T4K3.news

Chips Act funds eyed for Intel stake

The administration weighs a government equity stake in Intel using CHIPS Act funds to bolster US semiconductor manufacturing.

Officials discuss using CHIPS Act money to acquire an equity stake in Intel to rescue the company and bolster domestic semiconductor manufacturing.

Trump Administration Eyes Chips Act Funds to Take Stake in Intel

Officials familiar with the talks say the Trump administration is weighing using CHIPS Act funds to take an equity stake in Intel Corp. The discussions are in an early stage and other options are under consideration. Possible approaches include converting existing CHIPS Act grants into equity, creating a new financing line, or combining CHIPS Act money with other funding streams.

A move to back Intel would aim to shore up domestic semiconductor manufacturing and strengthen the nation’s supply chain. It would mark a direct instance of government investment in a private company and raise questions about returns, governance, and accountability. No decision has been made and other routes remain under review.

Key Takeaways

"A government equity stake would shift risk from the company to taxpayers."

Stresses fiscal exposure and accountability.

"If policy moves fast, oversight must be tight and transparent."

Calls for governance safeguards and transparency.

"This is about resilience as much as it is about rescue."

Highlights supply chain goals alongside rescue efforts.

The proposal reflects a broader sense of urgency about securing critical tech supply chains amid global competition. It could speed up capacity growth, but it also risks politicization and budget pressure if costs rise or promises are not kept.

Policy makers must balance national security needs with market discipline and the precedent such a deal would set for future interventions. If guardrails and transparent oversight are in place, the plan could minimize taxpayer risk while signaling resolve; without them, it could invite scrutiny and slow down other urgent investments.

Highlights

- The state stepping into a boardroom is policy in motion.

- Chips Act funds for Intel mean taxpayers chase returns and guardrails.

- National security and balance sheets collide in a bold funding twist.

- Public money for private stakes invites lasting scrutiny.

Political and budget risk around government stake in Intel

Using CHIPS Act funds to buy into a private company could provoke political backlash, affect budget planning, and invite debates over transparency and return on public investment. The move would also raise questions about governance and the handling of public money in private enterprise.

A test of how far public money should back private industry is ahead

Enjoyed this? Let your friends know!

Related News

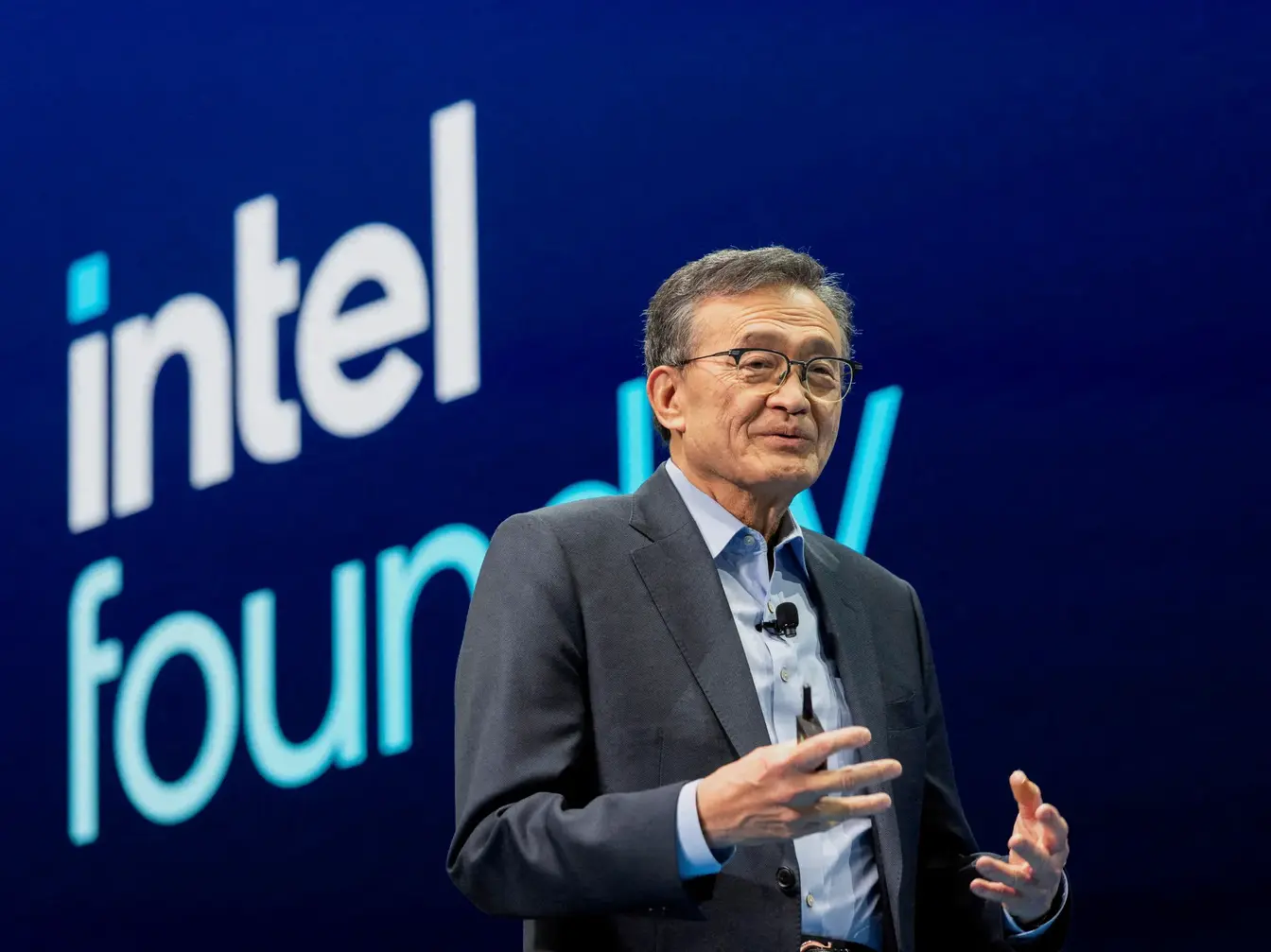

Trump administration eyes 10% Intel stake

US weighs stake in Intel

Intel stake under review after political clash

Tariffs on chips spark market risk

US considers 10 percent stake in Intel

SoftBank invests in Intel for 2 percent stake

Trump demands Intel CEO resign over conflicts

Intel leadership under political pressure