T4K3.news

Speciality Steel insolvency hearing advances

London High Court sets date to hear winding-up petitions as Gupta pursues a pre-pack plan backed by BlackRock.

A plan to rescue Speciality Steel with BlackRock funding faces a high-stakes clash with major creditors.

Gupta lines up BlackRock financing to buy Speciality Steel out of insolvency

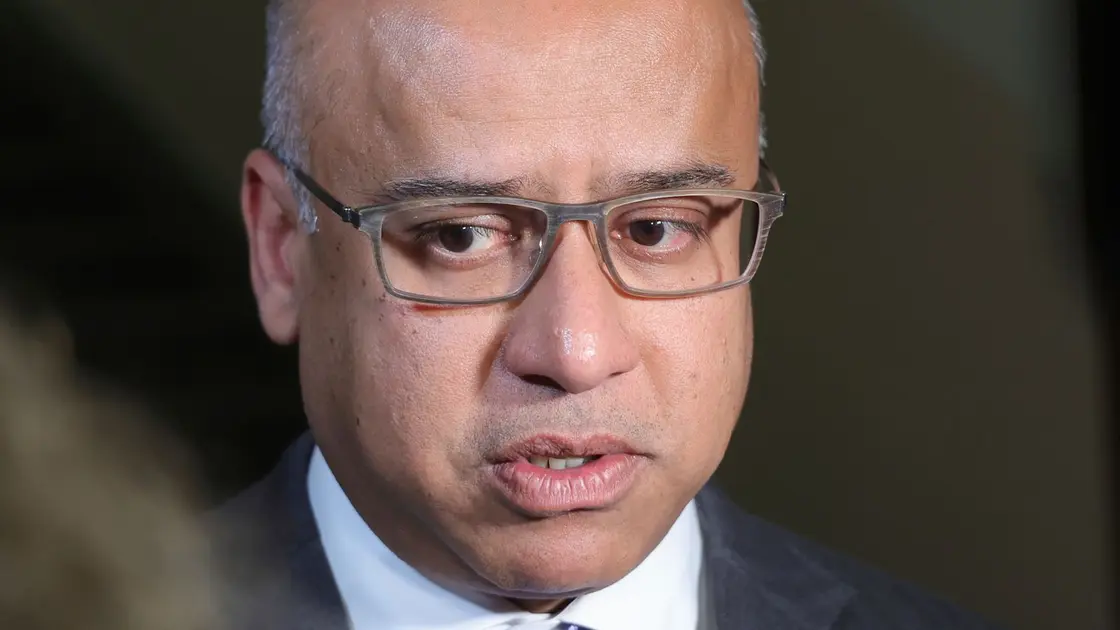

Sanjeev Gupta is seeking financing from BlackRock to back a plan that would put Speciality Steel into administration and then buy it out of insolvency. The approach, supported by Begbies Traynor for the administration, aims to create a pre-pack sale that could hand Gupta a fresh ownership stake in the UK operation. Lenders led by UBS have warned they stand to lose money under such a scenario, and pitch the dispute as a test of how far creditors must go to protect their claims. A High Court hearing on the winding-up petition is set to proceed in London as the parties argue over the path forward for about 1,500 workers across five sites in the north of England.

Key Takeaways

"The chaos must end"

Union reaction to prolonged uncertainty at Liberty Steel

"We need a long-term solution that safeguards jobs"

Union call cited in coverage of the dispute

"This plan tests the balance between saving assets and paying creditors"

Editorial assessment of the insolvency strategy

"Creditors face losses that could ripple through the market"

Financial risk noted in industry discussions

The plan spotlights a broader tension in UK manufacturing: can private capital rescue a troubled asset without erasing the value owed to creditors? A successful rescue could preserve jobs and keep production going, but it also raises questions about transparency and who bears the losses when a debt overhang meets a pre-pack exit. BlackRock’s involvement signals how global fund managers are increasingly willing to participate in contentious restructurings, even as the Greensill-linked liabilities and ongoing investigations shadow Gupta and his group. The case also comes as government action to shield strategic steel assets has already interrupted other parts of the sector, suggesting policymakers will watch this process closely for precedent and impact on public confidence.

Highlights

- The chaos must end

- We need a long-term solution that safeguards jobs

- This deal tests the balance between saving assets and paying creditors

- Creditors face losses that could ripple through the market

Financial and political risk in insolvency plan

The proposed rescue blends private capital with a contentious creditor landscape and active legal proceedings. If it proceeds, it could reshape creditor outcomes and trigger public and regulatory scrutiny, especially given the sector’s strategic importance.

The court decision will reveal if a private rescue can responsibly align interests of workers, creditors, and local communities.

Enjoyed this? Let your friends know!

Related News

Gupta plan for UK steel arm

Gupta s SSUK liquidation

Government intervention secures pay and pensions at South Yorkshire steelworks

Government prepares special managers for Liberty Steel SSUK

UKs steelworks falls under government control

SSUK liquidation prompts government control

UK government appeals Epping hotel ruling

Gupta SSUK under scrutiny as pre-pack rescue explored