T4K3.news

Elon Musk awarded shares worth $29 billion

Tesla allocates 96 million shares to its CEO, pending a two-year vesting period.

The electric carmaker has approved the award of 96 million shares to its billionaire chief executive.

Elon Musk receives $29 billion Tesla shares approval

Tesla has approved the allocation of 96 million shares, valued at approximately $29 billion, to Elon Musk, its chief executive officer. This approval reflects a similar compensation structure to Musk's 2018 compensation package, which was invalidated by a Delaware court. The shares are set to vest in two years, allowing Musk to purchase them at $23.34 each, significantly lower than their market price. Following the announcement, Tesla shares experienced a rise of 2.1 percent in pre-market trading, highlighting the market's positive reaction. Meanwhile, as Musk strengthens his position focusing on advanced technology, he also maintains a 13 percent stake in the company, prompting discussions about Tesla's shift towards becoming an AI and robotics leader rather than just an electric vehicle manufacturer.

Key Takeaways

"As long as Musk remains the company’s chief executive, the shares will vest in two years at a fraction of their current value."

This highlights the enticing structure of Musk's compensation that encourages long-term leadership.

"Elon Musk’s focus is shifting from cars to AI and robotics, positioning Tesla for future growth."

This reflects a significant change in Tesla's strategy under Musk’s leadership.

The approval of Musk's stock award at Tesla raises important questions about executive compensation and shareholder interests. As Musk accelerates Tesla's transformation into a tech-focused entity, the move emphasizes the balance of innovation versus traditional vehicle manufacturing. Interestingly, this stock award's timing aligns with broader shifts in investor sentiment, particularly around advanced technology investments. As Tesla diversifies into AI, aligning shareholder expectations with leadership compensation will be crucial to maintaining investor trust and company valuation amidst a rapidly evolving market.

Highlights

- Musk is set to transform Tesla's future with advanced technologies.

- Investors react positively to Tesla's innovative shift.

- A bold move for a bold leader in the tech world.

- Tesla faces a turning point with Musk at the helm.

Executive compensation raises possible investor concerns

Musk's large share award may intensify scrutiny over executive compensation practices, potentially affecting investor confidence if deemed excessive or misaligned with shareholder value.

Musk's stock award signifies his influential role in Tesla's future direction and market perception.

Enjoyed this? Let your friends know!

Related News

Tesla awards Elon Musk $29 billion in shares

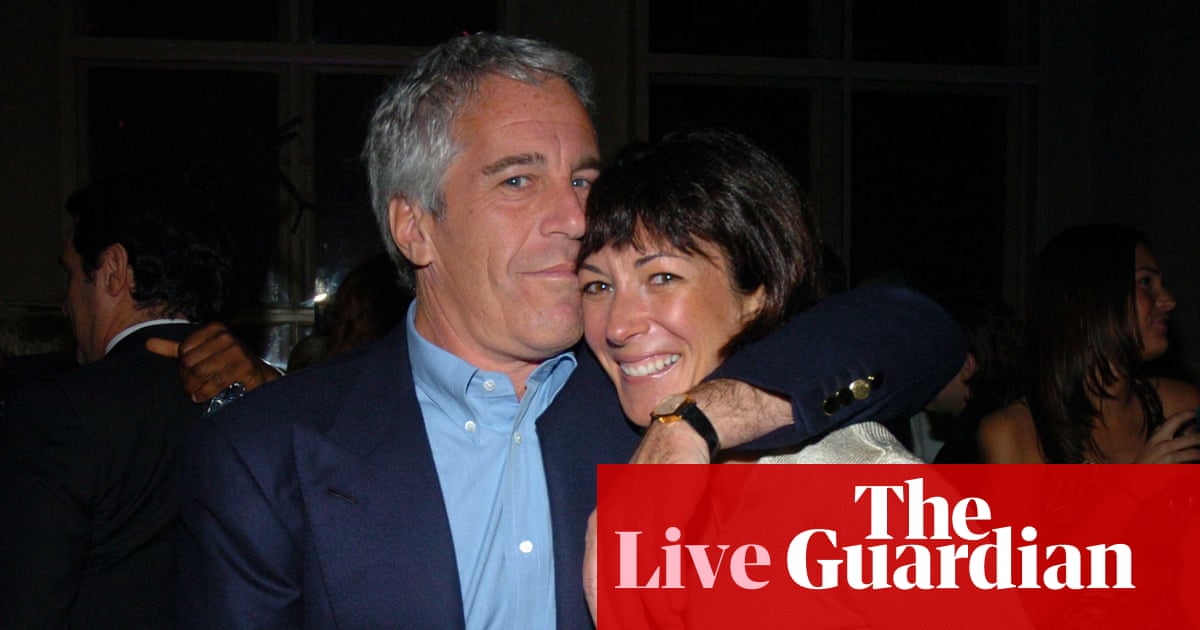

Ghislaine Maxwell meets with Justice Department official in Tallahassee

Elon Musk's net worth drops following significant Tesla share decline

Elon Musk loses $15B after announcing new political party

Elon Musk loses $12 billion after Tesla's revenue drop

Musk loses $17 billion after Tesla's revenue drop

Musk Announces New Chat Feature for X

Elon Musk raises concerns about Tesla control