T4K3.news

Intel secures SoftBank investment amid stake talk

SoftBank's $2 billion investment in Intel comes as reports surface that the US government may take up to a 10% stake in the company, signaling heightened policy attention to chip supply and leadership.

SoftBank commits $2 billion to Intel as reports surface that the US government may seek a stake in the chipmaker.

SoftBank backs Intel with $2bn investment amid possible US stake

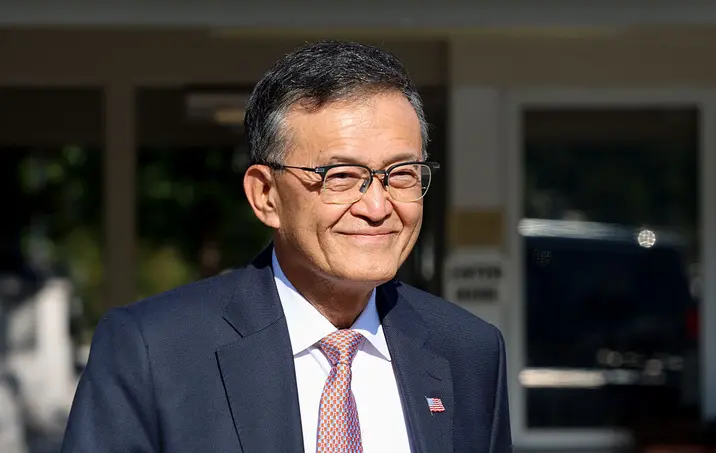

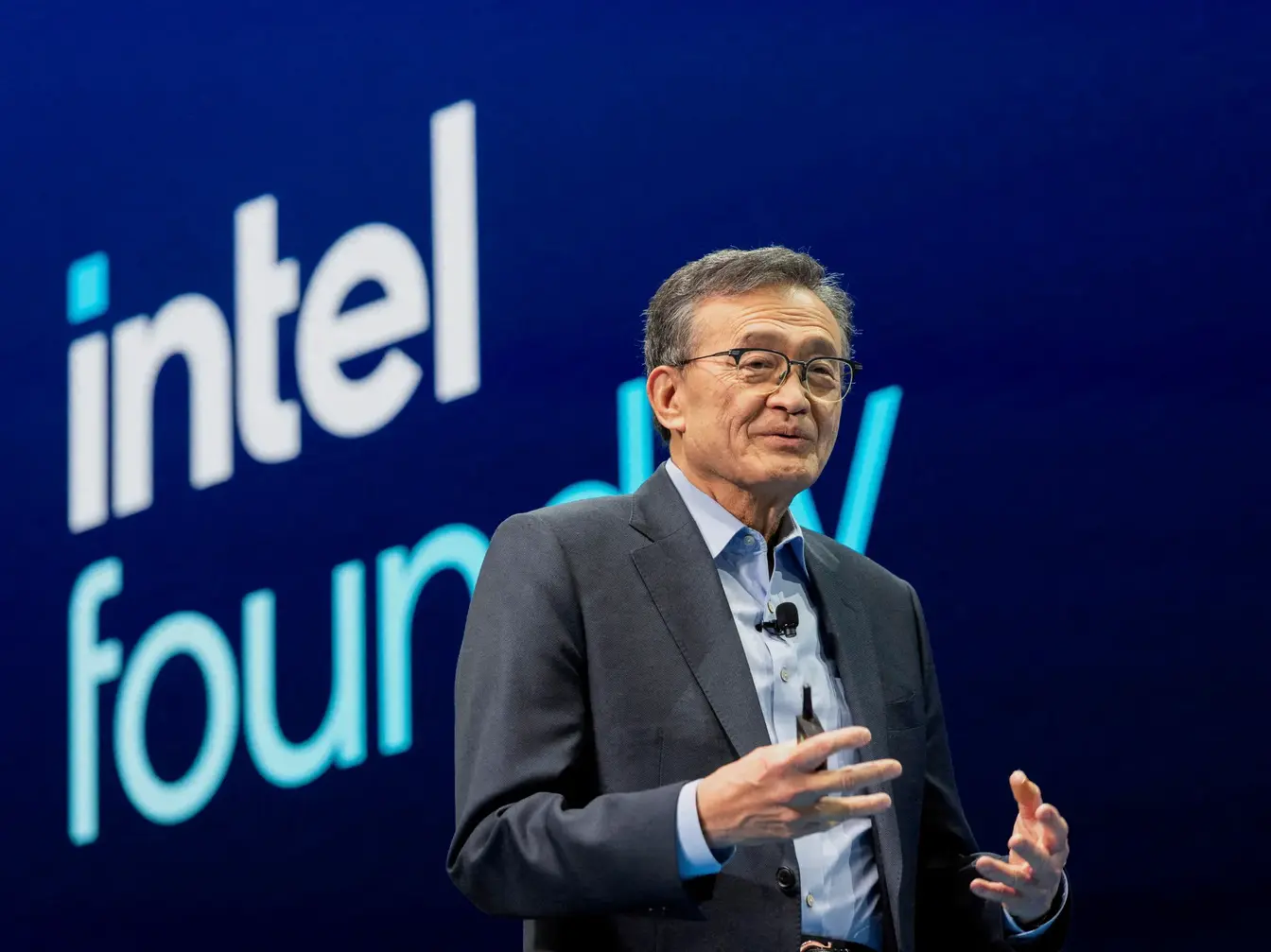

SoftBank announced a $2 billion investment in Intel, giving the Japanese group roughly a 2 percent stake in the New York listed chip maker. The move comes as reports circulate that the Trump administration is considering taking a stake in Intel, potentially up to 10 percent. Intel chief Lip-Bu Tan, who took the top job four months ago, said the company is pleased to deepen its relationship with SoftBank. After hours, Intel shares rose more than 5 percent while SoftBank shares fell in Tokyo.

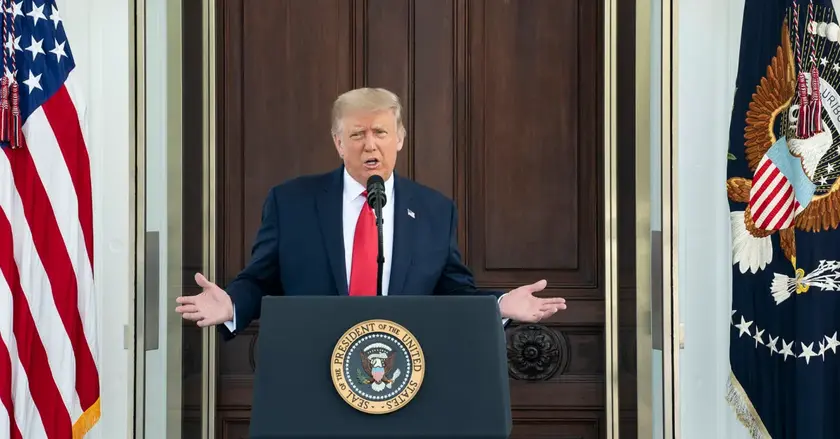

Tan has been tasked with a difficult turnaround amid slow sales and a struggle to keep Intel at the technological edge. The policy backdrop adds risk, with Washington signaling a desire to protect strategic tech assets and ideas of higher government involvement in private firms. If a government stake appears, it would mark a major shift in how governing bodies interact with private tech companies and could affect investment decisions. Trump had earlier criticized Tan but later praised him after a meeting in Washington. The broader context shows a push to secure supply chains and manufacturing leadership in the tech sector.

Key Takeaways

"This strategic investment reflects our belief that advanced semiconductor manufacturing and supply will further expand in the US"

