T4K3.news

Government intervention secures pay and pensions at South Yorkshire steelworks

The government appoints special managers to Liberty Steel UK after insolvency, guaranteeing August pay and pension contributions as it seeks a buyer and a viable path forward.

The state takes control of Liberty Steel UK operations and guarantees payroll and pension payments as it seeks a path to restart and a possible new buyer.

Government intervention secures pay and pensions at South Yorkshire steelworks

A UK court ruled Liberty Steel UK Speciality Steel UK insolvent and the government appointed special managers from Teneo to run the business. The company had only £650,000 in the bank while August payroll of £3.6m was due, prompting questions about how the payments would be funded. The judge noted that Gupta’s assurances to fund payments via Liberty Capital UK were questionable at best. The managers told unions last night that August pay would be paid before the bank holiday and that unpaid employer pension contributions for the past year would be funded, protecting workers’ pension entitlements and avoiding gaps in national insurance protection next month. They signaled that production could restart at sites such as Rotherham and Stocksbridge soon, though timing remains unclear and will depend on cash flow and the ability to generate cash from operations. The government will temporarily bear administration costs while a sale or restructuring is pursued, and several potential buyers have already expressed interest in acquiring SSUK. Gupta’s group, GFG Alliance, still controls other UK businesses, but SSUK has been removed from its direct oversight, with the door left open for a possible buyback if a credible plan emerges.

Key Takeaways

"Pay and pensions secured for now"

A key outcome from the special managers to workers

"This intervention must become a lasting commitment to jobs"

Union leaders urging durable protections

"Restarting production will test the plan's credibility"

Officials signaling a potential resumption of work

"The town needs more than promises it needs a buyer and a plan"

Community sentiment about a durable solution

This intervention shows how the state can act as a caretaker when a large industrial asset teeters on collapse. It underscores the human stakes in a crisis where jobs, pensions and regional economic health hinge on a successful restart. Yet the move also raises questions about taxpayer exposure and long term responsibility for a business that has burned cash for years. The key test will be whether a viable buyer steps forward with a credible plan to turn around a plant that has lost hundreds of millions of pounds over four years. Public support will depend on tangible progress, clear timelines and a commitment to jobs as part of any restructuring. The current dynamic blends political risk with economic need, and the outcome will shape how Britain treats its stubborn manufacturing chapters.

Highlights

- Pay and pensions secured for now

- This intervention must become a lasting commitment to jobs

- Restarting production will test the plan's credibility

- The town needs more than promises it needs a buyer and a plan

Budget and political risk around steel administration

The government covers payroll and pension liabilities while the plant remains in administration, creating potential taxpayer exposure and political scrutiny. The ultimate outcome depends on attracting a credible buyer and delivering a durable restructuring plan.

The next chapter will test whether a rescue can become a durable renewal for a regional industry

Enjoyed this? Let your friends know!

Related News

UK government appeals Epping hotel ruling

Liberty Steel plants in South Yorkshire put into government-managed administration

Gupta s SSUK liquidation

UK government prepares to take control of steel plant to save 1500 jobs

Government takes control of SSUK plants

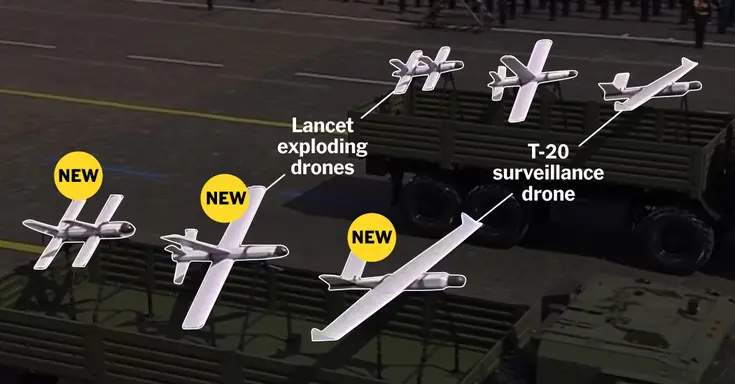

Russia Builds a Wartime Edge

Property tax debate continues

Government prepares special managers for Liberty Steel SSUK