T4K3.news

Chip firms strike policy-linked revenue deal in China

Nvidia and AMD agree to share 15% of China chip sales revenue with the U.S. government in exchange for export licenses, a move amid tariff tensions.

A revenue sharing arrangement ties 15 percent of certain chip sales in China to U.S. government oversight, highlighting how policy tools are shaping tech trade amid tariff tensions.

Nvidia AMD 15% of China chip sales revenues to U.S. FT reports

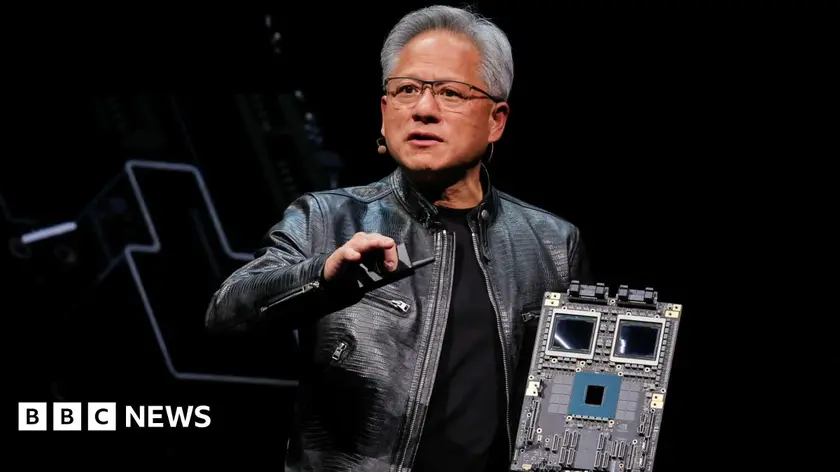

According to the Financial Times, Nvidia and AMD will remit 15% of revenues from specific chips sold in China to the U.S. government in exchange for export licenses to market Nvidia's H20 and AMD's MI308 in China. The pact is described as unprecedented and follows a meeting between Nvidia CEO Jensen Huang and President Donald Trump last week. Nvidia said it complies with the rules the U.S. government sets for participation in worldwide markets.

The arrangement unfolds as President Trump studies tariff options, including the possibility of a 100% levy on semiconductors unless production is expanded in the United States. Observers say the deal shows how trade policy can be used as leverage in high‑tech supply chains, even as firms emphasize regulatory compliance and ongoing business realities.

Key Takeaways

"We follow rules the U.S. government sets for our participation in worldwide markets."

Nvidia's official response to the FT report

"I would implement a 100% tariff on imports of semiconductors and chips, unless a company was building in the United States."

Trump's tariff stance referenced in reporting

"An unprecedented arrangement with the White House signals a new bargaining tool."

FT analysis of the policy leverage at play

"Export licenses in exchange for revenue share show policy catching up with technology."

Description of the deal mechanics

This case reveals how policy choices are becoming an extension of corporate strategy in the tech sector. When governments attach financial obligations to licenses, policy objectives move closer to the bottom line, influencing investment decisions and market access. The move also reflects a broader pattern: technology and security concerns now travel through wallets as much as through orders and patents.

However, the arrangement raises questions about fairness, transparency, and reliability. Linking revenue streams to political goals could invite backlash from investors and foreign partners, and it blurs lines between market competition and state strategy. In a field where global supply chains are already fragile, such tools may either accelerate strategic alignment or chill innovation if companies fear future policy shifts.

Highlights

- We follow rules the U.S. government sets for our participation in worldwide markets.

- I would implement a 100% tariff on semiconductors and chips unless production is in the United States.

- An unprecedented arrangement with the White House signals a new bargaining tool.

- Export licenses in exchange for revenue share show policy catching up with technology.

Political and budget risks tied to policy-driven licensing

The arrangement links private revenue to government policy, raising concerns about market distortions, national security framing, and potential investor backlash. It also exposes the companies to shifts in trade policy that could affect certainty and shareholder value.

Policy and markets will keep pushing the boundaries of what business can do under political pressure.

Enjoyed this? Let your friends know!

Related News

Nvidia and AMD to pay 15 percent of China revenue to US

Nvidia and AMD face new export rules

Nvidia AMD 15 percent China revenue levy announced

China maintains oil purchases from Iran and Russia

China refuses US oil purchase demands

China reaffirms commitment to Russian and Iranian oil imports

NVIDIA Resumes AI Chip Sales to China After US Policy Shift

Nvidia and AMD sign 15% China sales agreement