T4K3.news

Export licenses tied to revenue share

Nvidia and AMD will pay 15% of China AI chip revenue to the U.S. government as a condition for export licenses.

Nvidia and AMD will pay 15 percent of China AI chip revenue to the U.S. government as a condition for export licenses.

Nvidia AMD revenue share ties China exports to U.S. policy

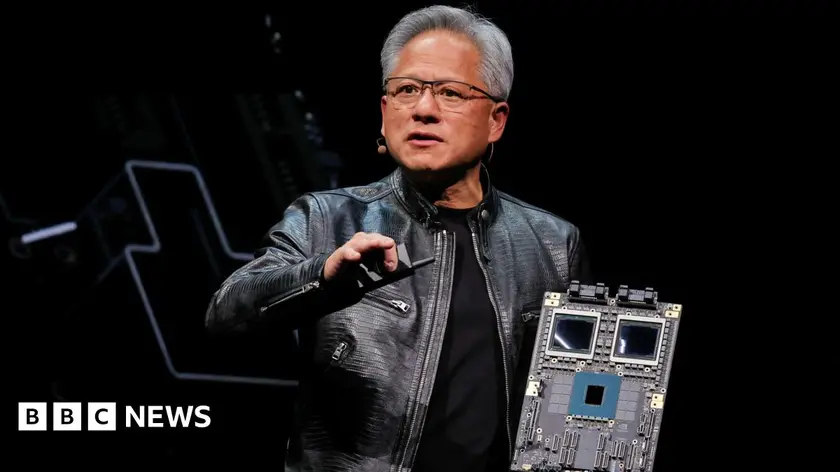

Nvidia and AMD have agreed to pay 15 percent of revenue from their AI chips sold in China to the U.S. government as a condition for export licenses to resume those sales. A White House official confirmed the terms to CBS News, and The Financial Times reported the deal as a feature of the licensing arrangement. Such a revenue share is unusual because export licenses typically carry no fees. President Trump described the pact as a benefit to the nation and recalled negotiating the percentage with Nvidia chief Jensen Huang, with Huang proposing 15 percent.

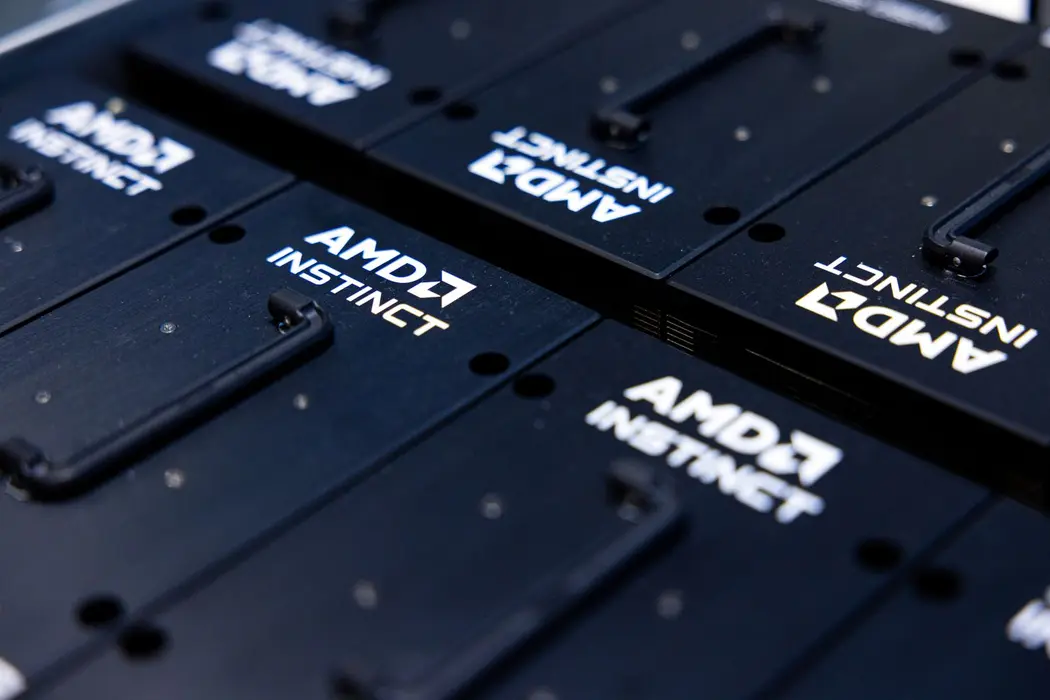

The move comes after the administration previously restricted Nvidia H20 chips and AMD MI308 chips for China. Nvidia had said it had won approval to sell its H20 chips to China, while AMD’s MI308 chips are also aimed at AI. Officials say the funds are not yet tied to a specific use, and both companies declined to comment on specifics. The policy context frames this as part of a broader effort to curb advanced chip capabilities that could affect national security.

Key Takeaways

"I want 20% if I'm going to approve it for you"

Trump describing the initial demand during a meeting with Nvidia CEO Jensen Huang

"Will you make it 15%"

Huang responding during the discussion

"We follow rules the U.S. government sets for our participation in worldwide markets"

Nvidia spokesperson on compliance

The deal signals a new way the United States uses export controls to shape technology flows. Linking a revenue share to licenses creates a form of policy leverage that could influence corporate strategy, supplier relations, and the pace of AI development. It also blurs the line between trade policy and fiscal policy. For the companies, it adds a layer of regulatory risk and changes the economics of selling into China. For China watchers, it raises the political stakes in tech diplomacy and could invite similar approaches with other export controls.

For investors, this adds uncertainty about how future licensing deals will be priced and what that means for earnings. If the government sees value in directing funds, the arrangement could become a template for future negotiations. If not, it may provoke backlash or provoke other countries to challenge or retaliate in the tech sphere. The outcome will test how far policy can steer high stakes tech without undercutting market incentives.

Highlights

- Export rules wear a price tag

- Money talks in policy rooms

- Policy and profits collide at the licensing desk

- The export gate now carries a price

Political and financial risk in export license deal

The revenue share to the U.S. government creates a new precedent for government involvement in corporate exports and raises questions about how funds will be used, potential backlash from China, investors, and industry players.

Policy and markets keep moving, and the rules will follow.

Enjoyed this? Let your friends know!

Related News

Nvidia AMD 15 percent China revenue levy announced

Chip firms strike policy-linked revenue deal in China

AMD shares dip after mixed Q2 results

Trump pushes 15 percent share on Nvidia H20 sales

Nvidia and AMD face new export rules

Nvidia and AMD to pay 15 percent of China revenue to US

Stock market trends for July 15 analyzed

AMD stock declines despite strong quarterly results