T4K3.news

Private investment urged to save Intel lead

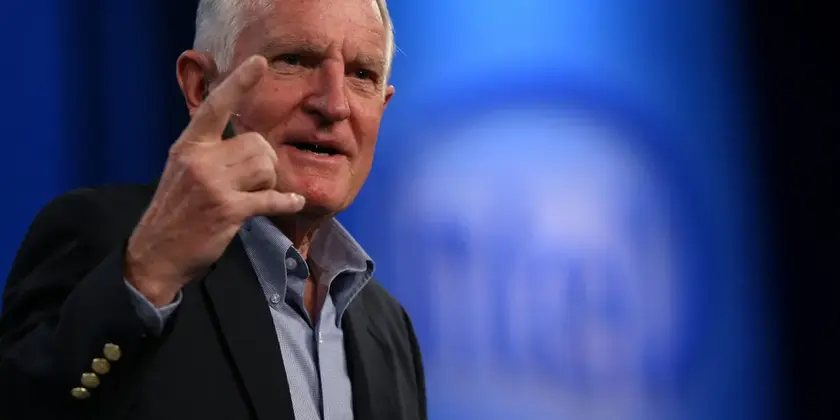

Former Intel CEO Craig Barrett calls for a 40B private infusion from chip customers to maintain US leadership in advanced manufacturing.

Former Intel CEO Craig Barrett calls for a private $40 billion cash infusion from chip customers to keep the United States at the forefront of advanced manufacturing.

Private investment can save Intel and US chip leadership

Former Intel CEO Craig Barrett argues that Intel needs roughly 40 billion dollars in private funding to stay at the front lines of logic manufacturing. He says the money should come from cash rich customers such as Nvidia, Apple and Google, rather than from the government, and that government help is unlikely to be the main source of support. Barrett notes that Samsung and TSMC have no near term plans to move state of the art manufacturing to the United States.

Barrett also warns that Intel is cash poor and cannot alone finance the capacity needed to replace TSMC or a large fraction of its capacity. He suggests a scenario where several customers invest a few billion each in exchange for guaranteed supply and a stronger domestic base. He mentions the possibility that policy tools like tariffs could catalyze domestic production if the administration coordinates action with private capital. While some critics argue for splitting Intel, Barrett says the real issue is immediate investment, committed customers and a clear national security rationale.

Key Takeaways

"America needs a second source for its lead chips"

Stressing supply diversity and resilience

"Leadership in chipmaking is a long game that requires money now"

Editorial emphasis on urgency of investment

"Private capital can save a national asset if used with clear conditions"

Guardrails for investment

The plan signals a shift toward private capital playing a larger role in funding strategic tech infrastructure. If successful, it could redefine how critical manufacturing is financed and who bears the risk of large scale capacity building. It also tests the balance between market forces and national security goals in a sector long seen as a government-facing priority.

Yet the idea carries risks. Relying on a handful of big customers to finance a core supplier could distort pricing, corporate leverage and competitive dynamics. It could also invite political backlash if taxpayers feel pressured to back private bets or if demand collapses. The debate highlights a broader policy question: should the state catalyze domestic production through direct support and guardrails, or let market actors shoulder most of the risk with occasional policy nudges? The outcome will reveal how far the United States is willing to redefine the mix of private finance and public policy in safeguarding critical tech leadership.

Highlights

- Private money must step up to save a national asset

- A second source for lead chips is a national security issue

- Leadership in chipmaking is a long game that demands money now

- Invest now or risk losing the tech edge

Budget and political risk surround Intel rescue plan

The proposal relies on private investment from major customers and potential policy actions, raising concerns about private market dynamics, government subsidies, and public reaction.

The path to a resilient US chip ecosystem remains uncertain and depends on a coordinated mix of private commitment and thoughtful policy.

Enjoyed this? Let your friends know!

Related News

Intel CEO responds to Trump resignation demand

Weight loss drug raises mental health alarms

Pension awareness grows amid rising retirement concerns

Caravan buyers face hidden costs and financial distress

Trump allows crypto investments in retirement plans

Adriana Gallardo builds $300 million insurance empire

Chancellor proposes new investment campaign

State Pension Age Review Announced