T4K3.news

SoftBank backs Intel with 2 billion investment

SoftBank will buy Intel common stock at $23 per share in a move analysts see as support for US chip manufacturing and AI hardware plans.

SoftBank will pay $23 per share for Intel common stock in a $2 billion investment.

SoftBank backs Intel with 2 billion investment

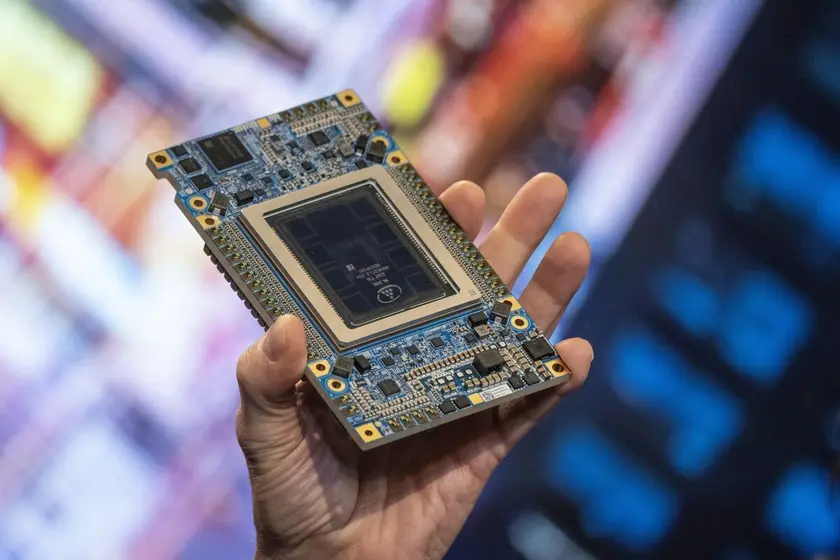

SoftBank has agreed to invest $2 billion in Intel by purchasing common stock at $23 a share. The deal was announced after markets closed and sent Intel shares higher in after hours trading, with the stock rising more than 5 percent. The move is framed as a vote of confidence in US chip manufacturing and in Intel as a partner in AI related hardware. SoftBank has recently shown renewed interest in the United States, including a factory purchase in Lordstown, Ohio, connected to AI data center plans.

Masayoshi Son said the investment reflects a belief that advanced semiconductor manufacturing and supply will grow in the United States, with Intel playing a critical role. Intel is undergoing a broad restructuring under chief executive Lip-Bu Tan, focusing on its data center and core client portfolio while scaling back other units. The company has shuttered its automotive architecture business and is reducing the Foundry division workforce by a portion of its staff. In the political arena, President Trump has raised questions about Tan and conflicts of interest, and there have been reports of discussions about a government stake in Intel. The deal arrives as the administration hints at tariffs on imported semiconductors, adding a layer of policy risk to the sector.

Key Takeaways

"Bold bets shape the next decade of tech"

A takeaway about strategic investments in tech

"Chip supply resilience is more than a slogan"

Commentary on supply chain importance

"Capital meets manufacturing in a fragile supply chain"

Observation on risk

"US chip making gains need steady politics"

Policy context

The investment signals that foreign capital remains willing to back US manufacturing in a field dominated by a few players. It also underscores a broader trend where non US capital seeks strategic ties to AI hardware and domestic production. For Intel, the money may help stabilize the transition under Tan and reinforce the company’s focus on data center and foundry capabilities amid competitive pressure from Nvidia and other chipmakers. Yet the move comes with political and policy headwinds that could complicate execution, from ongoing tariff talk to scrutiny of executive conflicts of interest. In this environment, how Intel uses the funds to accelerate its roadmap will matter as much as the price of the stock.

Highlights

- Bold bets shape the next decade of tech

- Chip supply resilience is more than a slogan

- Capital meets manufacturing in a fragile supply chain

- US chip making gains need steady politics

political and regulatory risk around intel investment

The deal sits at the intersection of business strategy and political scrutiny, including potential tariff moves and questions about government involvement in tech giants. This creates uncertainty for investors and for Intel as it executes its roadmap.

A test for how tech finance and policy collide in the race for chip supremacy.

Enjoyed this? Let your friends know!

Related News

SoftBank invests in Intel to bolster chip ambitions

SoftBank invests in Intel for 2 percent stake

Intel secures SoftBank investment amid stake talk

Stocks Fall as Tariff News Shakes Market

Intel to cut 24,000 jobs and end projects in Europe and Costa Rica

Tech Rally Pushes Markets Higher

S&P 500 and Nasdaq Close at Record Highs

FTSE 100 hits new high on tariff cues