T4K3.news

Trump debanks policy

A new executive order directs regulators to probe political bias in banking and limit reputation risk in account decisions.

A new executive order directs regulators to investigate and sanction banks over alleged political bias in account access, tying banking practice to political and crypto concerns.

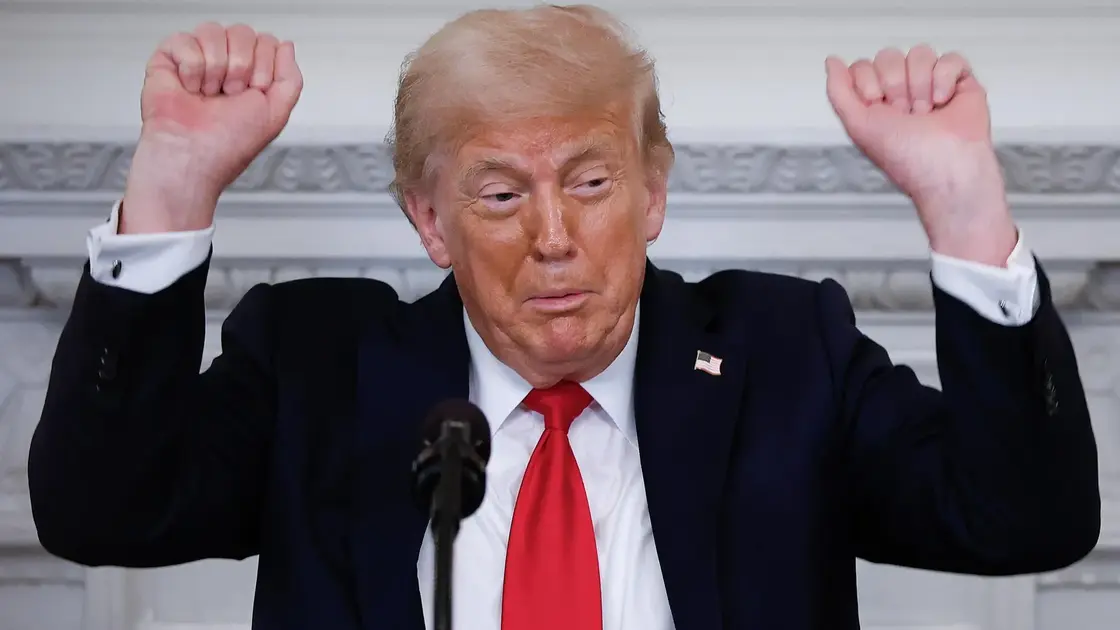

Trump Cracks Down on Politically Motivated Debanking

US President Donald Trump has signed an executive order directing federal banking regulators to probe alleged discrimination against conservatives and certain business types in access to bank accounts. The order asks the Federal Reserve, the FDIC, and the OCC to investigate whether banks have unlawfully denied services based on political or religious beliefs, and to impose penalties if discrimination is found. It also requires regulators to stop banks from considering reputation risk when reviewing applications, a shift regulators had already begun implementing. Supporters say the move is a necessary check on a politicized banking system, while critics warn it could dampen lending flexibility and invite regulatory overreach. The initiative fits into a broader Republican effort to counter what they describe as anti-conservative bias in banking and finance, with crypto firms in particular looking for a clearer regulatory path.

The executive order comes amid ongoing hearings and legislation aimed at debanking concerns. It aligns with a flush of crypto industry support for a friendlier regulatory environment and with appointments seen as crypto-friendly in key agencies. Critics argue that tying access to political beliefs risks eroding risk-based lending and could invite political tests into routine banking decisions, potentially chilling legitimate risk management practices.

Key Takeaways

"Bank regulators have used supervisory scrutiny and other influence over regulated banks to direct or otherwise encourage politicized or unlawful debanking activities."

Direct quote from the executive order describing alleged practices.

"Such practices are incompatible with a free society and the principle that the provision of banking services should be based on material, measurable, and justifiable risks."

Statement from the executive order about standards for banking decisions.

"The order requires banking regulators to conduct an investigation into instances of politically-motivated discrimination."

Directive within the executive order.

The move signals a tension between the principle of non-discrimination and the practical duties of banks to assess risk. By tying penalties to perceived ideological bias, the order imports political calculation into the core of banking supervision. That could push banks to widen their definition of risk or retreat from serving controversial clients, with consequences for small businesses and startups that rely on stable access to dollars. The policy also tests regulatory independence, as agencies lean into political fights rather than plain economics. If challenged, this could become a proxy battleground over how much politics should shape financial services and who bears the cost.

Highlights

- Banking must be risk based not ideology

- Politics should not enter the ledger

- Access to banking cannot be a political statement

- Crypto needs steady rules not signaling

Political and regulatory risk tied to new order

The order introduces a political lens into banking regulation and could spark legal challenges, regulatory pushback, or unintended consequences for lenders and crypto firms. The policy also heightens scrutiny over how regulators balance risk, ideology, and market stability.

A real test is how regulators implement the rules without creating new distortions in lending practices.

Enjoyed this? Let your friends know!

Related News

Trump signs 401k crypto policy expansion

Trump takes action to support crypto industry

Trump’s Crypto Policy Sends Bitcoin Futures Soaring

Trump orders probe into banking discrimination

Trump orders investigation into bank discrimination

Trump signs executive order against banking discrimination

Trump allows crypto investments in retirement plans

Manufacturing revival linked to new US tariffs announced