T4K3.news

Trump orders probe into banking discrimination

President Trump mandates investigation into potential bias against conservatives by banks.

President Donald Trump has ordered an investigation into whether banks have discriminated against conservatives and industries like gun manufacturers and cryptocurrency companies.

Trump initiates investigation into alleged banking discrimination against conservatives

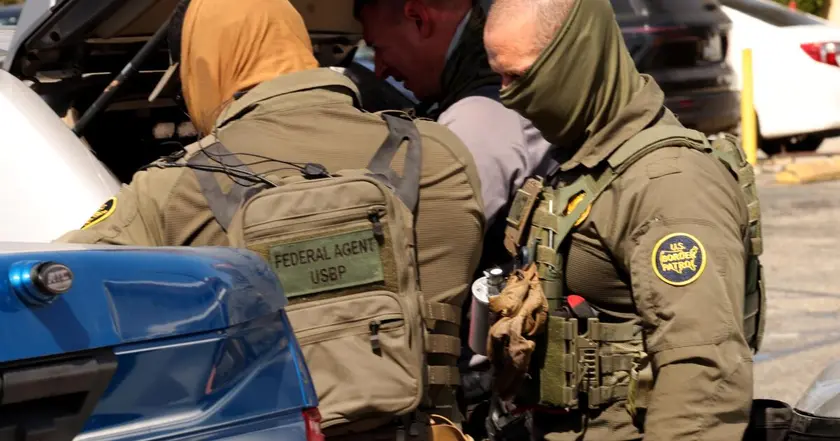

President Donald Trump has signed an executive order compelling federal regulators to investigate possible discrimination by banks against conservatives and specific industries, including gun manufacturers and cryptocurrency firms. This order aims to address the practice known as "debanking," where banks close accounts or refuse to work with entities based on perceived reputational risks. Trump has previously claimed that institutions like JPMorgan and Bank of America have unjustly denied him and his businesses banking services, a claim both banks have dismissed. The directive requires bank regulators to scrutinize instances of alleged political bias and report their findings to the Department of Justice within 120 days. The implications of this order could lead to significant civil or criminal responses against financial institutions.

Key Takeaways

"Today’s Executive Order helps ensure all consumers and businesses are treated fairly."

This quote reflects the banking industry's support for the investigation into discrimination.

"They totally discriminate against... me maybe even more, but they discriminated against many conservatives."

Trump's statement underscores his personal stake in this issue and allegations of political bias.

"We don’t close accounts for political reasons, and we agree with President Trump that regulatory change is desperately needed."

A JPMorgan spokesperson emphasizes the bank’s position while acknowledging the need for regulatory reform.

"Republicans aim to cut down on alleged acts of debanking as part of their broader agenda."

This highlights the political dimension surrounding the banking industry's practices.

This move emerges from a growing frustration among conservatives regarding perceived double standards in banking practices. How banks classify reputational risk has become a contentious issue. Critics, including Trump, argue that these classifications allow for biased practices against conservative individuals and businesses. The ongoing tension may reshape banking policies toward a more politically neutral framework, even as financial institutions stress their right to choose clients. A potential backlash from the banking community remains, as they fear this investigation may threaten their autonomy and business decisions, especially under heightened political scrutiny.

Highlights

- Banks face increased scrutiny as Trump targets alleged bias.

- Reputational risk has become a battleground between banks and conservatives.

- This executive order could reshape how banks operate under political pressure.

- Discrimination claims may spur new legislation in banking.

Potential risks linked to Trump's banking investigation

The executive order may lead to extensive investigations into banks, risking civil or criminal penalties for institutions potentially accused of discrimination. This could trigger backlash from the banking sector and affect public perception of financial institutions.

The future of banking practices may hinge on the outcomes of this investigation and ongoing political pressures.

Enjoyed this? Let your friends know!

Related News

Trump orders investigation into bank discrimination

Trump debanks policy

Trump intensifies focus on debanking issue

Trump signs executive order against banking discrimination

Manufacturing revival linked to new US tariffs announced

CFPB halts operations due to White House directives

Kremlin presses Donetsk surrender in ceasefire offer

Trump takes action to support crypto industry