T4K3.news

Nvidia AMD 15 percent China revenue levy announced

Reports say the US will take 15 percent of AI chip sales revenue to China as a condition for export licenses.

A Financial Times report says Nvidia and AMD will pay 15 percent of China AI chip sales to the US government as a condition for export licenses.

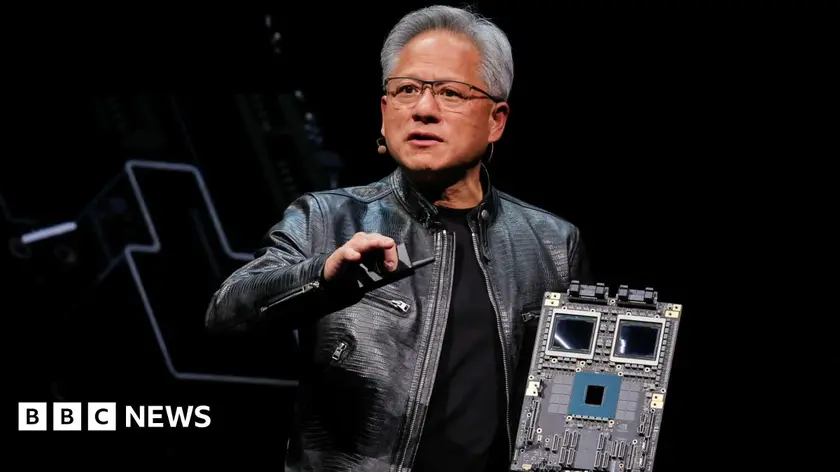

Nvidia and AMD face 15 percent China revenue levy

Nvidia and AMD saw their shares slip in early premarket trading after reports that they will pay 15 percent of revenue from AI chip sales to China to the US government. The payments are described as part of a broader deal tied to export licenses granted last week, with Nvidia to levy the 15 percent on revenue from its H20 AI chips and AMD on its MI308 chips designed for the Chinese market.

The Financial Times report cites unnamed US officials and others familiar with the discussions, saying the levy was a necessary condition for the licenses. Nvidia has said it has not shipped H20 to China for months, and it hopes export control rules will let America compete in China and worldwide. It is unclear whether the 15 percent will be reflected in chip pricing for Chinese buyers.

Key Takeaways

"The deal was a necessary condition for the China export licenses."

Quoted as part of the Financial Times report noting licensing terms.

"We don't sell them our best stuff, not our second best stuff, not even our third best."

Commerce Secretary Lutnick’s remark cited in coverage of the export policy.

"The Trump playbook applied in exactly the wrong domain."

Liza Tobin’s comment on policy cited in the Wall Street Journal op-ed.

"The controls on Nvidia’s H20 chips appear to have been working until CEO Jensen Huang’s lobbying secured a reversal."

Comment from Liza Tobin in response to licensing shifts.

The arrangement blends national security policy with corporate revenue, signaling a shift in how export controls may be used to influence market access. By tying licenses to a revenue share, the administration appears to turn policy into a revenue mechanism, a move that could set a precedent for future licensing negotiations. If this approach persists, it may reshape how chipmakers price products for sensitive markets and how investors evaluate the stability of export rules.

Beyond the immediate market reaction, the episode exposes the ongoing fragility of the US-China tech struggle. Policy ambiguity and shifting enforcement create risk for suppliers and buyers alike, potentially slowing innovation and complicating supply chains as firms recalibrate strategy around licenses, compliance costs, and political signaling.

Highlights

- Export rules were meant to shield the edge not monetize it

- A security gate now doubles as a royalty check

- National security ideals collide with corporate strategy

- Licenses granted come with a price tag on China sales

National security and political backlash risk

The move blends export controls with revenue sharing, risking political backlash, investor volatility, and broader tensions in US-China tech policy. It highlights policy fragility and potential unintended costs for suppliers and buyers.

Policy and markets will keep shifting in the AI chip race.

Enjoyed this? Let your friends know!

Related News

Nvidia and AMD to pay 15 percent of China revenue to US

Export licenses tied to revenue share

Nvidia and AMD face new export rules

Chip firms strike policy-linked revenue deal in China

Nvidia and AMD sign 15% China sales agreement

Stocks Fall as Tariff News Shakes Market

Stock Markets Climb as Earnings Reports Approach

S&P 500 Declines Amid Rising Inflation