T4K3.news

Nvidia wins licenses to export H20 chips to China

U.S. licenses Nvidia to export H20 chips to China, lifting a major hurdle for sales.

U.S. authorities begin approving licenses for Nvidia to ship H20 chips to China, a move reported by the Financial Times that could lift investor sentiment.

Nvidia wins licenses to export H20 chips to China lifting NVDA stock

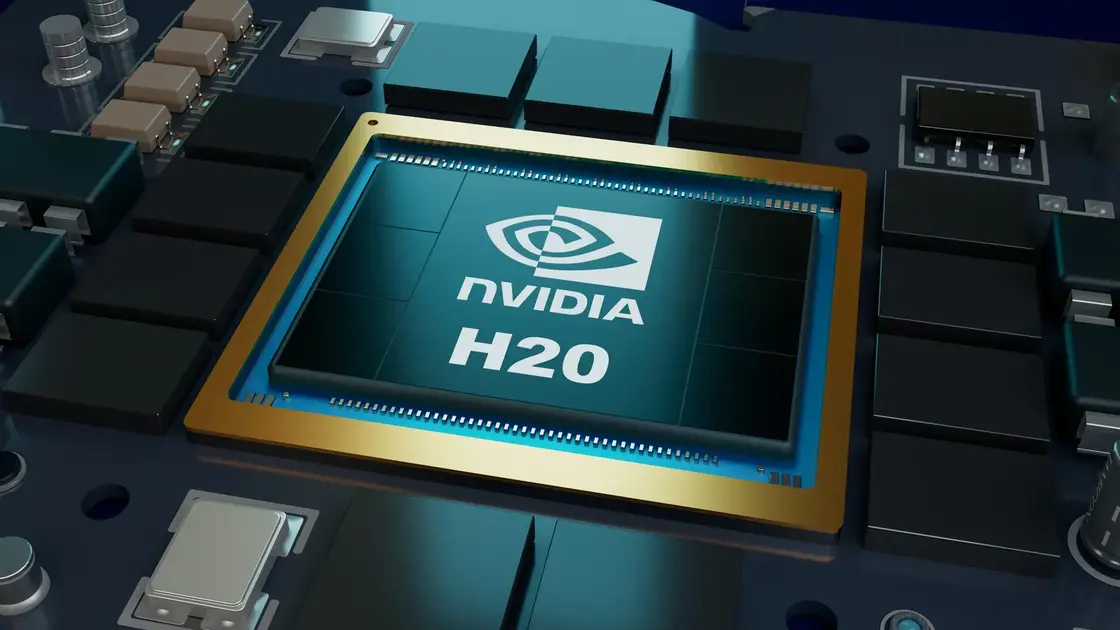

The U.S. Commerce Department has begun issuing licenses for Nvidia to export its H20 AI chips to China, the Financial Times reported. The move follows earlier restrictions on advanced AI chips under the Biden administration and a reversal after a meeting between Nvidia chief executive Jensen Huang and President Donald Trump. Nvidia had warned that a ban could wipe out roughly $8 billion in July-quarter sales, and its H20 chips generated $4.6 billion in revenue in Q1, with China accounting for about 12.5% of total revenue.

Analysts expect Nvidia's second-quarter results to show continued AI demand, with EPS around $1 and revenue near $45.7 billion, supported by AI developments such as GPT-5.

Key Takeaways

"Nvidia clears a major policy hurdle in China"

A succinct takeaway about licensing impact

"AI demand remains Nvidia's main driver and growth engine"

Editorial framing of market tailwinds

"China revenue accounted for about 12.5% of Nvidia’s quarterly revenue"

Factual note from the report

"Investors will watch the Q2 print closely"

Market reaction line

The license decision reduces a key business hurdle for Nvidia in a critical market and signals policymakers are willing to grant strategic flexibility amid broader tech tensions. Nvidia benefits from access to a large customer base in China, but the policy environment remains unpredictable and could tighten again.

The longer-term risks include dependence on China for growth and the possibility that new restrictions could hit margins or delay product launches. The H20 licensing is welcome, yet it does not resolve the political and regulatory risk that runs through Nvidia's business.

Highlights

- Nvidia clears a major policy hurdle in China

- AI demand remains Nvidia's main driver

- Policy shifts can turbocharge growth but invite scrutiny

- The China revival comes with new political risk

Export policy volatility risks Nvidia earnings

The licensing decision ties Nvidia to shifting U.S.-China policy. Further changes could affect revenue visibility and market sentiment.

Policy and markets move in step, and Nvidia stands at the intersection.

Enjoyed this? Let your friends know!

Related News

Nvidia export licenses to China move forward

Export licenses tied to revenue share

Nvidia AMD 15 percent China revenue levy announced

Nvidia and AMD sign 15% China sales agreement

Nvidia and AMD face new export rules

Chipmakers report stock declines following US export restrictions

Trump pushes 15 percent share on Nvidia H20 sales

NVIDIA Resumes AI Chip Sales to China After US Policy Shift