T4K3.news

Trump signs executive order against banking discrimination

The order aims to protect customers from being denied bank services based on their political beliefs.

The new executive order aims to protect customers from politically motivated banking practices.

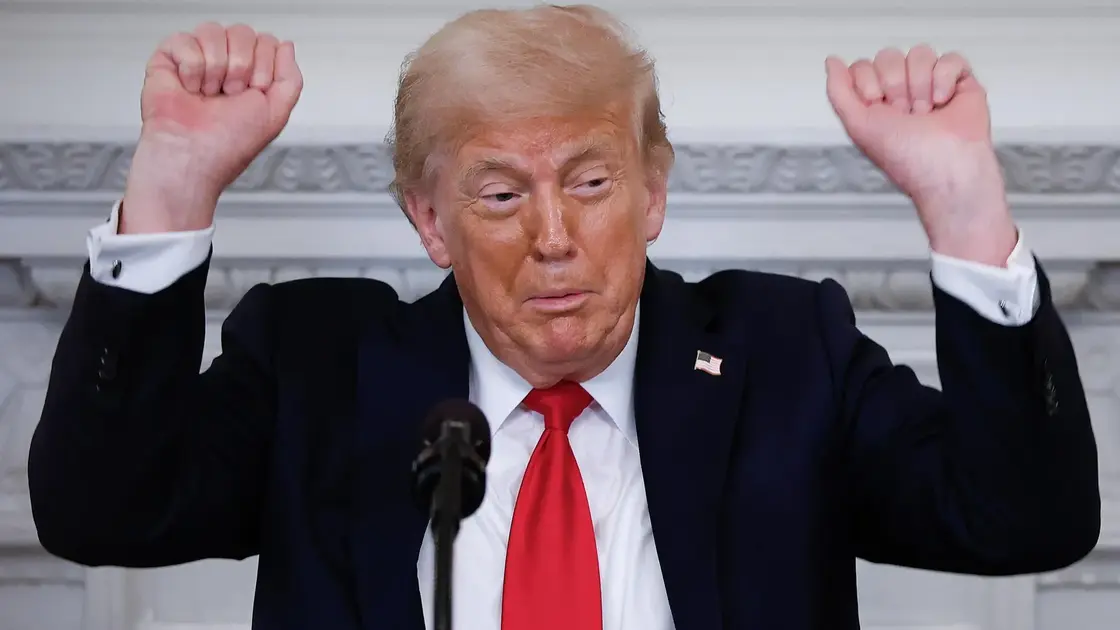

Trump signs executive order targeting banking discrimination

President Donald Trump is set to sign an executive order that seeks to combat what he claims are discriminatory banking practices against customers based on their political or religious beliefs. This order will direct federal banking regulators to eliminate the notion of "reputational risk" from their guidelines, a term that critics argue has led to unjust rejection of certain businesses, especially among conservatives and the crypto sector. While many major banks assert that they do not close accounts based on political beliefs, they have expressed support for the reform, hoping to ease regulatory pressures.

Key Takeaways

"The banks discriminated against me very badly, and I was very good to the banks."

Trump claims unfair treatment from banks after his presidency, reflecting broader concerns among conservatives.

"It’s nuts. We don’t say we aren’t going to bank conservatives."

A banker responds to Trump's claims, expressing that political bias is not a practice within banks.

"Regulatory change is desperately needed."

A JPMorgan spokesperson supports Trump's call for reform, indicating industry-wide agreement on the need for change.

"We’ll take it if it helps get regulators off their backs."

A banking insider acknowledges the potential benefits of Trump's order despite disagreements on its premise.

The executive order represents a significant shift in how banks may handle customer relationships, particularly for conservative individuals and businesses. Trump's assertion of discrimination against himself shows a broader narrative among some conservatives that they face systemic bias from financial institutions. While banks deny these allegations, the order may lead to increased scrutiny of their practices, potentially reshaping both the regulatory landscape and consumer banking experiences. The implication of this order could lead to a more polarized banking environment, raising questions about the balance between financial security and political ideology.

Highlights

- Trump's move highlights concerns about political discrimination in banking.

- Major banks deny targeting conservatives, but support regulatory reform.

- This order could reshape banking practices regarding political affiliations.

- The issue of debanking sheds light on financial accessibility for all.

Concerns about banking regulations and political implications

Trump's executive order may prompt banks to reconsider their practices regarding customer accounts, sparking potential backlash and controversy around political affiliations in banking.

The forthcoming changes could alter how political affiliations influence banking practices.

Enjoyed this? Let your friends know!

Related News

Trump orders probe into banking discrimination

Trump orders investigation into bank discrimination

Trump debanks policy

Trump intensifies focus on debanking issue

Manufacturing revival linked to new US tariffs announced

Trump signs 401k crypto policy expansion

Trump takes action to support crypto industry

Trump signs executive order on college sports