T4K3.news

SoftBank invests in Intel for 2 percent stake

SoftBank commits 2 billion to Intel, signaling confidence in U.S. chip manufacturing as policy debates unfold.

SoftBank commits to a $2 billion stake in Intel while UK property tax plans spark questions about who pays and when.

SoftBank backs Intel with 2 billion investment as UK tax changes loom

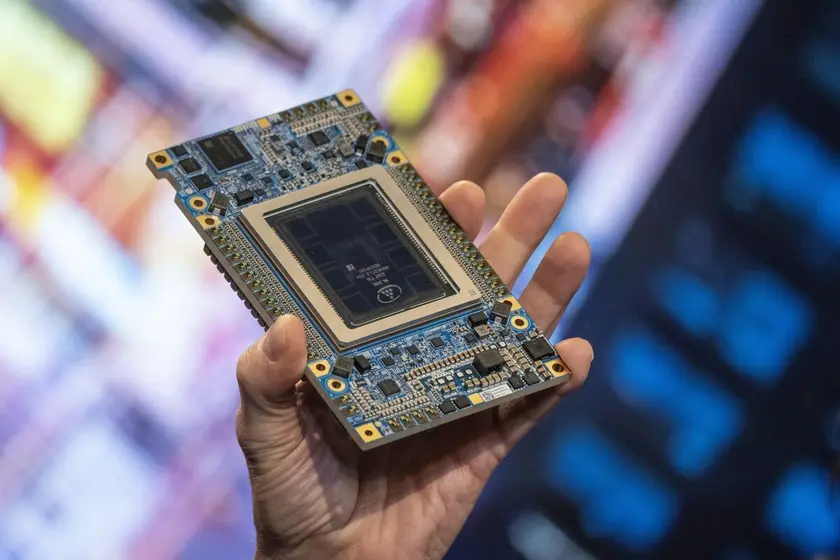

SoftBank has agreed to invest 2 billion in Intel, taking a 2 percent stake in the U.S. chipmaker. The deal marks a high profile show of support for Intel as the company aims to accelerate domestic manufacturing and regain ground in the global semiconductor race. The announcement came as Intel faced a stock reaction and SoftBank faced broader market headwinds, underscoring how big bets ride on both company performance and policy currents. Masayoshi Son, SoftBank’s chief executive, framed the move as a vote of confidence in Intel’s strategy to expand advanced semiconductor manufacturing in the United States. Analysts say the investment could speed up Intel’s capital program and its push to build more fabrication capacity at home.

Key Takeaways

"Semiconductors are the foundation of every industry. For more than 50 years, Intel has been a trusted leader in innovation."

Masayoshi Son explaining the strategic rationale for the investment

"This strategic investment reflects our belief that advanced semiconductor manufacturing and supply will further expand in the United States, with Intel playing a critical role."

Son outlining why SoftBank chose Intel

"Who is better off will come down to how closely the government chooses to follow any recommendations."

David Fell from Hamptons on how policy design could affect outcomes

Two stories sit at the crossroads of public policy and private capital. On one side, SoftBank’s investment highlights how private money continues to back national manufacturing goals in an industry central to modern economies. On the other, UK policy makers debate a tax shift that could change the calculus for buyers of expensive homes. Together they illustrate how policy and markets influence each other, shaping where money moves and what it costs to own property. The result could be a tug of war between stimulating growth and preserving affordability, with investors watching for credible, stable rules.

Highlights

- Capital moves faster than policy in a world of big bets

- Policy shifts can unlock growth or chill investment

- Tech bets ride on clear rules and steady funding

- Markets watch government steps as numbers and jobs collide

Budget and political implications

The deal intersects with large policy questions in both the United States and United Kingdom. It raises potential budgetary concerns and political sensitivity around how subsidies and taxes influence markets and public sentiment. If policy promises falter or costs rise, reactions from voters and investors could intensify.

Policy shifts will shape the next phase of how and where capital flows

Enjoyed this? Let your friends know!

Related News

Intel secures SoftBank investment amid stake talk

SoftBank backs Intel with 2 billion investment

Trump administration eyes 10% Intel stake

SoftBank invests in Intel to bolster chip ambitions

Intel reports Lunar Lake gains for gaming

Grocery inflation cools but discounters push hard

Trump moves on Intel stake

FTSE 100 hits new high on tariff cues