T4K3.news

Gupta SSUK under scrutiny as pre-pack rescue explored

SSUK could pursue a connected pre-pack administration to save parts of its UK steel operations, with government planning and creditor opposition shaping the next steps.

Sanjeev Gupta's Liberty Steel UK unit may pursue a connected pre-pack administration to salvage operations and limit losses for creditors while jobs hang in the balance.

Gupta SSUK faces a fragile path as linked pre-pack rescue is explored

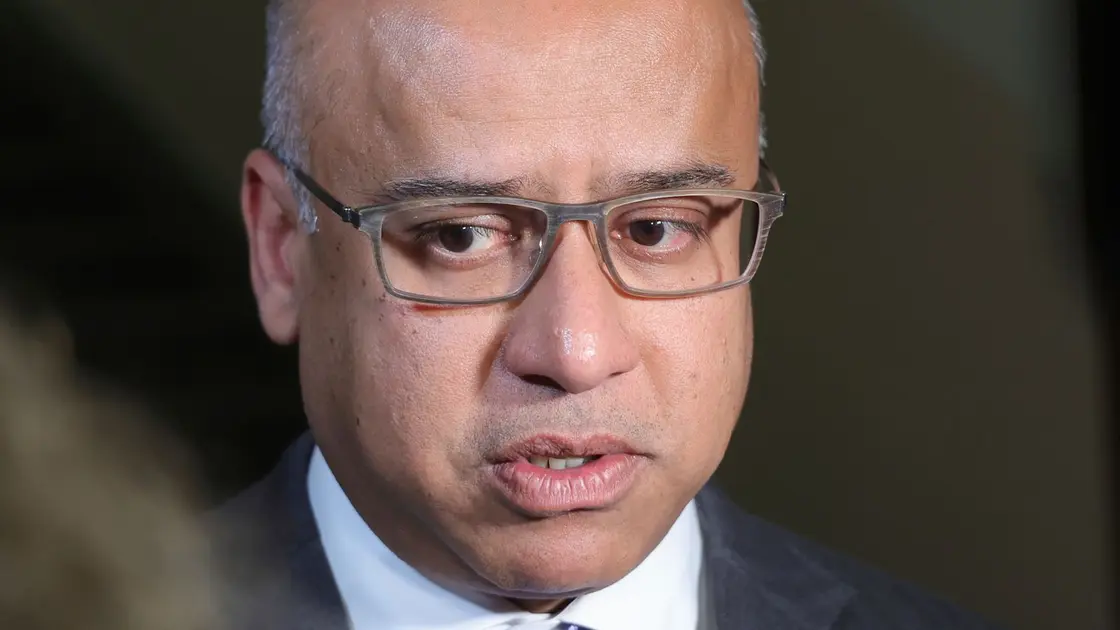

Sanjeev Gupta’s Liberty Steel UK unit SSUK is reported to be discussing a connected pre-pack administration that could see its assets sold after wiping out a large portion of debt to creditors. The move, if it proceeds, would aim to preserve electric arc furnace steelmaking at sites in Sheffield and Rotherham but could involve sales to parties tied to the Gupta family. Begbies Traynor is said to be assisting in moving the process forward, while Whitehall officials have stepped up contingency planning for a potential collapse should the winding-up petition move ahead next week.

Creditors including HM Revenue & Customs and banks are watching closely. A connected pre-pack could shift liabilities away from creditors and toward the state, a scenario that would invite scrutiny from lawmakers and the public. The Serious Fraud Office has been investigating the Gupta family group, and any government involvement would attract political attention. SSUK has faced years of financial pressure, with energy costs and dependence on imports cited as core challenges. The government has not ruled out support, but officials say any intervention would hinge on a sustainable plan that protects jobs and critical capabilities across the UK steel sector.

Key Takeaways

"Protect workers and the plant at stake"

emotional plea for job and plant preservation

"Transparency must lead any rescue"

call for open and fair negotiations

"Taxpayers should not bear insider costs"

critique of insider deals at the taxpayers' expense

"A true national steel strategy beats a lone rescue"

policy-driven framing for a broader approach

The case tests a core tension in industrial policy: can a selective rescue of a single plant justify potential costs to taxpayers and to creditors who funded the business through tough times? A connected pre-pack raises questions about transparency and accountability, especially if assets could pass to insiders. Yet preserving steelmaking capacity in the UK matters beyond a single company; it touches on national strategy, supply chains and regional employment. Ministers face pressure to show they will act decisively when a strategically important industry is at risk, while also avoiding moral hazard and preferential treatment for one group of creditors.

Highlights

- Protect workers and the plant at stake

- Transparency must lead any rescue

- Taxpayers should not bear insider costs

- A true national steel strategy beats a lone rescue

Political and budget risks in a linked pre-pack rescue

The connected pre-pack raises concerns about who pays and who profits, potentially drawing political scrutiny and affecting public funds. Opposition from creditors and the prospect of taxpayer involvement heighten the risk of public backlash and controversy.

The next hearing will reveal how far ministries are prepared to go to steer this industrial chapter.

Enjoyed this? Let your friends know!

Related News

Liberty Steel SSUK facing court action and rescue talks

Speciality Steel insolvency hearing advances

Atelier Ryza Secret Trilogy Deluxe Pack launch date confirmed

Magic Gathering Edge of Eternities expansion boosts card prices

SpongeBob SquarePants: Titans of the Tide release date announced

Donkey Kong Bananza Launches Amid Nostalgia

Proposed Gifting Strategy May Face Tax Scrutiny

Rampage Gains Popularity on Streaming Services