T4K3.news

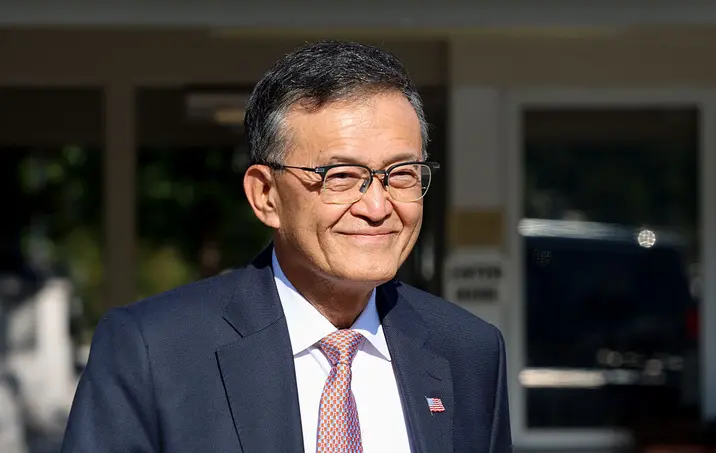

Intel stake under review after political clash

U.S. government stake in Intel discussed at White House; comments from Intel and senators not yet provided.

Trump’s criticism of Intel's chief comes amid debates over national security, CHIPS Act funding, and potential state involvement in a critical tech firm.

US may purchase stake in Intel after Trump attacked CEO

Donald Trump and Intel CEO Lip-Bu Tan reportedly discussed the possibility of the United States taking a financial stake in Intel during a White House meeting. The Wall Street Journal cited unnamed sources and described the talks as exploratory, with Intel branding them as rumors and offering no details on how such a stake would be structured. The discussions follow Trump’s demand that Tan resign, a move framed by a senator’s letter alleging Chinese ties and prompting questions about governance and national security.

Senator Tom Cotton’s letter asks Intel to address potential conflicts of interest and whether any divestments would be required to meet CHIPS Act obligations, noting Intel’s receipt of CHIPS Act funding. It also probes whether Tan disclosed ties to the Chinese government. Intel and Cotton’s office did not comment when contacted. The episode highlights broader tensions between U.S. industrial policy, China concerns, and the private sector’s role in critical supply chains.

Key Takeaways

"Policy and profits have stopped pretending to be separate"

Editorial observation on the overlap of politics and business

"National security is now a factor on every earnings call"

A reflection on how security concerns shape corporate budgeting

"Rumors can move stock as fast as a press release"

Comment on how political chatter affects markets

"A government stake changes more than a balance sheet"

Insight on governance implications of state investment

The episode puts a spotlight on how policy aims can intrude into boardroom decisions. A government stake would not only reshape governance at a blue-chip company but also test investor confidence and market resilience amid geopolitical frictions. The CHIPS Act framework adds another layer, turning funding into potential leverage or obligation. This is less about a single CEO and more about how Washington intends to balance national security and economic competitiveness with corporate autonomy.

Highlights

- Policy and profits have stopped pretending to be separate

- National security is now a factor on every earnings call

- Rumors can move stock as fast as a press release

- A government stake changes more than a balance sheet

Political and budget risk in proposed government stake in Intel

The report ties a potential U.S. government stake in Intel to ongoing political tensions around national security, CHIPS Act funding, and scrutiny of corporate ties to China. This raises concerns about policy clarity, investor confidence, and governance if the state participates in a critical supplier.

The coming days will test how policymakers balance security aims with market realities.

Enjoyed this? Let your friends know!

Related News

Intel stake under review by government

Lib Dem push for review of terrorism laws

Trump halts Gaza medical visas after Loomer post

Epstein files and political blame game

Trump demands Intel CEO resignation

Chips Act funds eyed for Intel stake

Trump moves on Intel stake

US weighs stake in Intel