T4K3.news

US weighs Intel stake without governance rights

The US is considering converting Chips Act subsidies into an equity stake in Intel, while promising no governance rights.

The US is considering a plan to take an equity stake in Intel while promising no governance rights, a move that would convert subsidies into private equity.

US weighs Intel stake without governance rights

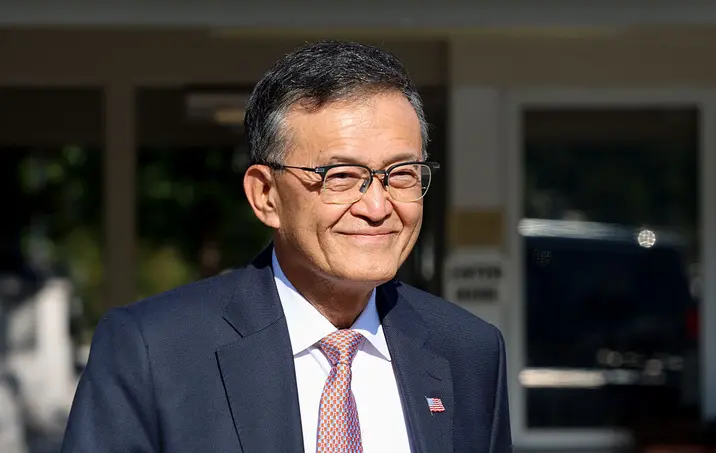

Commerce Secretary Howard Lutnick confirmed discussions between the US and Intel about the government taking a stake in the chipmaker. He said the plan would convert Chips and Science Act grants into equity, but the government would not gain governance or voting rights even if it becomes Intel’s largest shareholder.

Lutnick criticized the chips law for subsidizing semiconductor makers without delivering a clear return to US taxpayers. The arrangement would place a federal stake in Intel while avoiding control, a setup that could alter how public money supports the industry without giving the government formal influence over business decisions.

Key Takeaways

"Stake without a vote still tilts the risk."

Editorial reflection on governance rights

"Taxpayers deserve clear returns not vague promises."

Civics and accountability focus

"This plan turns subsidies into equity while avoiding governance."

Description of the mechanism

"The optics of government stake without control will draw scrutiny."

Public perception concern

This move tests a new model of government support, one that couples financial risk with ownership but not control. If it becomes a template, it could reshape expectations for taxpayer returns and industry accountability. The plan also foregrounds the politics of subsidies, inviting scrutiny over whether equity alone is enough to justify public money.

The optics matter. If lawmakers frame this as a win for national security and domestic manufacturing, critics may still press for stronger safeguards and clearer timelines for when the government would see a tangible benefit. The outcome will hinge on details hidden from public view today and on how investors, workers, and voters perceive the balance of risk and reward.

Highlights

- Stake without a vote still tilts the risk

- Taxpayers deserve clarity on returns

- Subsidies become equity while governance stays away

- The optics of government stake without control will draw scrutiny

Budget and governance risk in Intel stake plan

The plan links government subsidies to an equity stake without governance rights, raising questions about taxpayer returns, political accountability, and potential public backlash.

The next steps will reveal whether this quiet equity move delivers real gains for taxpayers or simply shifts risk to the market.

Enjoyed this? Let your friends know!

Related News

US considers equity stake in Intel under chips act funding

Intel stake under review after political clash

Chips Act funds eyed for Intel stake

Trump moves on Intel stake

Protests surge as Gaza City plan tests Israeli resolve

US weighs stake in Intel

Government stake in Intel

Intel stake under review by government