T4K3.news

Nvidia and AMD to pay 15 percent of China revenue to US

A new deal requires Nvidia and AMD to share 15% of China revenue with the US government as export licences are pursued.

A deal links a share of Nvidia and AMD China revenue to the US government as export licences are pursued.

Nvidia and AMD to Pay 15 Percent of China Revenue to US

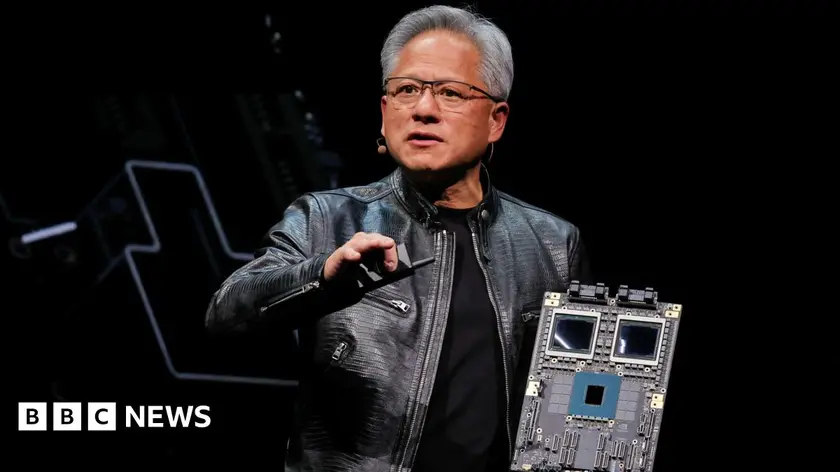

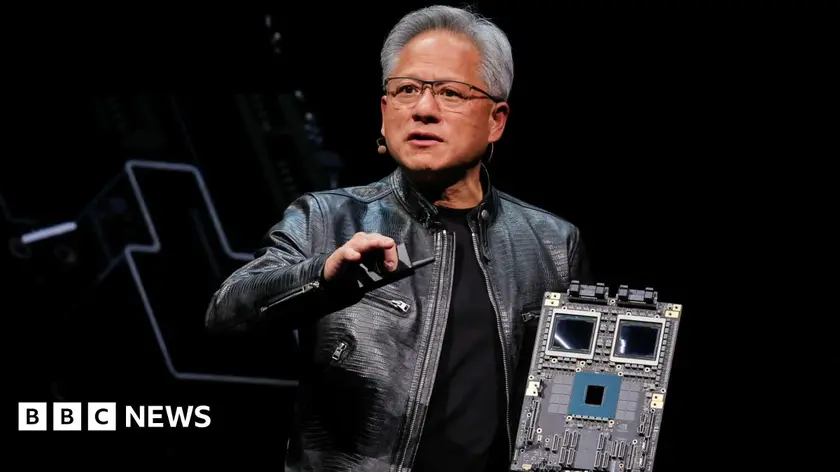

Under a new agreement Nvidia will pay 15% of revenues from its H20 chip sales in China to the US government, and AMD will do the same for its MI308 revenues. The arrangement is meant to secure export licences as Washington reassesses access to Chinese markets. Nvidia previously faced a ban on H20 sales to Beijing, and the sale was effectively halted by the Trump administration in April this year. Jensen Huang has spent months lobbying for a resumed path, including a reported meeting with the president. The broader backdrop shows a cautious thaw in US-China tech tensions, with Beijing easing rare earth export controls and the US relaxing some chip design software rules. A 90-day tariff pause agreed earlier this year remains in flux as August 12 approaches, while administrations on both sides weigh policy shifts and market signals. Large players in tech have begun to frame investments around a reshaped geopolitical landscape, raising questions about who bears the cost when policy moves out in front of profits.

Key Takeaways

"America cannot repeat 5G and lose telecommunication leadership"

Nvidia statement to the BBC about leadership in telecom and AI

"The AI tech stack can be the world's standard if we race"

Nvidia statement to the BBC about setting global standards

"Trade tensions ease yet the pressure remains"

Editorial observation on the evolving US-China dynamics

"Policy and profits collide in the race for chip supremacy"

Editorial line on the politics of chipmaking

The move signals a rare moment of policy driven pragmatism in a divided tech world. By tying a slice of China revenue to federal oversight, firms shift some political risk onto the policy table while retaining access to a crucial market. Yet the arrangement could invite more scrutiny from investors and lawmakers who worry about entangling profits with diplomatic leverage. If this is a blueprint, it tests how far governments will push market access in exchange for compliance with export controls.

In the longer view, the episode underscores a broader trend: the US seeks domestic benefits from global tech leadership while China remains a key arena for innovation and supply chains. As trade tensions ebb and flow, companies must navigate a landscape where fiscal incentives, regulatory demands, and national security concerns all collide. Expect more regulatory questions and more strategic recalibration from chipmakers and their partners.

Highlights

- America cannot repeat 5G and lose telecommunication leadership

- The AI tech stack can be the world's standard if we race

- Trade tensions ease yet the pressure remains

- Policy and profits collide in the race for chip supremacy

Political and financial risk from revenue sharing with China

The arrangement exposes Nvidia and AMD to policy reversals and political backlash. It also adds regulatory and compliance costs and could affect investor sentiment in a volatile US-China tech relationship.

Policy and markets will continue to collide as the next round of talks unfolds.

Enjoyed this? Let your friends know!

Related News

Nvidia AMD 15 percent China revenue levy announced

Nvidia and AMD sign 15% China sales agreement

Nvidia and AMD face new export rules

Export licenses tied to revenue share

Stock Markets Climb as Earnings Reports Approach

Chip firms strike policy-linked revenue deal in China

Mortgage approvals increase as housing market stabilizes

NVIDIA Resumes AI Chip Sales to China After US Policy Shift