Statement from SoftBank CEO Masayoshi Son

"an amazing story"

Trump praising Intel CEO after a meeting

"We are very pleased to deepen our relationship with SoftBank"

Lip-Bu Tan on the deal

The deal highlights how private capital and national strategy are intertwining in the chip sector. A SoftBank investment can help Intel stabilize while it reshapes its business, but it also brings political risk into the boardroom. If the government takes a stake, governance and strategic priorities could move closer to public policy than market signals.

This moment could set a precedent for future cross border investments in semiconductors. The balance between market discipline and policy influence will test investor confidence and corporate autonomy in critical industries. The outcome will reveal how much leverage policymakers want over the most sensitive parts of the tech supply chain.

Highlights

- Chips politics just entered the boardroom

- A foreign investor bets on American manufacturing

- Supply security has become a national concern

- Markets react to policy as much as profits

Political and budget implications for Intel investment

The article ties SoftBank's investment to a potential government stake in Intel, raising concerns about political influence, national security, and budgetary implications for private firms.

The path ahead will test how far public policy and private capital can align

Enjoyed this? Let your friends know!

Related News

Trump moves on Intel stake

Chips Act funds eyed for Intel stake

SoftBank backs Intel with 2 billion investment

FTSE 100 hits new high on tariff cues

Intel CEO Resists Resignation Demand

SoftBank invests in Intel for 2 percent stake

Intel stake under review after political clash

Trump demands Intel CEO resign over China ties