T4K3.news

Government stake in Intel

U.S. government pursues a 10% stake in Intel by converting CHIPS Act grants, signaling a rare blend of public funding and private ownership.

A government equity plan tests the line between public funding and private control as SoftBank backs Intel and the Trump administration weighs a big stake.

US government targets 10 percent stake in Intel after SoftBank investment

SAN FRANCISCO — The Trump administration is pursuing a 10 percent stake in Intel by converting federal CHIPS Act grants into stock, a move that would make the government one of the firm’s largest shareholders and align public incentives with a private company.

The plan surfaced as Japanese investor SoftBank disclosed a $2 billion purchase that would give it about 2 percent of Intel at $23 a share. Officials say the aim is to strengthen domestic chip manufacturing and protect critical supply chains while using a government stake to influence long-term strategy. Intel declined to comment on the negotiations.

The push comes as Intel struggles to regain momentum after missing the mobile era and now contends with a fast-changing AI landscape in which Nvidia and AMD have surged ahead. The CHIPS Act has funded U.S. projects, but Intel’s use of roughly $2.2 billion of an $7.8 billion pledge has drawn criticism as the company faces delays and restructuring under CEO Lip-Bu Tan. The government would issue non-voting shares to avoid direct control, yet the move still raises questions about taxpayer exposure and corporate governance in a private firm.

Key Takeaways

"We think America should get the benefit of the bargain."

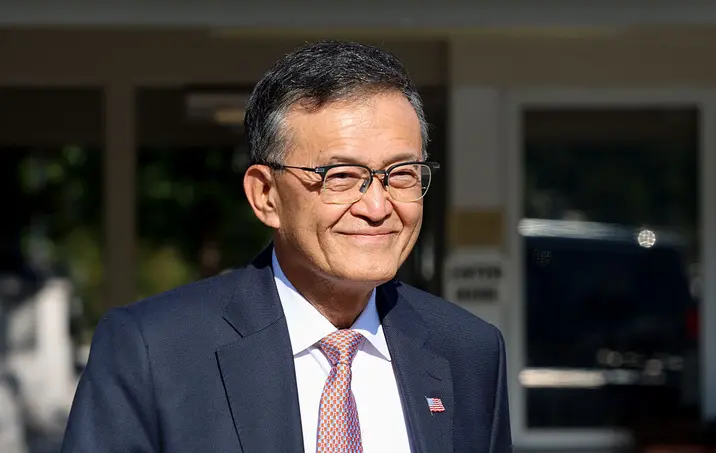

Lutnick explaining the rationale in CNBC interview.

"Semiconductors are the foundation of every industry."

Masayoshi Son on SoftBank's investment rationale.

"This strategic investment reflects our belief that advanced semiconductor manufacturing and supply will further expand in the United States"

Son on the US role in semiconductors.

"We want Intel to be successful in American"

Lutnick on national focus for Intel.

The idea of a state-backed stake in a tech behemoth highlights a larger trend: governments are increasingly willing to blend policy and equity to secure strategic sectors. Yet it also foregrounds risk. Turning grants into equity creates a potential ceiling on the government’s distance from company decisions while inviting political scrutiny and market volatility. If the stake remains non-voting, the government reduces day-to-day influence but still shoulders financial risk and reputational exposure should Intel stumble again. Observers will watch how this interacts with ongoing U.S. efforts to localize semiconductor supply and whether investors perceive the move as a bailout, a strategic shield, or a new form of state capitalism.

Highlights

- America buys a piece of its own silicon future

- A state stake shifts a company’s priorities

- The market will judge this bet on US tech leadership

- Non voting shares keep politics out of daily decisions for now

High political and budget risk in government stake plan

The proposed conversion of grants into equity could blur lines between public funding and private control, inviting political backlash and investor scrutiny. The plan raises questions about governance, oversight, and long-term value to taxpayers.

The next chapter will reveal whether a government stake can truly align public purpose with private growth.

Enjoyed this? Let your friends know!

Related News

US weighs Intel stake without governance rights

Intel stake under review by government

Trump administration eyes 10% Intel stake

US considers 10 percent stake in Intel

Intel stake under review after political clash

US considers equity stake in Intel under chips act funding

US weighs stake in Intel

Intel secures SoftBank investment amid stake talk