T4K3.news

Autumn tax rise expected as forecasters differ

Forecasts vary on the size and type of taxes Reeves may raise in autumn budget, with final figures tied to the OBR forecast.

Forecasters see a tax rise in the autumn Budget as the Chancellor struggles to meet fiscal rules, with predictions spanning several billions and a range of tax tools.

Autumn Tax Rise Pressure Hits Reeves as Forecasts Vary

Forecasters expect Chancellor Rachel Reeves to raise taxes in the autumn Budget to close a gap between current rules and planned spending. With the Office for Budget Responsibility forecast due alongside the budget, the exact size of any tax rise remains uncertain.

Predictions vary widely. Capital Economics sees a package of about £15bn to £25bn, while NIESR suggests the gap could exceed £40bn. Pantheon Macroeconomics and Oxford Economics point to around £20bn to £25bn, and Deutsche Bank expects £10bn to £15bn from tax changes, with other steps filling the rest. Possible measures include freezing tax thresholds, higher rates on income, or new levies such as a health and social care levy, a wealth tax, or changes to VAT. The government has signaled it will avoid broad tax increases on working people, complicating the path forward.

Key Takeaways

"If it's towards the upper end, the Government may be forced to pull one of the big tax levers it has previously ruled out"

Ruth Gregory on potential major tax moves

"Taxes have already been significantly raised; most burden this time will probably fall on households"

Ruth Gregory on who bears the load

"I would suggest that if she needs to raise something of the order of £40-50bn then she will have to raise one of the big three taxes"

Stephen Millard on major tax options

"Tax hikes are comprised of an extension of the fiscal drag"

Sanjay Raja explains the mechanism

This spread shows a government walking a political tightrope. Reeves must raise revenue without eroding trust with voters who expect relief for working households. The forthcoming OBR forecast will constrain options and shape the final package.

If the plan leans on income tax changes or new levies, the political calculus becomes a test of balance between fairness and growth. The burden on households could grow even if the headline tax burden is framed as a levy or reform. Public reaction, investor sentiment, and long-term growth will all be in play as the details emerge.

Highlights

- If it's towards the upper end the Government may be forced to pull one of the big tax levers it has previously ruled out

- Taxes have already been raised most burden this time will probably fall on households

- I would suggest that if she needs to raise something of the order of £40-50bn then she will have to raise one of the big three taxes

- Tax hikes are comprised of an extension of the fiscal drag

Budget and political risk

The article discusses potential tax changes and policy levers ahead of a major fiscal event. It highlights uncertainty, varying expert forecasts, and the likelihood of public and market reaction to tax policy choices.

The budget will reveal how far Reeves is willing to stretch the tax system to meet the rules and fund promised priorities.

Enjoyed this? Let your friends know!

Related News

Bank of England prepares for significant interest rate cut

Government borrowing reaches record high

Pension triple lock tests Reeves

UK borrowing exceeds £20bn in June

Government borrowing in UK rises significantly

Reeves plans stealth taxes to fill budget gap

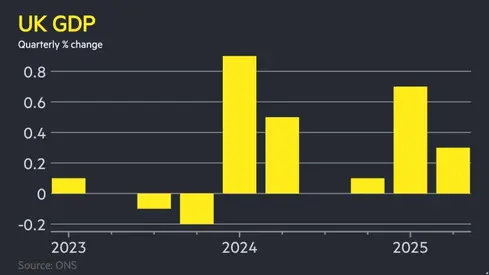

UK growth slows in Q2

UK borrowing rises unexpectedly putting pressure on Chancellor