T4K3.news

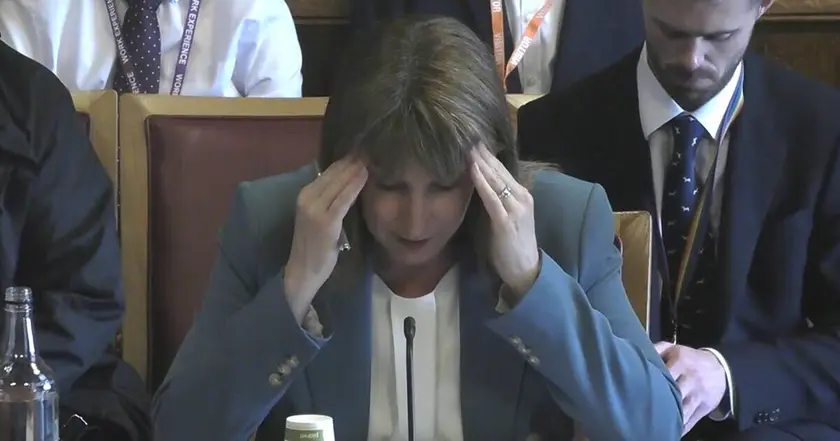

Rachel Reeves under pressure to raise taxes

A think-tank suggests increasing income tax rates to close a £40bn budget gap.

A leading think-tank urges Rachel Reeves to raise taxes to address a £40bn budget gap.

Rachel Reeves faces pressure to increase taxes amid growing deficit

The National Institute of Economic and Social Research has called on Rachel Reeves to raise taxes to tackle a projected government deficit exceeding £40 billion. This figure has surged due to an economic slowdown and unexpected inflation. NIESR suggests a 5p increase in income tax rates to fill this budget gap, although it also advocates for a comprehensive review of the tax system. The increase in taxes could help Reeves rebuild a fiscal buffer of nearly £10 billion while addressing welfare issues and rising public sector wage demands. Speculation continues about which specific taxes may be raised as Labour grapples with meeting manifesto promises amidst fiscal challenges.

Key Takeaways

"It will be crucial for the chancellor to restore market confidence by demonstrating fiscal discipline."

This emphasizes the need for responsible financial strategies in the face of rising deficits.

"Moderate but sustained tax rises will be needed to tackle the deficit."

This suggests that temporary measures may not be sufficient to resolve long-term financial issues.

"Businesses are closing, unemployment is up, inflation has doubled."

A critique of the current government's approach to economic management.

This situation sends a clear message about the challenges facing Labour under Reeves's leadership. The proposed tax rises highlight a growing need for fiscal responsibility, but they also risk backlash from both the public and party members. Critics, including some Labour backbenchers, worry that fulfilling tax increase plans could lead to discord within the party, especially after recent successes in challenging budget cuts. As inflation and the cost of living continue to strain households, the pressure on Reeves to balance practical financial solutions with political promises intensifies.

Highlights

- Reeves must confront the fiscal challenge head-on.

- Tax rises may be unavoidable to rebuild public trust.

- Labour risks backlash if manifesto promises falter.

- The path to fiscal stability is fraught with political danger.

Potential backlash over proposed tax increases

Calls for increased taxes could anger public sector workers and lead to internal party conflict, particularly among those who remember past manifesto commitments.

The outcome of these fiscal discussions will likely define Labour's economic credibility going forward.

Enjoyed this? Let your friends know!

Related News

Economic confidence reaches historic low amid tax worries

UK faces rising fiscal deficit with urgent need for council tax reform

Government borrowing in UK rises significantly

Pension triple lock tests Reeves

Reeves announces major deregulation to promote economic growth

Rachel Reeves announces record £2.2 billion inheritance tax receipts

IMF advises UK to reconsider pension and NHS treatment policies

UK borrowing exceeds £20bn in June