T4K3.news

Trump’s Crypto Policy Sends Bitcoin Futures Soaring

Following Trump's orders, Bitcoin futures saw a boost before quickly retreating.

Futures market reaction shows investor behavior following new crypto policies.

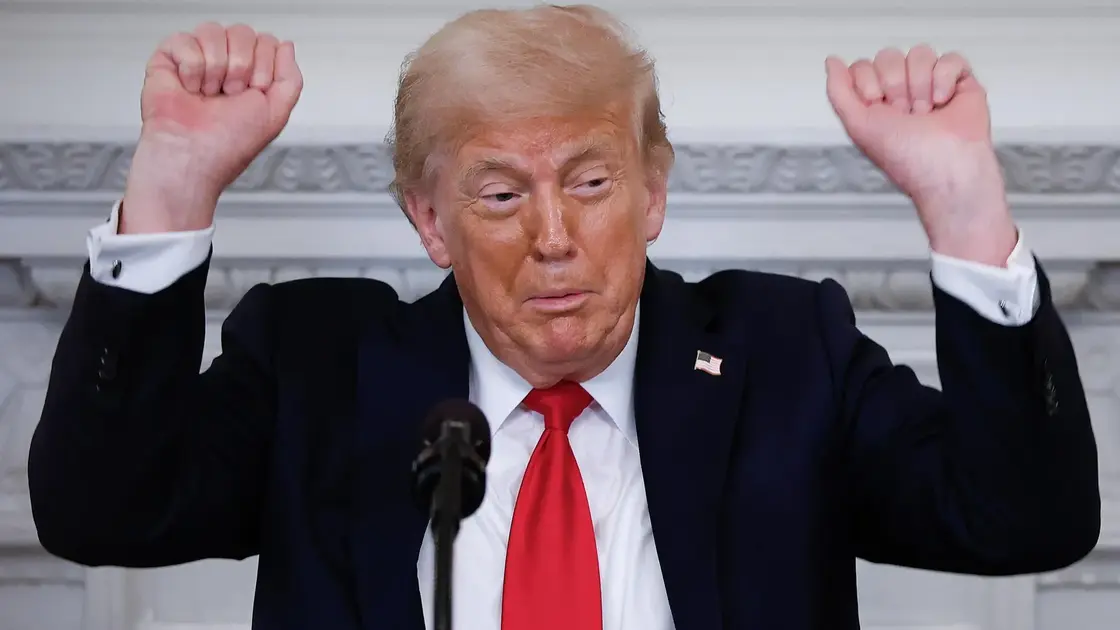

Trump’s Pro-Crypto Orders Trigger Surge and Fall in Bitcoin Futures

President Donald Trump’s recent executive orders supporting cryptocurrency have led to a notable spike in Bitcoin futures. After announcing that crypto can be included in 401(k) plans and that debanking of crypto initiatives would be prohibited, Bitcoin saw a surge in interest. Trading data revealed that around $300 million in short positions were liquidated following this news, reflecting a powerful, though temporary, increase in trading activity. Bitcoin reached prices close to $117,580; however, this interest quickly retreated. The open interest in Bitcoin futures surged briefly above $10 billion before dropping back down, showing that profit-taking occurred almost immediately after the initial rally.

Key Takeaways

"While it’s very positive news for the industry and investors, we don’t anticipate this action alone having an outsized impact on near-term prices."

Gerry O’Shea highlights the cautious optimism in the market following Trump's announcements.

"Thursday’s developments from the White House are collectively legitimizing crypto in the eyes of investors."

O'Shea emphasizes the long-term significance of Trump's crypto measures.

The market's response to Trump's orders reveals a complex relationship between policy and investor sentiment. While the announcements were met with excitement, the rapid liquidation of positions indicates traders are cautious about sustaining momentum. This suggests that while governmental support may uplift the cryptocurrency sector in the long term, immediate reactions can be volatile. The mixed signals may reflect an uncertain market, where hope coexists with skepticism. As O’Shea pointed out, the legitimacy bestowed by these actions could define investor strategies for the months ahead, despite the immediate market fluctuations.

Highlights

- Market reactions show the volatility of crypto investments.

- Trump's orders could change the game for crypto investors.

- Caution remains high despite brief euphoria in Bitcoin trading.

- Is this the beginning of crypto being taken seriously?

Market Volatility Linked to Political Moves

The influence of political announcements on crypto markets can lead to rapid fluctuations, raising concerns among investors about stability and reliability.

This market activity suggests an evolving landscape for cryptocurrency investors as policies shift.

Enjoyed this? Let your friends know!

Related News

Trump signs 401k crypto policy expansion

Trump escalates pressure on Fed Chair Powell

Trump Endorses Bitcoin in Video Post

Trump era crypto boom reshapes wealth map

Trump meets with crypto executives to discuss strategy

Musk promotes Bitcoin in new political party

Bitcoin breaks $87,000 amid political optimism

Trump Media holds $2 billion in bitcoin and plans for future crypto investments