T4K3.news

Inheritance tax changes eyed to fill £50bn gap

Chancellor Reeves weighs tighter inheritance tax rules to address a large public finances gap ahead of the Budget.

Chancellor Rachel Reeves weighs tighter inheritance tax rules to address a £50 billion gap in public finances ahead of the next Budget.

Rachel Reeves Seeks Inheritance Tax Changes to Fill £50bn Gap as Conservative Critics Attack Labour

Chancellor Rachel Reeves is weighing reforms to inheritance tax to help plug a £50 billion gap in the public finances before the next Budget. The proposals under discussion include a lifetime cap on gifts and tighter rules for wealth passed to heirs. The Guardian says ministers are also considering shifts in capital gains tax and a firmer link between reliefs and support for British business.

Labour faces criticism from the Conservative side, which calls the plan a politics of envy and a form of class warfare. Officials say any changes must be fair, avoid punishing savers, and align with growth goals. The plan comes as Labour's public support shows signs of strain in polling, and backbenchers push for wealth-focused options while farmers and pension pots are under scrutiny.

Key Takeaways

"The politics of envy strikes again"

Mel Stride criticizes Labour's plan

"We have to find ways to better tap into the inheritances of those who can afford to contribute more"

Treasury source cited in coverage

"IHT can raise more, and the threshold staying frozen will keep money coming in"

Treasury commentary on revenue

"We are committed to keeping taxes for working people as low as possible"

Treasury reassurance on taxpayer burden

The inheritance tax debate reveals Labour's attempt to rebalance fiscal pressure through wealth instruments. If pushed too hard, the plan could alienate middle England voters who see savings and gifts as a way to pass on hard work. The challenge is to design a system that closes gaps without deterring investment or saving, especially when assets like houses have surged in value.

At stake is whether wealth taxes can be framed as fairness without triggering a broader backlash against growth policies. The government stresses growth, but public reaction will depend on how clearly the policy targets high net worth individuals and how the changes affect ordinary savers and pension holders. The political calculus is delicate, and the next budget cycle will test Labour's ability to balance competing demands.

Highlights

- Tap wealth without choking investment

- Envy politics won't fix the books

- Hit the right targets in wealth taxation

- Growth must come before broad tax rises

Budget sensitivity and political backlash over inheritance tax changes

The proposed inheritance tax reforms intersect tax policy with broader political debate. They could trigger backlash from savers and pension holders and risk loopholes that undermine revenue goals. Any changes will face close scrutiny over fairness, effectiveness, and impact on investment.

The budget debate is just beginning and the public will judge fairness against growth.

Enjoyed this? Let your friends know!

Related News

Treasury weighs inheritance tax reforms

Inheritance tax to apply to pension pots

Treasury weighs IHT tweak up ahead of budget

Factory staffing under policy pressure

John Fredriksen lists £250million London mansion

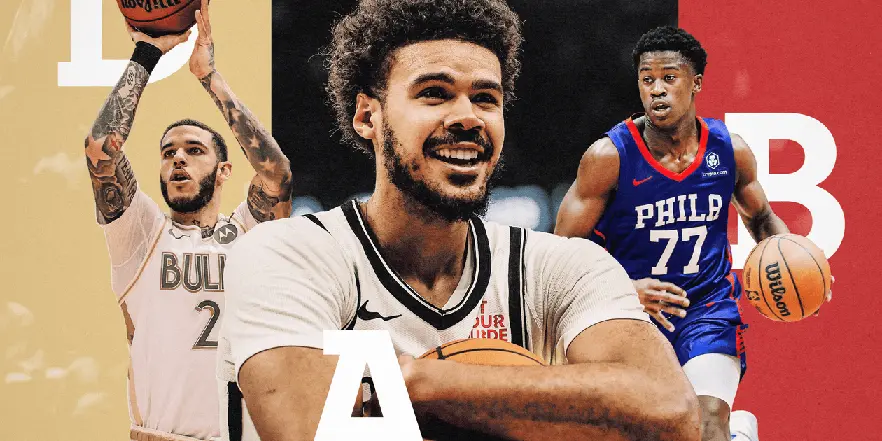

NBA offseason grades reveal team performances

Pension withdrawals spike ahead of tax changes

State Pension Age to Rise Starting 2026