T4K3.news

Treasury weighs inheritance tax reforms

The Treasury is considering inheritance tax changes to fill a £50bn gap ahead of the autumn Budget.

The Treasury is weighing inheritance tax changes to raise revenue as it faces a £50bn budget gap ahead of the autumn Budget.

Treasury weighs inheritance tax reforms to close £50bn budget gap

The Treasury is reportedly weighing changes to inheritance tax to raise revenue as it faces a £50 billion gap ahead of the autumn Budget. Options under consideration include a lifetime cap on gifts outside the tax, tighter rules for gifts made within seven years of death, and changes to taper relief. The Guardian reports that no substantive talks at a senior level have occurred and no decisions have been made.

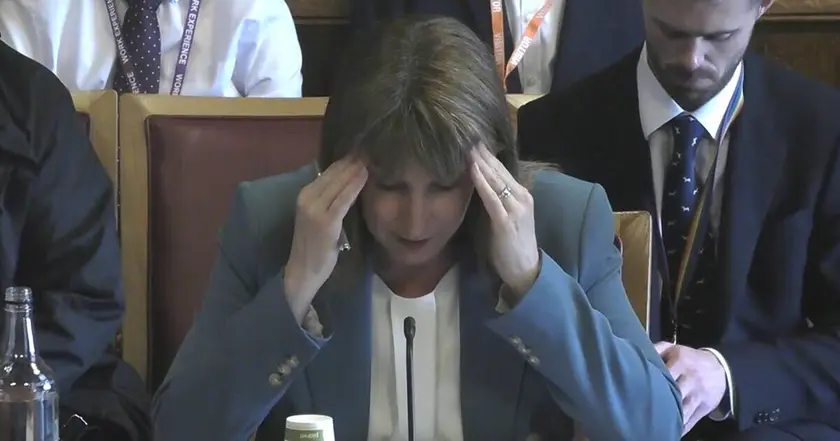

Chancellor Rachel Reeves has ruled out increases to income tax, national insurance or VAT, while inheritance tax brought in a record £6.7bn in 2022-23. Some analysts warn that wealthy investors have left the UK in part due to measures such as the abolition of non-doms, which adds pressure on public finances. The Treasury says its focus remains growth and cites planning reforms that are expected to boost the economy and lower borrowing.

Key Takeaways

"We have to find ways to better tap into the inheritances of those who can afford to contribute more"

A source describing the motive behind reform

"It’s hard to make sure these taxes don’t end up with loopholes that undermine their purpose"

Warning about potential loopholes

"We are committed to keeping taxes for working people as low as possible"

Treasury spokesperson on overall tax stance

Tax policy in a small, open economy must walk a tight line between raising funds and maintaining trust. The inheritance tax debate reflects a practical choice: find revenue without triggering broad political backlash or capital flight. If reforms are framed as closing loopholes and simplifying rules, they stand a better chance of public acceptance. But the risk is real: even well intentioned changes can create perceived unfairness or invite new loopholes that undermine the goal of fairness.

Highlights

- Taxes must fund services while staying fair and clear

- Growth and fairness can share the same path if rules are simple

- A credible reform needs real revenue and real impact

- Policy clarity beats budget theatre

Budget and political risk in inheritance tax reform

The story highlights a large budget shortfall and potential changes to a sensitive tax. If reforms are perceived as unfair or complex, they could face political backlash and affect investor confidence ahead of the Budget.

The autumn Budget will show whether reform rhetoric translates into credible policy.

Enjoyed this? Let your friends know!

Related News

Treasury weighs IHT tweak up ahead of budget

Inheritance tax changes eyed to fill £50bn gap

Migrant arrivals hit 50 000 as debate tightens

Inheritance tax to apply to pension pots

Economic confidence reaches historic low amid tax worries

US debt climbs past 37 trillion

Pension triple lock tests Reeves

Rachel Reeves announces record £2.2 billion inheritance tax receipts