T4K3.news

SoftBank invests in Intel to bolster chip ambitions

SoftBank commits 2B to Intel, signaling a new phase in US chip strategy and investor support.

SoftBank Group will buy $2 billion of Intel stock, a move that strengthens a troubled US chipmaker and expands SoftBank’s semiconductor ambitions.

SoftBank Bets $2 Billion on Intel as US Chip Push Expands

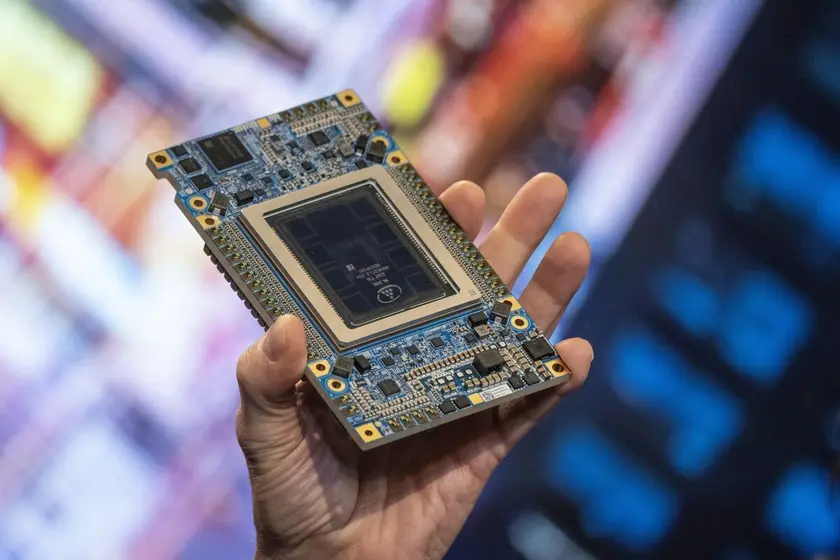

SoftBank Group agreed to buy 2 billion dollars of Intel stock, paying 23 dollars per share. Intel will issue new shares to SoftBank as part of the deal. After hours, Intel shares rose more than 5 percent, while SoftBank’s Tokyo listing fell about 5 percent. The investment marks a notable shift as SoftBank broadens its chip portfolio beyond Nvidia and Taiwan Semiconductor.

This deal comes as Intel seeks capital to fund a turnaround while the US government pushes domestic chip manufacturing. The arrangement underscores a broader trend of nontraditional investors taking positions in semiconductor players to satisfy strategic and financial goals. It also raises questions about governance and how much influence an external investor could gain as Intel charts its next phase.

Key Takeaways

"This is a vote of confidence in Intel’s long term turnaround"

factual

"Investors are betting on chips even as the market tests patience"

opinion

"SoftBank’s move could reshape Intel’s strategy and partnerships"

factual

The move signals how capital is flowing into semiconductors from a diverse set of backers, not just traditional tech peers. It also highlights how policy aims to strengthen the US chip supply chain can attract strategic bets from abroad. Yet the price and structure of the deal suggest caution: a modest per-share discount and the potential for diluted ownership could shape how Intel pursues its turnaround. As SoftBank joins a small circle of big chip players, the partnership will test how much influence an outsider can exert over a company in need of rapid execution.

Highlights

- Cash meets silicon in a bold chip move

- A quiet show of faith in Intel's turnaround

- Investors back resilience in a battered industry

- Capital reshapes the future of chip supply

Financial and political risk in SoftBank Intel deal

The investment intersects with government policy to strengthen US chip supply and could invite public and investor scrutiny. Dilution effects and governance questions may influenceIntel’s strategic options and performance.

Markets will watch how this alliance shapes Intel’s comeback plan and the US chip landscape.

Enjoyed this? Let your friends know!

Related News

SoftBank backs Intel with 2 billion investment

Intel secures SoftBank investment amid stake talk

SoftBank invests in Intel for 2 percent stake

Chips Act funds eyed for Intel stake

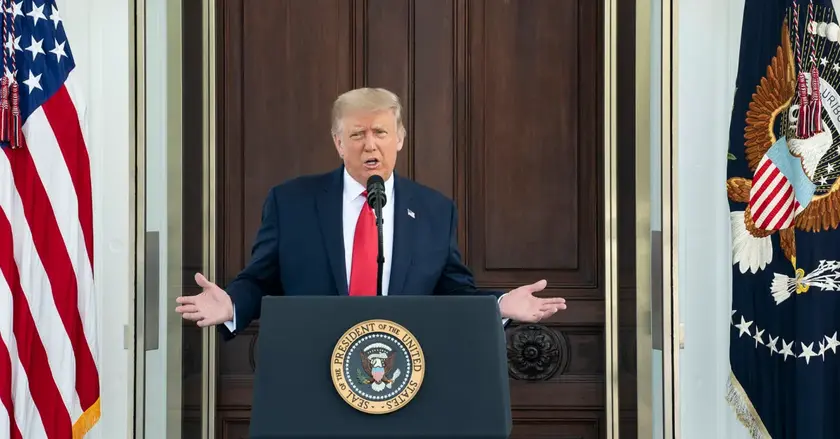

Trump demands Intel CEO resign over China ties

US considers 10 percent stake in Intel

AMD stock slides on Zen 7 AM5 rumor

Intel CEO Resists Resignation Demand