T4K3.news

Reeves plans stealth taxes to fill budget gap

UK economists predict Reeves could fund a budget gap with sin taxes and threshold freezes, sparking debate over fairness and economic impact.

UK economists forecast Reeves could fund a budget gap with higher taxes on goods and services and other tightening moves.

Reeves plans stealth taxes to fill budget gap

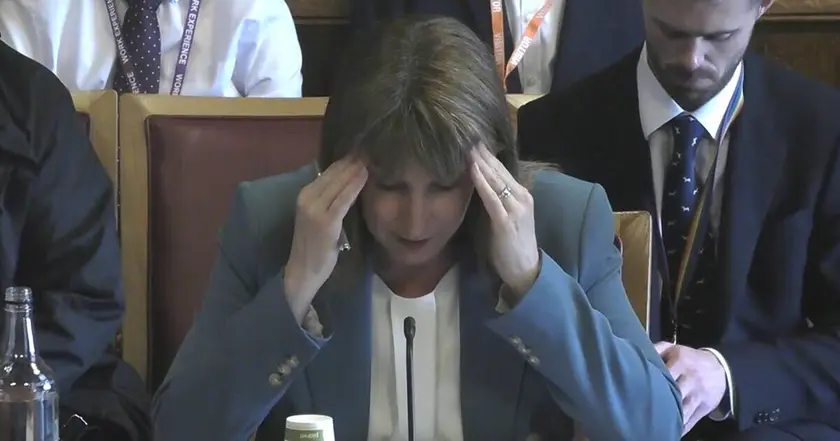

Chancellor Rachel Reeves is tipped to confront a looming budget hole by adopting a mix of stealth and sin taxes. Pantheon Macroeconomics warned that a fall in welfare savings and weaker tax receipts could erode the government’s fiscal headroom, with the autumn budget needing to raise roughly £20bn. Proposals circulating include higher levies on gambling, a possible extension of the income tax threshold freeze, and ending certain benefit protections to close a substantial gap.

Beyond gambling, ideas under discussion include nudging up duties on tobacco, alcohol, sugar, and possibly milk-based drinks. The aim is to rebuild a thin fiscal buffer while avoiding a large upfront tax rise. Critics warn that sin taxes are regressive and hit lower-income households hardest, even as supporters argue they target behavior and raise needed revenue. Some commentators also flag risks to bond markets if fiscal rules are bent or moved ahead of plan.

Key Takeaways

"Sin taxes take a greater share of income from the poor than the rich."

IEA critique of regressive taxation

"The sugar tax has been such a dramatic failure that it should be repealed, not expanded."

Christopher Snowdon of the IEA on sugar levies

"Increasing levies on online casinos and slots to 50 percent could cover the costs."

Gordon Brown's proposal referenced in the piece

"A stealth tax hurts lower income households hardest."

Editorial assessment of impact

The debate tests more than numbers. It probes fairness, political courage and the credibility of long-term fiscal rules. Raising stealth taxes could offer a quick fix, but it risks widening inequality and eroding public trust if the burden falls on everyday essentials. The call to tweak rules to generate extra headroom would be a high-stakes gamble with markets and voters watching closely.

Policy-makers face a choice between targeted reform and broader tax widening. Targeted welfare savings or closing tax gaps could be more palatable than broad health or consumption levies, but they require political will and administrative clarity. In the end, the outcomes will hinge on how the public perceives fairness, not just the size of the budget quarter.

Highlights

- Stealth taxes hit the poorest hardest and rarely fix the budget

- Taxes that sneak in through the back door rarely feel fair

- Fairness is the test of any tax plan

- Policy without equity invites backlash

Budget and political sensitivity risk

The push for stealth and sin taxes touches political risk, potential public backlash, and market sensitivity if fiscal rules are adjusted.

The budget contest will test government discipline and public trust in the tax system.

Enjoyed this? Let your friends know!

Related News

Rachel Reeves under pressure to raise taxes

Inheritance tax changes eyed to fill £50bn gap

Autumn tax rise expected as forecasters differ

Treasury weighs inheritance tax reforms

Inheritance tax to apply to pension pots

Rachel Reeves may face tax increases to address budget gap

UK faces rising fiscal deficit with urgent need for council tax reform

Treasury weighs IHT tweak up ahead of budget