T4K3.news

Nvidia and AMD face new export rules

U S officials press for a 15 percent revenue share on Chinese chip sales as a condition for export licenses, signaling a shift in the China policy

Nvidia and AMD reportedly agreed to share 15 percent of revenue from Chinese chip sales with the US government as a condition for export licenses amid a tense US China trade fight.

US Demands 15 Percent Revenue Share from Nvidia and AMD for China Exports

The Financial Times reports that Nvidia and AMD have agreed to give 15 percent of revenue from Chinese sales of their advanced chips to the US government in exchange for export licenses to China. The arrangement is described as unprecedented and appears to reverse long standing national security restrictions on chip sales. The move comes as Trump era policies push for a shift in how the United States manages access to technology for China. Nvidia says it has not shipped H20 chips to China for months and that export control rules should let America compete globally, while AMD has not commented.

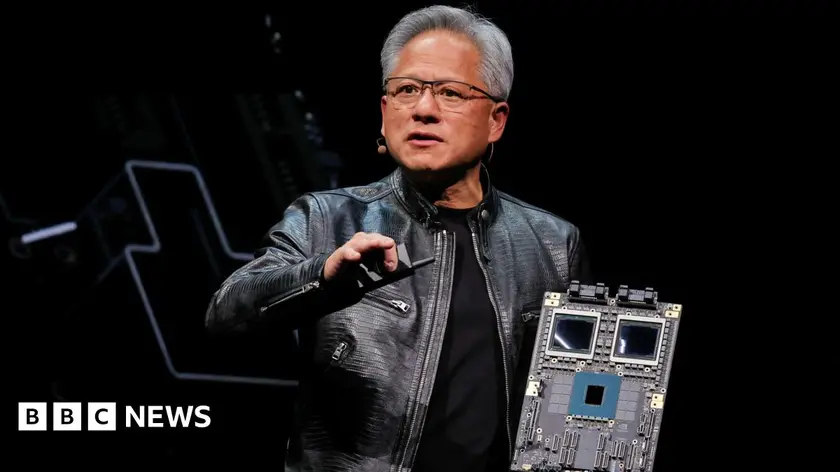

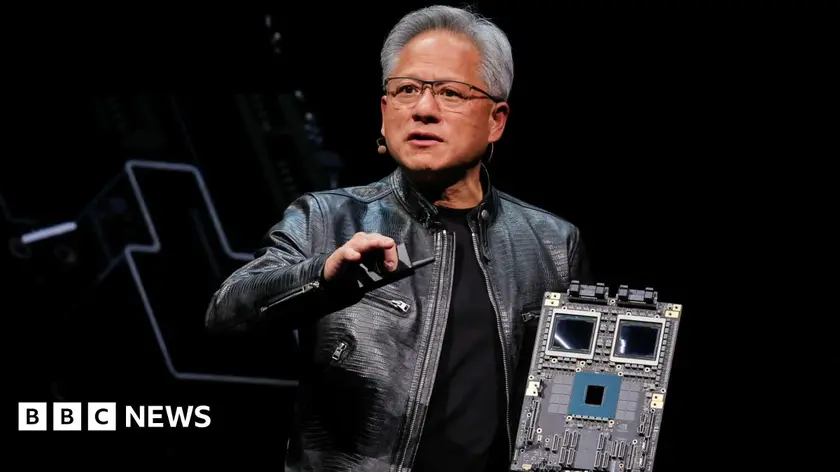

The policy context is clear. Washington has long sought to curb technology that could aid China in security and AI development. The H20 and MI308 chips were banned in April, but in recent weeks export licenses for these products have begun to appear, a change analysts link to broader shifts in policy and to the revenue sharing deal. Nvidia chief executive Jensen Huang has sought meetings with Trump and officials in Beijing to press for access, underscoring the high stakes for a company at the center of the AI boom.

Key Takeaways

"We follow rules the US government sets for our participation in worldwide markets. While we haven’t shipped H20 to China for months, we hope export control rules will let America compete in China and worldwide."

Nvidia statement following the FT report

"In addition to the policy problems with just charging Nvidia and AMD a 15% share of revenues to sell advanced chips in China, the US constitution flatly forbids export taxes."

Peter Harrell White House international economics adviser

"If we assume these national security restrictions can be bypassed by paying some sort of fee to the government then how can we keep these export controls credible?"

Ilaria Carrozza Peace Research Institute Oslo

Analysts say the proposal tests the credibility and legal basis of export controls. If governments can monetize access to security sensitive tech, they worry rules may be seen as negotiable rather than essential buffers. The move could ease some tensions in the short term but risks undermining trust among allies who rely on a rules based approach to trade and security. Investors will watch for how courts and lawmakers respond, and whether this sets a precedent for other sectors or countries. The episode also highlights the political fragility of the current approach to tech competition between the world’s two largest economies and the risk that policy shifts can outpace legal scrutiny.

Highlights

- Export controls should not be bought

- Credibility depends on rules not price tags

- Policy by payment creates a dangerous precedent

- Markets pay the price when policy becomes negotiable

Export controls credibility at stake

The proposed revenue share raises questions about legality and enforcement of national security rules. It could undermine trust among allies and invite legal challenges, creating a broader political risk beyond the chip industry.

The next policy moves will reveal whether this was a tactical pause or a lasting pivot.

Enjoyed this? Let your friends know!

Related News

Chipmakers report stock declines following US export restrictions

Nvidia AMD 15 percent China revenue levy announced

Nvidia and AMD to pay 15 percent of China revenue to US

Chip firms strike policy-linked revenue deal in China

AMD shares dip after mixed Q2 results

Stock Markets Climb as Earnings Reports Approach

Nvidia and AMD sign 15% China sales agreement

AMD Stock Sees Major Gains Amid Export Optimism