T4K3.news

SoftBank Invests in Intel

SoftBank commits 2 billion to Intel at 23 per share, boosting its stake and raising policy questions.

SoftBank’s 2 billion investment into Intel signals private capital support while raising questions about government influence and long term strategy.

SoftBank Bets on Intel With 2 Billion Cash Infusion

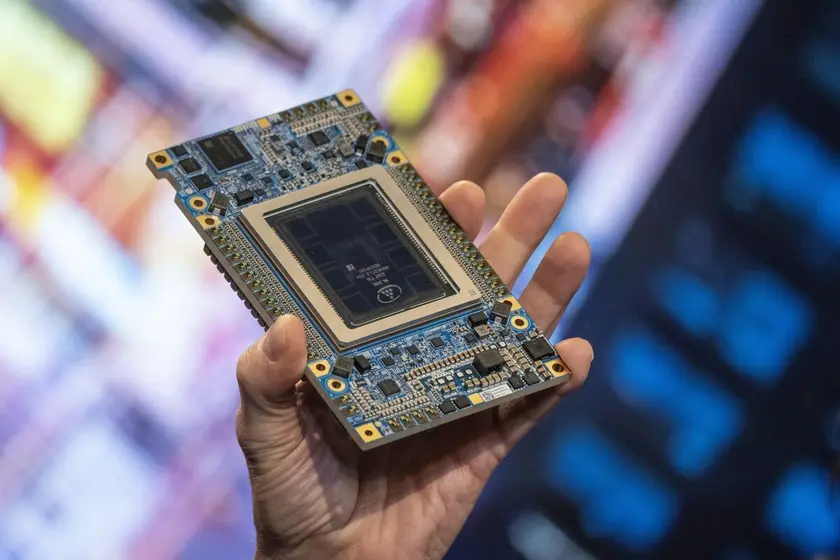

SoftBank is investing 2 billion dollars into Intel at 23 dollars a share, a slight discount to Intel’s 23.66 close on Monday. The deal values SoftBank at about 2 percent of Intel and makes it the company’s fifth-largest shareholder. Intel has been cutting jobs and divisions to conserve cash, so the new capital provides working capital as it pursues growth in areas such as AI chips. Intel shares rose about 7 percent in Tuesday trading on the news.

Separately, the article notes comments from a figure described as Commerce Secretary Howard Lutnick, who says CHIPS Act funds should come with an equity stake in Intel. The report also cites analyst ratings, showing a Hold consensus (one Buy, 27 Holds, three Sells in the past three months) and a price target around 22.15 dollars, implying potential downside. The combination of private capital and policy questions creates a mixed backdrop for Intel’s turn around.

Key Takeaways

"Masa (Masayoshi Son, founder of SoftBank) and I have worked closely together for decades, and I appreciate the confidence he has placed in Intel with this investment."

Lip-Bu Tan comments on the relationship and trust behind the deal.

"We will receive an equity stake in Intel in exchange for CHIPS Act funds."

Lutnick outlines the conditional funding arrangement tied to CHIPS Act dollars.

"The Biden administration literally was giving Intel for free, and giving TSMC money for free, and all these companies just giving them money for free."

Lutnick offers a sharp critique of subsidies and policy generosity.

The deal shows how private money is moving into the chip sector as companies reposition for AI demand. SoftBank’s investment could accelerate Intel’s retooling and provide a signaling floor for the stock, even as the price action suggests traders remain wary about execution and macro policy. The CHIPS Act dialogue highlights how policy conditions can become a real factor in corporate strategy and investor confidence, potentially reshaping how other firms price risk in government funding.

Looking ahead, investors will watch not just earnings and product milestones but also policy signals. If the government seeks equity stakes in more beneficiaries, the sector could see a shift in governance and risk appetite. That could attract certain investors while alienating others who prefer market-based finance and clearer milestones. The tension between public support and private discipline will define Intel’s trajectory in the coming year.

Highlights

- SoftBank bets big on Intel signaling a new AI chips era

- A private lifeline meets public policy in the tech race

- Investors watch policy moves as closely as earnings

- Intel gains capital while politics linger over CHIPS Act

Political and budget sensitivities around CHIPS Act funding

The report highlights potential equity stakes tied to government funding and the risk of political backlash or policy shifts that could affect Intel’s strategy and investor sentiment.

Policy and markets are converging, and Intel’s next moves deserve close watching.

Enjoyed this? Let your friends know!

Related News

SoftBank backs Intel with 2 billion investment

Intel secures SoftBank investment amid stake talk

SoftBank invests in Intel to bolster chip ambitions

SoftBank invests in Intel for 2 percent stake

Government stake in Intel

Market moves

Markets Waver as Nvidia Eyes China Chip Push

Stocks Mixed as Earnings Roll In and Chip Makers Lead