T4K3.news

Nvidia gains China chip license after White House talks

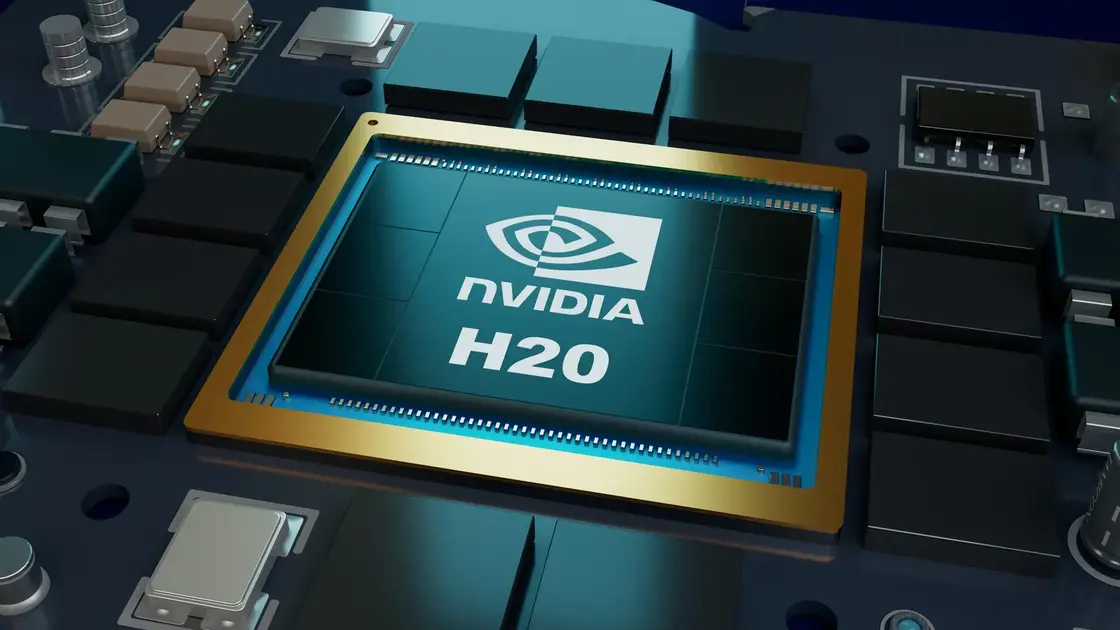

The Commerce Department has granted Nvidia a license to resume selling its H2O chips in China following high-level discussions, easing an major revenue risk.

Nvidia wins a license to sell its China focused chips after months of lobbying and a White House meeting, easing a potential revenue shortfall.

Nvidia Secures China Chip License After Trump Talks

Nvidia has won a license from the Commerce Department to resume selling its H2O AI chips to China after a White House meeting with CEO Jensen Huang on August 6. The decision ends months of export controls that had blocked top tier chips and forced Nvidia to take a $4.5 billion charge for excess inventory and purchase obligations. The license could shield Nvidia from an estimated $8 billion revenue shortfall this fiscal year and reopens a China market Huang has said could be worth around $50 billion in coming years.

Industry watchers say the move reduces near term risk for Nvidia while highlighting how export controls in high tech are shaped by diplomacy as much as by simple technical limits. Nvidia declined to comment, and the Commerce Department did not respond to requests for comment. The broader policy backdrop remains a tense arena in the US China tech war, where national security concerns and commercial stakes frequently collide.

Key Takeaways

"I said, "Look, we’ll break this guy up, before I learned the facts of life.""

Trump on his antitrust threat before meeting Jensen Huang

"Then I got to know Jensen, and now I see why."

Trump recounting his change of mind after meeting Huang at the White House

"What the hell is Nvidia? I’ve never heard of it before."

Trump's remark before he learned more about Nvidia

The episode shows how personal diplomacy can influence policy in a high stakes field where export controls mix national security with corporate interests. The White House reversal suggests that diplomacy can tilt government decisions even after stricter rules have been put in place. The case also illustrates how a company’s future is bound to the political climate more than to a single product line, especially when the China market is so central to growth.

For Nvidia, the reversal reduces immediate financial risk but keeps the policy environment uncertain. If export rules can move on the basis of outreach and perception, investors may continue to price in policy shifts as a core risk. The longer term question is whether similar concessions will be available in the next round of tech policy debates and how that will affect the global AI supply chain.

Highlights

- Chips meet diplomacy in a new era

- Personal talks can move policy faster than memo

- Markets ride on a White House visit and a chip license

- A handshake altered the year’s revenue forecast

Export controls and political risk loom

The license shows how diplomacy-driven policy shifts can save billions yet invite political and market volatility. Investors will watch for consistency in export rules and the impact on Nvidia's growth.

Policy stays in motion as markets watch the next earnings call and future diplomacy.

Enjoyed this? Let your friends know!

Related News

Export licenses tied to revenue share

Nvidia export licenses to China move forward

Nvidia and AMD sign 15% China sales agreement

Chip firms strike policy-linked revenue deal in China

Markets Edge Higher Ahead of Inflation Data

Stock market rises despite global uncertainties

Nvidia AMD 15 percent China revenue levy announced

Nvidia and AMD face new export rules