T4K3.news

US considers equity stake in Intel under chips act funding

The administration is evaluating converting Chips Act funding into a nonvoting equity stake in Intel to support domestic chip production.

The Trump administration is exploring converting Chips Act funding into an equity stake in Intel to boost domestic chip production.

US weighs equity stake in Intel under chips act funding

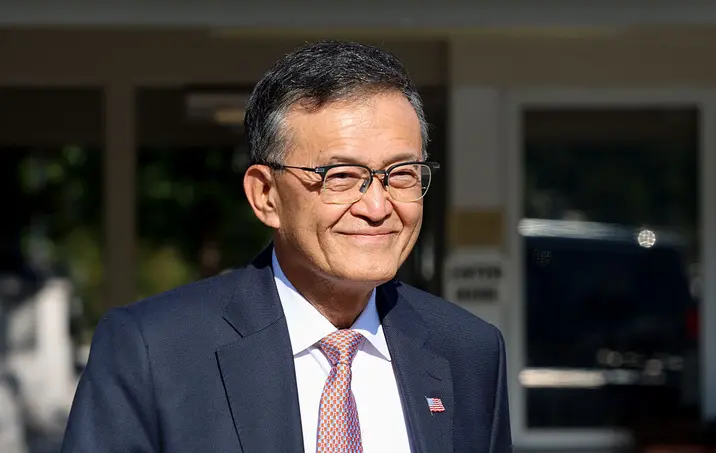

The Commerce Department confirmed discussions about converting Chips Act funding into a nonvoting equity stake in Intel. The plan would convert grants into a government equity position without giving the government governance rights. Howard Lutnick has spoken about the idea, framing it as a way to align public support with domestic chip production. The talks come as the US aims to reduce reliance on foreign suppliers and bolster US manufacturing capacity, including projects connected to Taiwan Semiconductor Manufacturing Company in the United States. Intel has faced competitive pressure from peers like Nvidia, and investor activity rose after reports of the discussions, with SoftBank also signaling support through a separate stake in the company.

Key Takeaways

"We need to make our own chips here. We cannot rely on Taiwan."

Lutnick explaining the rationale behind seeking a domestic equity stake

"The stake would be a conversion of the grants and maybe increase the investment into Intel to help stabilize the company for chip production here in the US. There’s no talk of trying to force companies to buy from Intel."

Lutnick describing mechanism and governance

"There’s no talk of trying to force companies to buy from Intel."

Scott Bessent on the policy implementation

"The last thing we’re going to do is take a stake and then try to drum up business."

Bessent outlining government role

The proposal highlights a shift in how the state may use subsidies to shape a strategic industry. Converting grants into equity could better align taxpayer interests with company performance, but it also raises questions about risk, governance, and accountability. If pursued, the move could set a precedent for future subsidies and provoke political scrutiny over taxpayer exposure and corporate favoritism. It may also complicate relations with allies and investors who weigh how much government support is appropriate for private firms.

Highlights

- We cannot rely on Taiwan

- The stake would be a conversion of the grants

- There’s no talk of forcing companies to buy from Intel

- We need to make our own chips here

Budget and political risk around equity stake in Intel

Transforming grants into equity raises taxpayer exposure and governance questions. It could trigger political backlash and intensify debates over state intervention in private companies and long-term subsidy effectiveness.

Policy choices in this space will test how far public investment can steer private industry without bypassing market dynamics.

Enjoyed this? Let your friends know!

Related News

Chips Act funds eyed for Intel stake

US weighs stake in Intel

US weighs Intel stake without governance rights

US considers 10 percent stake in Intel

Trump administration eyes 10% Intel stake

Government stake in Intel

SoftBank invests in Intel for 2 percent stake

SoftBank Invests in Intel