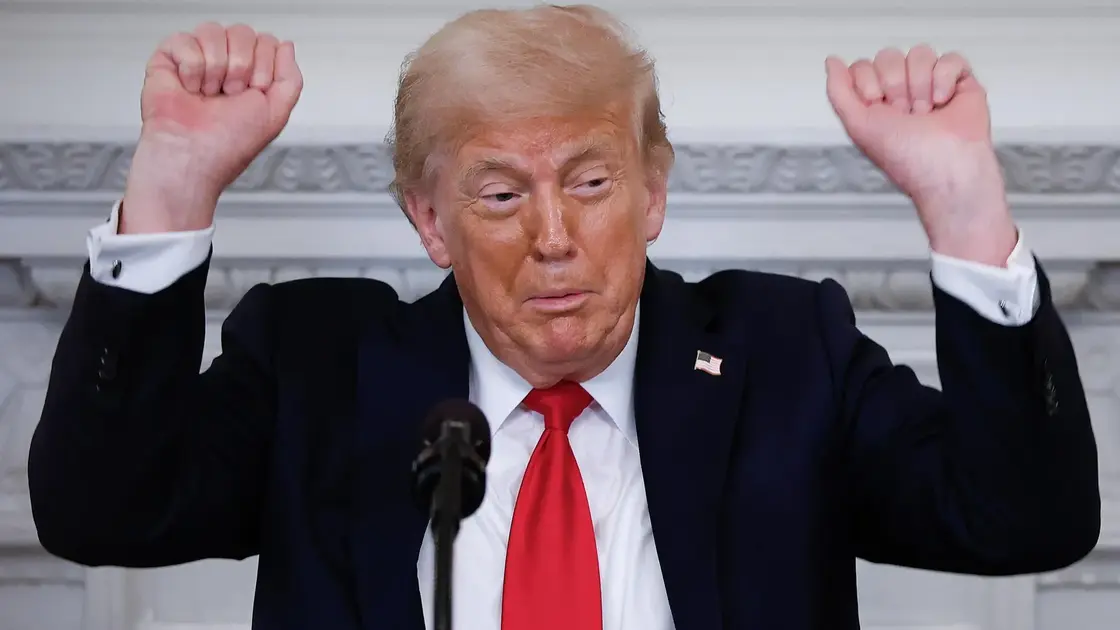

"Trump's interests directly align with the inclusion of cryptocurrency in retirement plans."

This raises questions about potential conflicts and transparency.

The president's order signals a significant shift in how retirement investments may evolve, notably allowing riskier assets like cryptocurrency. This introduces a fresh layer of complexity surrounding retirement planning, impacting investor confidence. As major firms prepare to adapt their offerings, the financial landscape appears poised for change. However, the long-term consequences of such investments remain unclear, particularly regarding investor protections. This shift could lead to a larger debate about the suitability of cryptocurrency in retirement plans, highlighting the precarious balance between innovation and risk in financial products.

Highlights

- Is cryptocurrency the future of retirement planning?

- Investing in your future just got riskier.

- Trump's move opens a door for crypto in retirement funds.

- The landscape of retirement investing is about to change dramatically.

Concerns over investment risks in retirement accounts

Trump's order encourages riskier asset inclusion in retirement plans, raising concerns about financial safety for workers. Investment strategies could become bolder, impacting long-term savings.

The ongoing evolution of retirement investments marks a new chapter in personal finance.

Enjoyed this? Let your friends know!

Related News

Trump opens 401k investment options to private equity and crypto

Private assets move closer to many 401k plans

Trump signs 401k crypto policy expansion

Trump to sign order permitting cryptocurrency in 401(k) accounts

401k changes could broaden investment choices

Retirement investors could gain new options

Trump allows crypto investments in retirement plans

Stellar's Price Set for Rise After Trump's Crypto Bill