T4K3.news

Treasury weighs IHT tweak up ahead of budget

The Treasury is considering changes to inheritance tax rules and capital gains tax to bridge a large deficit before the autumn budget.

The Treasury is weighing tighter inheritance tax rules and tweaks to capital gains tax to help bridge a multibillion pound gap ahead of the autumn budget.

Treasury eyes inheritance tax reform to close UK deficit

The Treasury has asked officials to explore tightening how wealth is gifted to reduce inheritance tax liabilities. A lifetime gifting cap is among options under consideration, and there is interest in adjusting the taper relief that reduces taxes on gifts made years before death. Officials note wealth is increasingly held in assets like houses that have risen in value, complicating IHT receipts and making reforms tempting.

Separately, the government is examining whether small increases in capital gains tax rates could be paired with incentives for investors in British businesses. The aim is to raise revenue without hitting earnings from work, while protecting some reliefs that support investment. In addition, plans to bring pensions and death benefits into IHT from 2027 are seen as part of a broader shift to tax wealth more consistently.

Key Takeaways

"IHT can raise more, and even if we do nothing, it will raise more money as the threshold for paying it stays frozen."

Guardian source on IHT revenue under frozen thresholds

"We do have taxes that tax the wealthy."

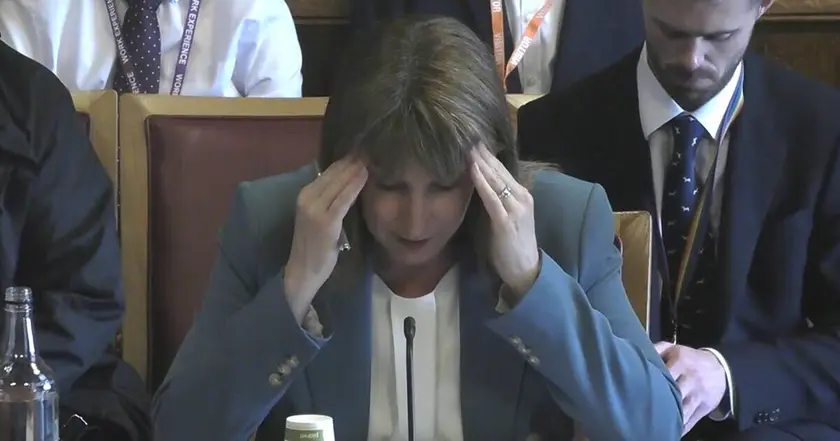

Reeves on tax options and wealth taxation

"I’m not keen to do what Switzerland has done and replace those with a wealth tax because I think there’s the risk of actually losing money by doing those things."

Reeves on avoiding a wealth tax

"those farmers with more than £3m to pass on should make a contribution"

Reeves defending farmer tax changes

The move places wealth taxes at the center of a wider fiscal debate: how to grow revenue without stifling economic activity. It reflects a willingness to consider incremental changes rather than a single sweeping overhaul, recognizing the political risk of hitting voters and powerful interests. Yet the proposals could strain public support if perceived as punishing savings and home ownership rather than earnings.

Beyond counts and caps, the policy path tests the balance between fairness and growth. If reforms push investors away or prompt wealth managers to relocate money, the government might face higher debt costs and slower growth just as it seeks to close a sizable deficit.

Highlights

- IHT can raise more, and even if we do nothing, it will raise more money as the threshold for paying it stays frozen.

- We do have taxes that tax the wealthy.

- I’m not keen to do what Switzerland has done and replace those with a wealth tax because I think there’s the risk of actually losing money by doing those things.

- those farmers with more than £3m to pass on should make a contribution

Budget and political risk around inheritance tax reform

The plan to raise revenue from IHT and CGT could trigger political backlash while the government balances growth with a pledge not to raise taxes on working people. Changes may affect farmers and wealthy households and could provoke investor or public reactions as the budget approaches.

The budget will reveal how far the Treasury is willing to push on wealth taxes while keeping growth front and center.

Enjoyed this? Let your friends know!

Related News

Treasury weighs inheritance tax reforms

Inheritance tax changes eyed to fill £50bn gap

Rachel Reeves announces record £2.2 billion inheritance tax receipts

US debt climbs past 37 trillion

UK borrowing rises unexpectedly putting pressure on Chancellor

Labour to revive NPR plan ahead of conference

Pension triple lock tests Reeves

FPL final squad deadline nears