T4K3.news

SSUK liquidation prompts government control

Speciality Steels UK is being liquidated with the government acting as liquidator and seeking a buyer to secure jobs.

The government steps in to liquidate Speciality Steels UK and pursue a new buyer to protect about 1,500 jobs.

Government takes control as Liberty Steel unit SSUK goes into liquidation

Speciality Steels UK has been placed into compulsory liquidation and will be run by the Insolvency Service with help from Teneo Financial Advisory. SSUK employs around 1,500 people at sites in Rotherham and across South Yorkshire, making it one of the UK’s larger steel producers. The move follows a long period of financial strain and a failure to file audited accounts for more than five years.

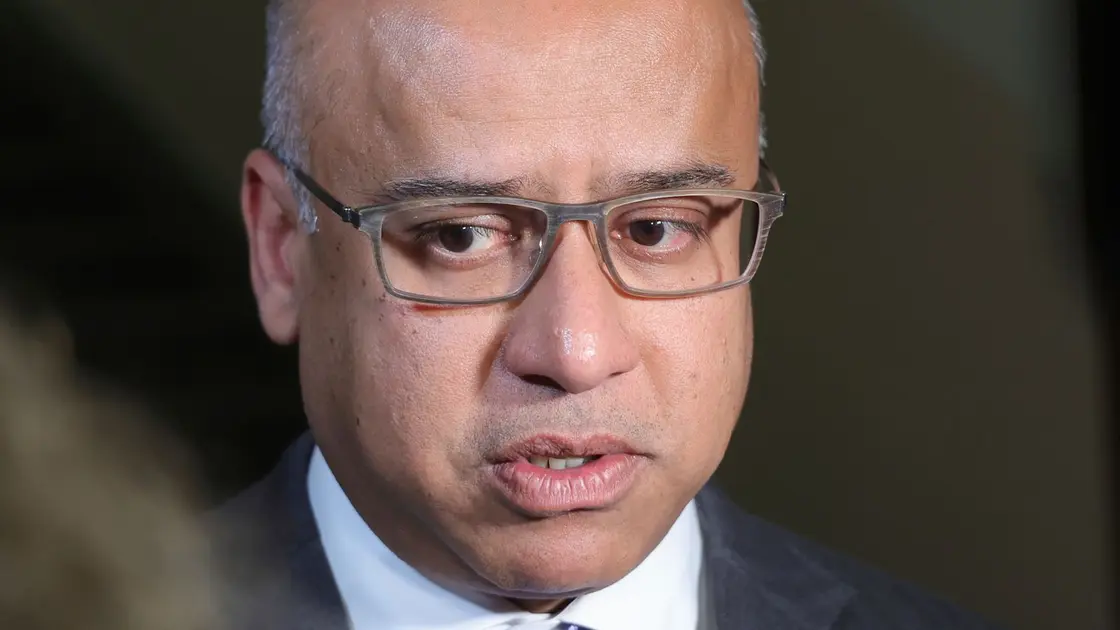

The government says it does not intend to own SSUK and will cover wages and costs for now while a buyer is sought. Negotiations for a rescue plan were underway but did not succeed, drawing sharp criticism from unions and local politicians about the leadership of the GFG Alliance, the parent company led by Sanjeev Gupta. The government’s involvement signals a preference for a sale that preserves jobs, but it also raises questions about accountability and the future structure of UK steel ownership.

Key Takeaways

"We know Liberty is a golden goose, but one they have starved for years."

Labour MP Sarah Champion commenting on Liberty Steel’s management.

"This is another tragedy for UK steel - and the people of South Yorkshire"

Charlotte Brumpton-Childs, national officer for the GMB union.

"The decision to push Speciality Steel UK into compulsory liquidation, especially when we have support from the world's largest asset manager to resume operations, is irrational."

Jeffrey Kabel, GFG's chief transformational officer.

"We know this will be a deeply worrying time for staff and their families."

UK government spokesperson on the liquidation.

The liquidation tests the balance between government intervention and market discipline. While saving jobs in the short term is important, taxpayers face costs tied to wage support and potential creditor settlements. The episode also underscores the fragilities of a UK steel sector long tied to a single family of buyers and lenders, including Greensill-linked debt that has shaped risk appetite for years. As the search for a credible buyer intensifies, independent oversight and clear governance will be essential to prevent repeated waves of public aid without lasting industry reform.

At stake is not just one plant but the resilience of a strategic industry. If a capable buyer emerges with a sustainable plan, SSUK could anchor a modernized supply chain. If not, the episode could feed a narrative of chronic mismanagement and political interference that weakens investor confidence and local morale.

Highlights

- Saving jobs is not a bailout without a plan

- This is a test of government willingness to act for UK steel

- Public money should back a long term strategy not a quick fix

- The future of UK steel rests on finding a capable buyer now

Public funds risk and job uncertainty

The move to liquidate SSUK while funding wages raises concerns about taxpayer exposure and long term job security. Independent oversight and a credible plan for a buyer are needed to limit ongoing public cost and strategic risk.

The next chapter will reveal whether a new owner can restore stability to a plant many say is essential to the region’s identity.

Enjoyed this? Let your friends know!

Related News

Gupta SSUK under scrutiny as pre-pack rescue explored

Gupta plan for UK steel arm

Gupta s SSUK liquidation

UK government prepares to take control of steel plant to save 1500 jobs

Government prepares special managers for Liberty Steel SSUK

UKs steelworks falls under government control

Liberty Steel plants in South Yorkshire put into government-managed administration

Government intervention secures pay and pensions at South Yorkshire steelworks