T4K3.news

Nvidia and AMD sign 15% China sales agreement

Chipmakers will transfer 15 percent of China revenue to the US government as part of export licensing talks

Chipmakers Nvidia and AMD will hand 15 percent of revenues from China sales to the US government in exchange for export licenses.

Nvidia and AMD pay 15 percent of China chip sales to US

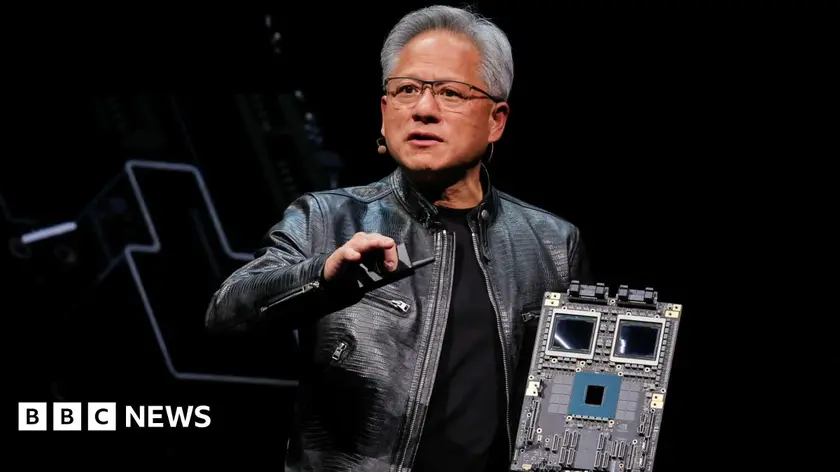

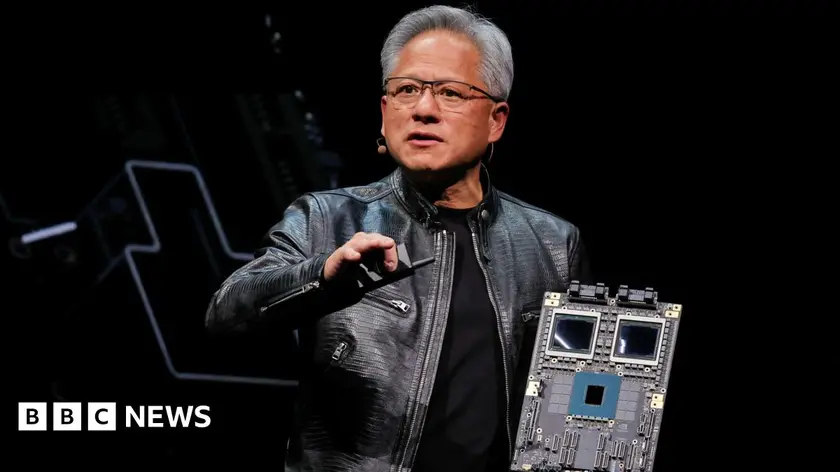

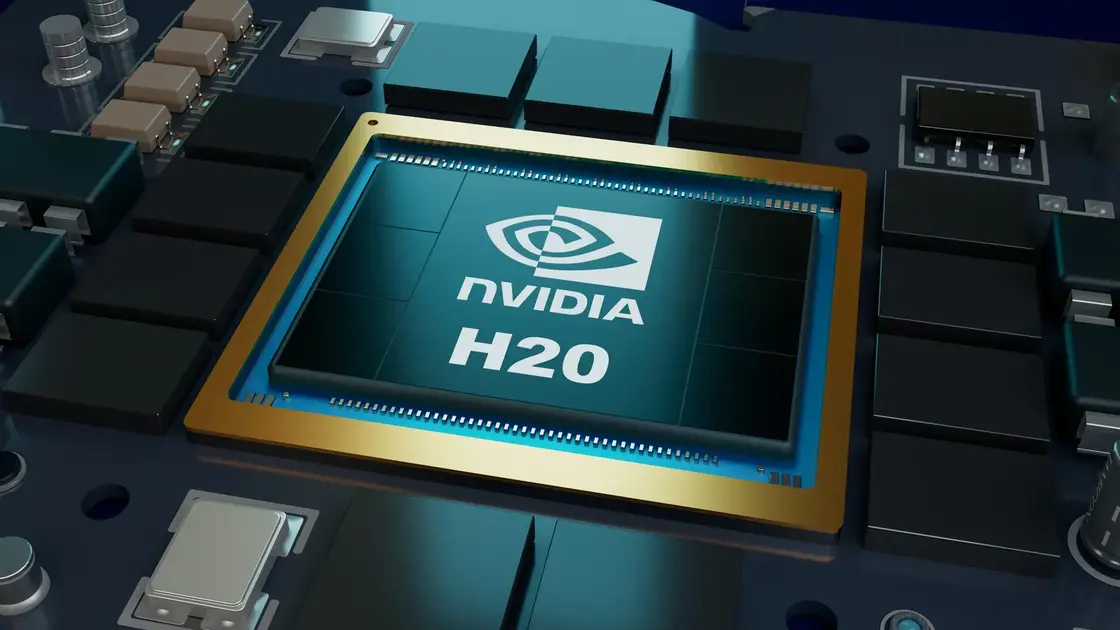

Nvidia will pay 15 percent of revenues from its H20 chip sales in China to the US government, and AMD will pay 15 percent of revenue from sales of its MI308 in China, under a licensing deal described by the White House and first reported by the Financial Times. The H20 chip was developed for the Chinese market after export controls were tightened in 2023. Sales of the chip were effectively banned by the Trump administration in April this year. Nvidia has pressed for a change in policy and has engaged with U.S. leaders to seek a path to resumed shipments, while Beijing has criticized export controls as unfair and warned against unilateral measures.

Beijing and Washington issued cautious responses to the agreement, with analysts noting the deal is unprecedented in its direct linkage of market access to revenue payments. A group of security specialists warned that chips optimized for AI could be used in military applications, highlighting broader concerns about how AI tech is governed in a geopolitically charged landscape.

Key Takeaways

"You either have a national security problem or you don't"

Comment from Deborah Elms on the logic of the deal

"America cannot repeat 5G and lose telecommunication leadership. America's AI tech stack can be the world's standard if we race"

Nvidia to the BBC about US tech leadership

