T4K3.news

Markets slip as Powell readies policy remarks

Stocks drift lower as investors await Powell's Jackson Hole speech and Walmart earnings.

Stocks drift lower as investors await Powell's Jackson Hole remarks and Walmart reports soft earnings.

Markets Slide Ahead of Powell Speech and Walmart Earnings

Stocks slipped in midday trading as investors prepared for Powell's remarks at the Jackson Hole symposium. The Dow Jones Industrial Average, S&P 500 and Nasdaq Composite were each down about 0.5% as tech shares led declines after a run of record highs.

Walmart fell about 4% after weaker than expected earnings, while other retailers reported results this week. Amazon, Meta Platforms, Broadcom and Tesla also moved lower, while Microsoft and Alphabet edged higher.

Bond yields edged higher and the dollar strengthened as traders priced in a cautious policy stance. Bitcoin traded near 112,800, after a high of 114,800, while oil rose to 63.05 a barrel and gold futures held near 3390.

Key Takeaways

"Investors want clarity on when rate cuts begin"

Market mood ahead of Powell's remarks at Jackson Hole

"Policy will move markets more than speeches"

Editorial note on sensitivity to inflation data

"Walmart's earnings miss rattles a fragile consumer backdrop"

Reaction to retailer results affecting sentiment

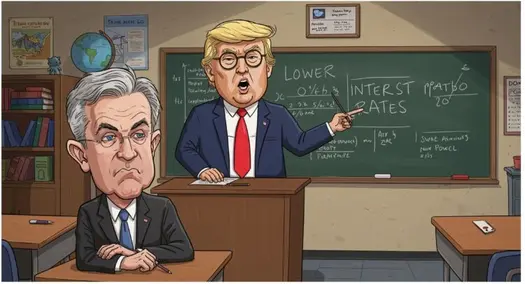

Powell's remarks at Jackson Hole serve as a focal point for policy bets, but the real signal will come from inflation data and the Fed's own data dependency. Markets are bracing for changes in the stance on rate cuts, and any hint of delay could extend the current pullback in equities.

The mix of moves shows a split market: large tech names wobble on earnings and growth concerns while some software and AI plays try to hold ground. The short term path remains data heavy, with volatility likely until a clearer policy outlook emerges.

Highlights

- Clear signals beat clever rhetoric

- Data drives policy more than podium talk

- Walmart's miss tests consumer demand

- Jackson Hole becomes a pulse check for markets

Market policy risk ahead of Powell speech

The report highlights potential market volatility tied to Powell's tone and inflation data. The event also carries political sensitivity due to policy implications and investor reactions.

Markets will continue to react as data and policy signals unfold

Enjoyed this? Let your friends know!

Related News

Dollar Under Pressure as Markets Hold

Market Slip Deepens as Walmart Weighs on Stocks

Dow Falls as Powell Speech Looms and Walmart Drops After Earnings

Dow Futures Slide on Trump Fed Clash

Fed signals eyed at Jackson Hole

Bitcoin Falls as Inflation Fears Grow and Markets Drop

Oil and stocks slip ahead of Zelenskyy Trump talks

Bitcoin dips ahead of Powell speech