T4K3.news

AMD shares dip after mixed Q2 results

Solid growth masked by an earnings miss and an $800 million inventory write-down tied to China export controls; potential upside if China shipments resume.

The chip maker shows solid growth but faces China export limits that could alter its AI ambitions.

AMD Bets on AI Growth Amid China Export Tightening

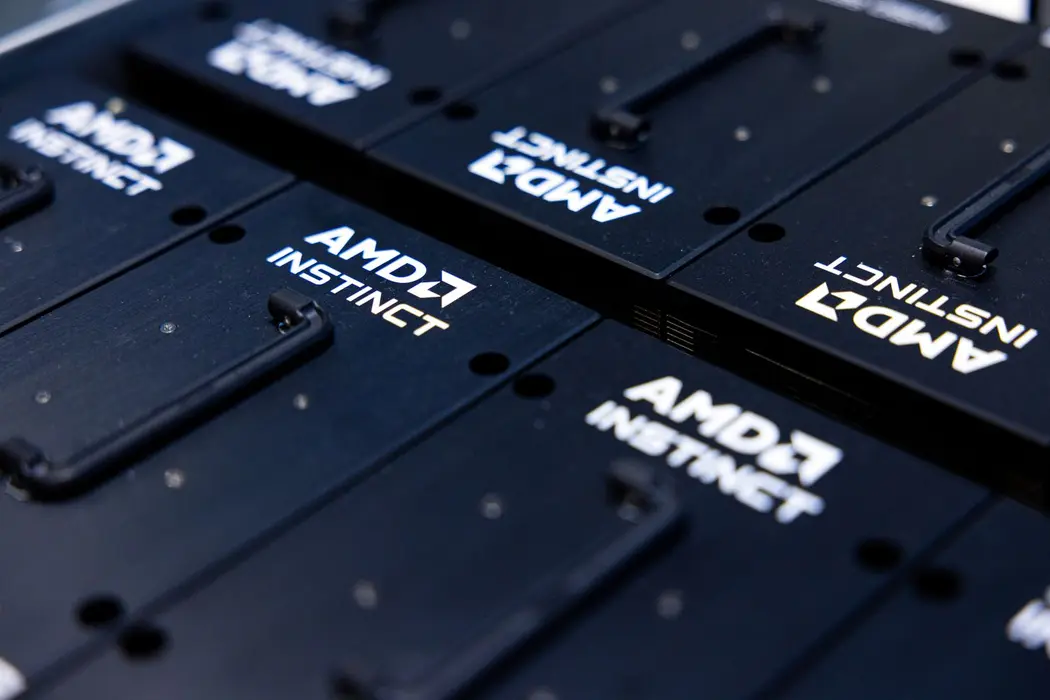

Advanced Micro Devices posted revenue of $7.69 billion in the second quarter, up 32% year over year, while adjusted earnings per share were $0.48, below the $0.49 expected by analysts. The miss was driven in part by an $800 million inventory write-down tied to export controls in China. The data center segment grew 14% year over year to $3.2 billion, but sales were affected by the ban on MI308 GPUs in China. AMD noted that shipments to China are not in its Q3 guidance, signaling a possible rebound if export licenses are approved.

Outside China, the company highlighted progress with the MI300 and MI325 GPUs and continued CPU gains in the server market. The client and gaming segment rose 69% to $3.6 billion, boosted by notebook demand and strong sales of new gaming GPUs. The embedded business fell 4% to $824 million, though management expects sequential growth in the second half. For the third quarter, AMD guided revenue of about $8.7 billion, plus or minus $300 million, excluding any MI308 shipments to China. The longer term view remains tied to AI inference and the potential return of China shipments.

Key Takeaways

"AMD's data center push remains the core driver, even with China limits."

Factual note on segment performance despite restrictions.

"If policy changes open doors, the AI opportunity could accelerate."

Editorial assessment of policy impact on growth.

"Investors should monitor policy timelines as much as quarterly results."

Cautionary investor-focused quote.

The China export restrictions create a clear near term headwind, but the longer horizon in AI could still deliver upside if policy shifts open the door to shipments. A policy change would likely lift AI revenue faster than new product launches alone, making the next few quarters a test of how quickly AMD can scale its inferencing stack without the China boost. This tension between policy risk and product momentum is a defining feature for AMD and peers in this cycle.

Valuation sits around 27.5 times the 2026 consensus earnings, a multiple that could expand if AMD proves it can grab a meaningful slice of the AI inference market. The stock remains a bet on execution and policy timing as much as quarterly results, with Nvidia as a key benchmark for performance and price. The big takeaway for investors is simple: policy clarity will shape how quickly AMD translates AI momentum into real profits.

Highlights

- Policy shifts could unlock a faster AI ramp for AMD

- The dip might be a doorway if AI demand stays strong

- Investors need clarity on export rules more than numbers

- Shipping lanes to China may decide the next earnings wave

Export controls and political risk loom over AMD

The article notes China export restrictions that limit GPU shipments and potential policy changes that could alter AMD's sales trajectory. This introduces political and budgetary uncertainty that could influence investor sentiment and stock performance.

Policy timing will shape the next leg of AMD's journey

Enjoyed this? Let your friends know!

Related News

Amazon stock drops 8.3% after disappointing earnings

Hims & Hers Health stock drops after mixed Q2 earnings report

Stocks Decline as Powell Shares Outlook on Interest Rates

AMD stock declines despite strong quarterly results

Philip Morris Reports Mixed Q2 Results

Stock Markets Climb as Earnings Reports Approach

AMD Stock Rallies Ahead of Q2 Earnings Report

U.S. stock futures increase as earnings results come in