T4K3.news

Gupta s SSUK liquidation

London court orders SSUK liquidation as governments safeguard jobs

This week collapse of the tycoon’s Yorkshire operations brings relief to some and echoes insolvency steps at fifteen of his companies

From Yorkshire to Australia how Sanjeev Gupta's steel empire unravelled

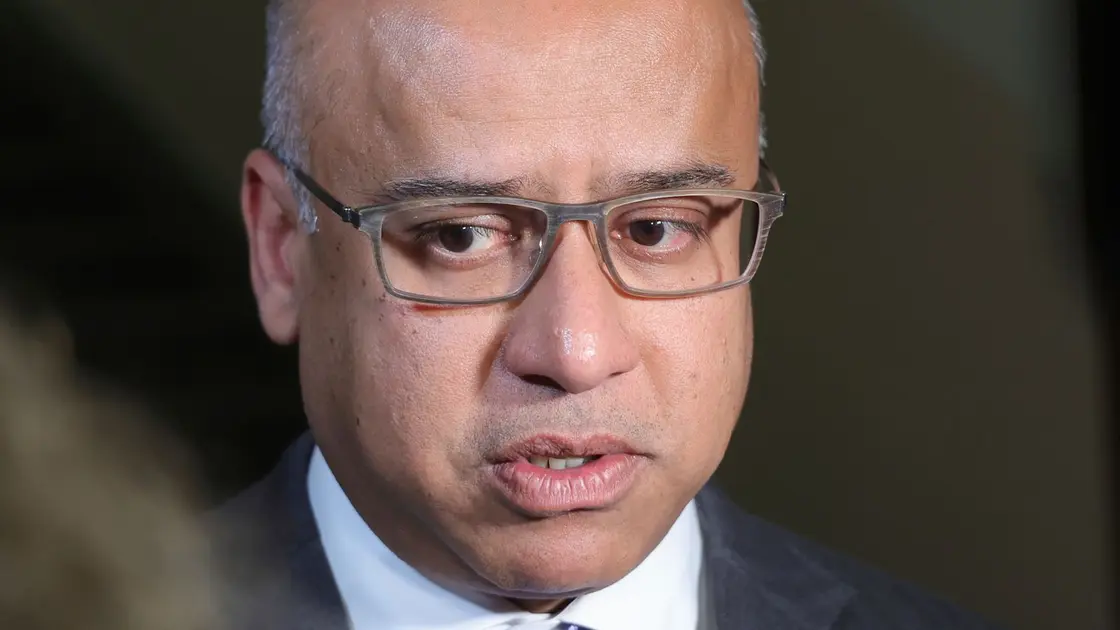

London's high court ruled that Speciality Steel UK should enter compulsory liquidation because it is hopelessly insolvent. Debts run to hundreds of millions of pounds and cash in the account is limited. After the hearing, government appointed managers moved to take control of steel plants in South Yorkshire and to ensure 1,450 workers are paid. Gupta was in Sydney and did not attend the hearing, while Liberty Steel said he was sad but not finished and that he aims to bid to buy back SSUK with backing from BlackRock.

Across the Gupta Family Group Alliance, other plants in the UK and abroad face the same stress. In Whyalla, Australia, the steelworks were found to have heavy debts and slow production. The national and state governments have stepped in with a support package to keep the plant operating during administration and to help the next owner upgrade the facility. A Serious Fraud Office investigation in the UK continues to shadow the group, and creditors across several countries are rethinking their exposure as more assets face restructuring or bankruptcy. Critics point to long standing mismanagement and under investment by Liberty Steel, while Gupta and his backers cite a tough global market and rising costs for decarbonisation.

Key Takeaways

"Liberty Steel has been catastrophic for European steelworkers."

Union leader Judith Kirton-Darling on the impact on workers

"There is a real material difference now."

Australian MP Eddie Hughes commenting on Whyalla changes

"Mr Gupta proposed to raise funds from entities he owned to discharge debts by paying one cent"

Singapore judge critique of Gupta plan to raise funds

"No one believed the situation would improve while he was that strong presence in Whyalla"

Local politics view of Gupta era in Whyalla

The Gupta saga exposes a business model built on aggressive asset buying and debt leverage. When markets tighten and promises stall, the rhetoric of turnaround fades and creditors demand transparency. Governments are forced to choose between protecting jobs and protecting public funds, a pressure cooker that tests political futures as much as balance sheets.

Going forward, the story will test whether rescue money can translate into lasting improvements or simply delay a costly restructuring. If governance improves and financing becomes credible, parts of the steel empire might recover. If not, communities may face further job losses and taxpayers could shoulder the cost of keeping strategic assets afloat.

Highlights

- Liberty Steel has been catastrophic for European steelworkers

- There is a real material difference now

- Mr Gupta proposed to raise funds from entities he owned to discharge debts by paying one cent

- No one believed the situation would improve while he was that strong presence in Whyalla

Financial and political risk from Gupta collapse

The SSUK liquidation and broader insolvencies at GFG Alliance raise risks for workers, taxpayers, and creditors. An ongoing SFO investigation adds political sensitivity as governments balance job protection with financial duty.

The next chapter will test whether rescue funding translates into lasting repairs or merely buys time.

Enjoyed this? Let your friends know!

Related News

Liberty Steel SSUK facing court action and rescue talks

Government prepares special managers for Liberty Steel SSUK

Gupta plan for UK steel arm

SSUK liquidation prompts government control

UK government prepares to take control of steel plant to save 1500 jobs

Liberty Steel plants in South Yorkshire put into government-managed administration

Gupta SSUK under scrutiny as pre-pack rescue explored

Government intervention secures pay and pensions at South Yorkshire steelworks