T4K3.news

Markets Waver as Nvidia Eyes China Chip Push

Markets fall as policy risk and big earnings shape the week ahead, with Nvidia signaling China chip plans.

Markets slipped on Tuesday as policy risk and mixed earnings influenced trading in tech names and retailers.

Markets Waver as Nvidia Eyes China Chip Push

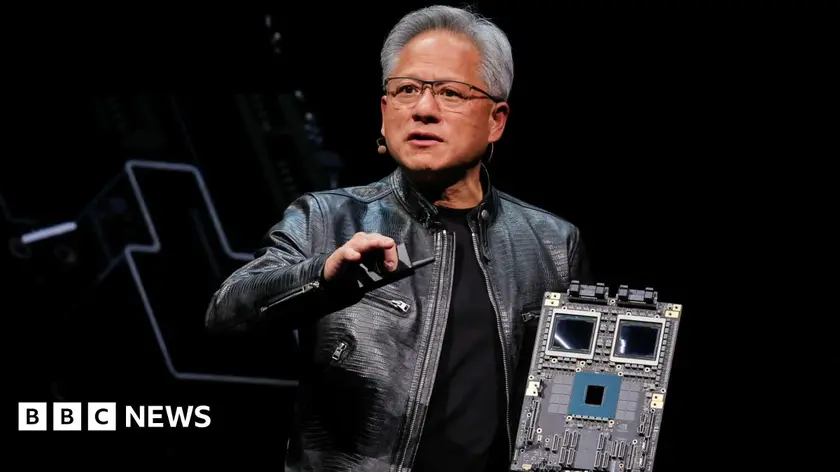

Tech shares moved lower on Tuesday after Nvidia signaled more products for the Chinese market and eyes on a new AI chip. The company described a roadmap that could include a chip called B30A based on its Blackwell architecture, following a licensing deal with the United States that includes a 15 percent revenue share for sales into China. Nvidia stock fell about 3 percent in the session, though the stock has gained strongly this year on AI demand. Analysts highlighted the policy dimension as a factor in the stock’s volatility while noting potential long term demand in AI hardware.

Other stories added to the market mood. Viking Therapeutics fell after its VK2735 weight loss pill showed safety concerns in a Phase 2 trial, with higher discontinuation due to GI side effects. Best Buy expanded its online marketplace to include hundreds of third party brands, signaling a shift toward broader commerce beyond its stores. Palo Alto Networks beat profit and revenue expectations and issued strong guidance, while announcing leadership changes at the CTO role. Home Depot reaffirmed its outlook as demand for home projects remained solid, and Intel jumped on news that SoftBank is investing 2 billion dollars in the company, a sign of confidence in U.S. chip manufacturing.

Key Takeaways

"prepared to compete to the extent that governments allow"

Nvidia spokesperson on China approvals and expansion plans

"GI-related adverse event rates might be further reduced through lower starting doses"

Viking Therapeutics CEO on safety and dosing

"They are partnering with us because our platforms are designed to work in concert"

Palo Alto Networks CEO on customer demand and platform strategy

Policy and geopolitics are shaping the tone of a week that otherwise centers on earnings. Nvidia shows how policy details can move stocks even as future demand looks robust, underscoring the fragility of the supply chain in the AI era. The mix of big tech earnings, M and A style investments, and retail platform expansion reflects a market hungry for growth but cautious about the regulatory and political environment. The SoftBank stake in Intel signals a broader belief that U.S. chip manufacturing remains a strategic priority, even as global tensions persist. The week ahead will likely test whether markets can price in policy risk without derailing longer term momentum in AI and cybersecurity spending.

For readers, the story is about more than single stock moves. It is about how companies diversify income and how investors balance growth with the risk of regulatory backlash or shifting trade rules. As leadership shifts unfold in several firms, the market will watch whether managements can translate growth into sustainable cash flow amid an uncertain policy backdrop.

Highlights

- Policy gray zones make AI bets feel like riding a tiger.

- China chip talks collide with real world rules.

- GI adverse event rates might be reduced by slower dose escalation.

- Market breadth matters more than any single stock.

Geopolitical and policy risks loom for tech earnings

The article highlights China related policy and export control risks that could affect major tech firms. Investors should watch for regulatory changes, potential backlash, and shifts in U.S. policy that could alter revenue assumptions and growth trajectories.

Policy signals will keep shaping the market as earnings news continues to unfold.

Enjoyed this? Let your friends know!

Related News

Stock market trends for July 15 analyzed

China guides firms away from Nvidia H20 chips

Tariff era reshapes chip deals and AI plans

Markets Edge Higher Ahead of Inflation Data

Trump pushes 15 percent share on Nvidia H20 sales

China scrutinizes Nvidia H20 chips

Tariffs and Trump merch push tighten grip on tech market

Markets Rally on Trump Chip Sales Easing