"Chips optimized for AI inference will not simply power consumer products or factory logistics; they will enable autonomous weapons systems, intelligence surveillance platforms and rapid advances in battlefield decision making"

Security specialists' warning to policymakers

"The arrangement underscores the high cost of market access amid escalating tech trade tensions creating substantial financial pressure and strategic uncertainty for tech vendors"

Forrester analyst Charlie Dai on the deal

The pact formalizes a new form of market access pricing, turning export permissions into a revenue tax of sorts for tech vendors. It signals that tech diplomacy now governs more than just licensing terms and raises the question of how sustainable such arrangements are for long term planning and investment. For investors, the arrangement adds another layer of risk in an already volatile market and may push companies to rethink margins and supply routes. For policymakers, it underscores the urgency of balancing national security with the need to keep global tech ecosystems moving.

Highlights

- Export controls are becoming a payroll for geopolitics

- America cannot repeat 5G mistakes in a race for AI leadership

- Market access just got a new price tag

- Chips are not just products they are leverage

Political and budget risk from export payment arrangement

The plan ties future revenue to regulatory permissions, inviting political backlash, investor scrutiny, and strategic risk for global suppliers.

Policy choices here will shape the global tech map for years to come

Enjoyed this? Let your friends know!

Related News

Nvidia and AMD face new export rules

Export licenses tied to revenue share

Nvidia and AMD to pay 15 percent of China revenue to US

Stock Markets Climb as Earnings Reports Approach

Nvidia AMD 15 percent China revenue levy announced

Chip firms strike policy-linked revenue deal in China

S&P 500 Declines Amid Rising Inflation

Stocks Fall as Tariff News Shakes Market