T4K3.news

Liberty Steel SSUK facing court action and rescue talks

A last-ditch plan to save Liberty Steel Speciality UK faces a courtroom decision as government contingency plans unfold.

A last-ditch bid to save the UK Speciality Steel unit comes as court action looms and officials plan for a possible collapse.

Liberty Steel SSUK Rescue Plan Tests Gupta Resolve

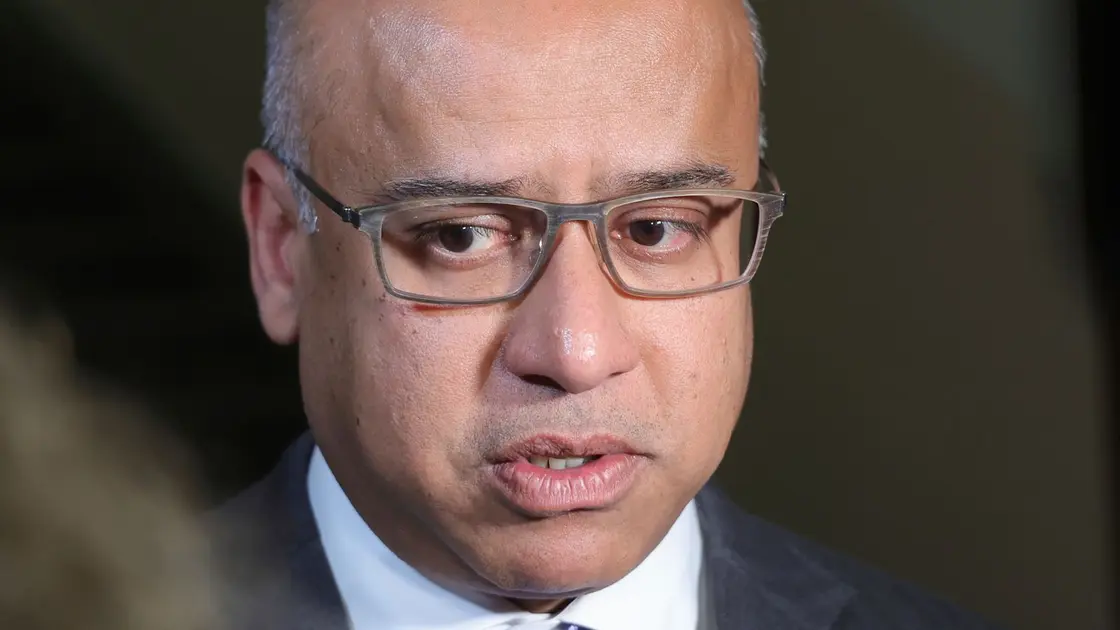

Sanjeev Gupta is pursuing an 11th-hour rescue for Speciality Steel UK, with Begbies Traynor reportedly structuring a pre-pack administration that would wipe out debts and liabilities before a potential buyback by Gupta or associates.

Any deal would hinge on the consent of creditors, including HM Revenue and Customs and UBS, and on the winding-up petition facing SSUK after a supplier’s action. SSUK employs about 1,500 people and runs plants in Rotherham and Stocksbridge, both of which could be affected if liquidation is approved. Government officials have begun contingency planning for a collapse, while regulators pursue Greensill-linked investigations that shadow Gupta’s broader empire.

Key Takeaways

"best serve the interests of creditors, employees and the broader community"

Liberty Steel spokesperson on SSUK options

"We continue to closely monitor developments around Liberty Steel, including any public hearings, which are a matter for the company."

Department for Business and Trade on oversight

"He has pleaded not guilty"

Gupta's legal status in the UK Companies House case

The case exposes a core tension in UK industry: rescue moves that shift risk from business to lenders while leaving workers and regional economies exposed. A pre-pack can shield a company from immediate debts, but it transfers uncertainty to creditors and the state, raising questions about accountability and long-term viability.

The government’s stance matters. If authorities intervene to keep plants running, it signals a willingness to insulate regional jobs, but it also risks creating a precedent where debt relief becomes a route to state-backed survival for large groups. The ongoing Greensill investigations add to the uncertainty, potentially coloring lenders’ willingness to participate and shaping public debate about corporate governance.

Highlights

- Time is running out for SSUK

- Debt decisions will decide the fate of thousands

- The clock is ticking over a town built on steel

- Rescue plans test the limits of public patience

Political and budget risk around SSUK rescue

The rescue plan relies on large debt write-offs and potential government action. If collapse occurs, taxpayers and the regional economy could bear costs, while investigations add political sensitivity.

The next days will reveal how much steady hands investor risk and regional jobs can expect from this saga.

Enjoyed this? Let your friends know!

Related News

UK government prepares to take control of steel plant to save 1500 jobs

Gupta plan for UK steel arm

UK government appeals Epping hotel ruling

SSUK liquidation prompts government control

Gupta SSUK under scrutiny as pre-pack rescue explored

Gupta s SSUK liquidation

Government takes control of SSUK plants

Speciality Steel insolvency hearing advances