T4K3.news

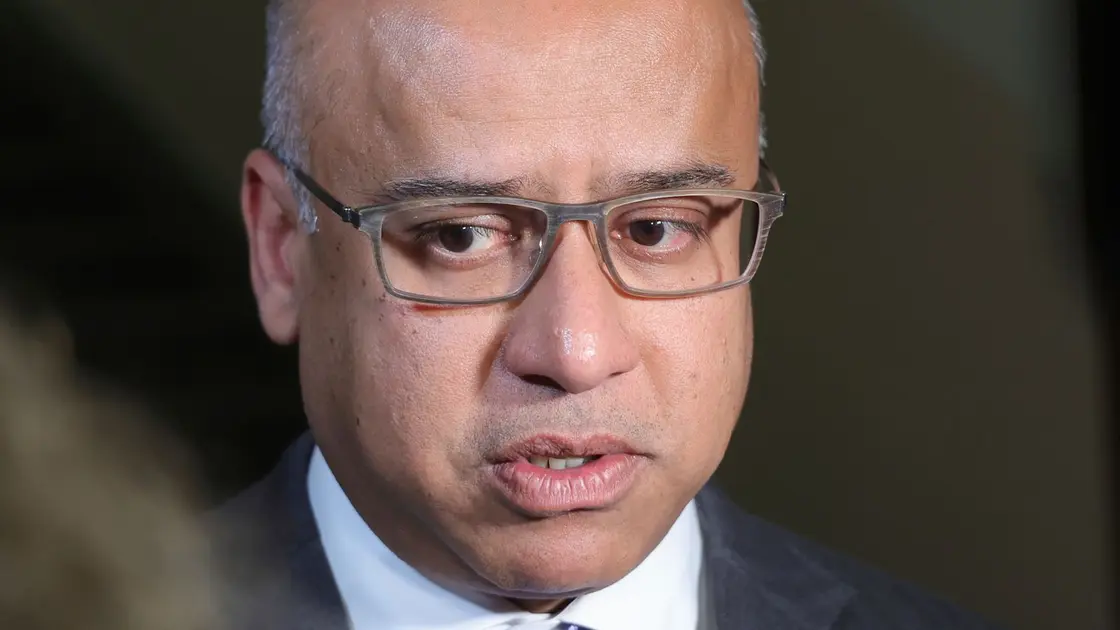

Gupta plan for UK steel arm

Gupta proposes a family-owned structure to manage Liberty Steel UK as officials weigh a possible compulsory liquidation

Sanjeev Gupta seeks an independent structure for Liberty Steel UK to avert a government led fire sale.

Gupta hands UK steel arm to family in bid to safeguard Liberty

Sanjeev Gupta is seeking to refinance Liberty Steel UK through a pre-pack administration that would place Liberty Steel Speciality Steels UK under a trust-like structure for the benefit of his family. The move comes as SSUK faces the risk of compulsory liquidation, putting around 1,500 jobs at sites across South Yorkshire at stake. A High Court hearing confirmed the government is prepared to step in if the company enters insolvency, with a formal process that could see a special manager appointed by the Official Receiver.

Begbies Traynor is assisting on the pre-pack plan. If liquidation proceeds, the Official Receiver would take control of SSUK’s affairs and a government letter signaled readiness to oversee the process. The idea is to keep some or all sites in steelmaking, with independent parties reportedly expressing interest in taking over operations. Gupta has suggested the structure would be independent and well-governed, while talks with investors and lenders continue behind the scenes. Financing support has been reported from a major asset manager and other backers, though details remain fluid.

Key Takeaways

"Independent third parties have expressed interest in returning some or all of the sites to steelmaking."

Source close to Gupta describing potential outcomes for site ownership.

"The Official Receiver is prepared to take control should SSUK enter compulsory liquidation."

Statement referenced in court about government readiness.

"Liberty's shareholder has invested nearly £200m, recognising the vital role steel plays in supplying the UK's strategic defence, aerospace and energy industries."

Liberty Steel spokesperson commenting on investment

"Our commercial solution provides the best outcome for the business without cost to UK taxpayers."

Liberty Steel spokesperson on the plan

The plan highlights how private rescue efforts can collide with public interests in a strategically sensitive industry. A family-backed, ring-fenced structure could offer certainty for Gupta’s group, but it raises questions about governance, accountability, and who ultimately bears risk if liabilities resurface. The involvement of government authorities, the potential for a pre-pack sale, and the scale of workers affected underscore the broader vulnerability of UK steel assets amid high energy costs and global competition. If the state steps in, it could reshape expectations around private equity and national industrial policy.

Highlights

- Independent third parties have expressed interest in returning some or all of the sites to steelmaking.

- The Official Receiver is prepared to take control if SSUK enters compulsory liquidation.

- Liberty's shareholder has invested nearly £200m, recognising the vital role steel plays in supplying the UK's strategic defence, aerospace and energy industries.

- Our commercial solution provides the best outcome for the business without cost to UK taxpayers.

Political and financial risk around Gupta plan

The proposal sits at the intersection of private rescue, government oversight, and worker security. It risks public scrutiny, investor confidence, and the possibility that liabilities re-emerge later. The plan could influence how future distressed assets are handled in the UK.

The next court hearing will test whether private rescue can coexist with public duty.

Enjoyed this? Let your friends know!

Related News

Liberty Steel SSUK facing court action and rescue talks

Gupta SSUK under scrutiny as pre-pack rescue explored

Speciality Steel insolvency hearing advances

Government prepares special managers for Liberty Steel SSUK

Trump and Starmer meet in Scotland for trade discussions

Severfield taps McNerney as new chief executive

Turkey secures $5.6 billion deal for fighter jets

French company plans ITV takeover